Can DPoS Solve High-Frequency Trading Bottlenecks on Blockchain?

High-frequency trading (HFT) is a method of buying and selling assets in financial markets at extremely high speeds. Traders utilize powerful computers and algorithms to place thousands of orders within seconds. In traditional stock markets, HFT is common because speed often means profit. The faster a system can process trades, the better the outcome for traders.

- Understanding DPoS Consensus in Simple Words

- Proof of Work vs. Proof of Stake vs. Delegated Proof of Stake

- How Delegates Work in DPoS

- Why DPoS is Known for Speed and Low Fees

- Real-World Examples of DPoS Blockchains

- The Problem: Why Blockchains Struggle with HFT

- Transaction Processing Speeds

- Network Congestion

- Latency Matters in Finance

- Smart Contract Delays

- Can DPoS Handle High-Frequency Trading Loads?

- Block Production in DPoS

- Low Latency and High Throughput

- Cost Benefits of DPoS for HFT

- Limitations of DPoS in HFT

- Case Studies: DPoS in Action

- EOS Performance

- TRON Adoption

- Lisk and Developer Tools

- Case Study Insights

- Technical Bottlenecks Beyond Consensus

- Network Latency

- Order Matching Complexity

- Smart Contract Execution

- Data Storage and Bandwidth

- Comparing DPoS with Other Emerging Solutions

- DPoS vs. Layer-2 Rollups

- Hybrid Consensus (DPoS + BFT, Sharding, and More)

- Centralized Exchanges as a Baseline

- DPoS vs Layer-2 vs Centralized Systems

- Risks and Criticisms of Using DPoS for HFT

- Centralization and Cartels

- Fair Ordering and MEV

- Security Trade-offs for Speed

- Compliance and Oversight

- Practical Deployment Risks

- Future Research and Innovations

- AI and Predictive Algorithms in DPoS

- Decentralized AI for Real-Time Order Routing

- Privacy-Preserving DPoS

- Hybrid Models

- Future Research Ideas for DPoS in HFT

- Conclusion: Is DPoS the Answer to HFT Bottlenecks?

- Frequently Asked Questions About DPoS Solving High-Frequency Trading Bottlenecks

- What is DPoS in blockchain?

- Why is high-frequency trading hard on blockchains?

- Is DPoS faster than PoW and PoS?

- Can DPoS blockchains replace centralized trading systems?

- What are the risks of using DPoS in finance?

- Glossary of Key Terms

Blockchain technology is now a viable option for financial trading, as it offers transparency, security, and decentralization. But there is a problem. Blockchains are often slow when compared to the demands of HFT. Networks like Bitcoin and Ethereum can only process a limited number of transactions per second. This creates bottlenecks that make it hard to run high-frequency trades on these blockchains.

In simple terms, a bottleneck is like traffic on a highway. If too many cars try to move at once, the road becomes jammed. The same thing happens on blockchains when too many trades are sent at the same time. Transactions line up, waiting to be confirmed, and the delay makes HFT impossible.

Delegated Proof of Stake (DPoS) has been suggested as a solution to this problem. DPoS is a type of blockchain consensus system designed to be a lot faster than older methods, such as Proof of Work (PoW) or Proof of Stake (PoS). The big question is: can DPoS really handle the heavy load of HFT, or are its limits still too large?

This blog will explain how DPoS works, why HFT needs speed, and whether DPoS can solve these challenges. It will also examine real-world examples, risks, and future research to determine if DPoS is the right solution.

Understanding DPoS Consensus in Simple Words

To determine how DPoS can be useful, it is necessary to define what it is. Consensus refers to the process of agreement of blockchains to which transactions are valid. The consensus is essential, as without it, a blockchain cannot operate, since no one would be able to verify which trades are genuine.

Proof of Work vs. Proof of Stake vs. Delegated Proof of Stake

- Proof of Work (PoW): Used by Bitcoin. Miners solve puzzles to add new blocks. It is secure but very slow and uses a lot of energy.

- Proof of Stake (PoS): Used by networks like Ethereum 2.0. Validators are chosen based on the number of coins they lock in the system. It is faster than PoW but still not fast enough for HFT.

- Delegated Proof of Stake (DPoS): A smaller group of elected delegates or validators is responsible for creating new blocks. Token holders vote for these delegates. Because fewer people are directly involved in producing blocks, transactions can be confirmed more quickly and at lower fees.

How Delegates Work in DPoS

Think of DPoS like a classroom election. Instead of every student voting on every decision, the class elects a few representatives to make decisions on behalf of the entire class. These representatives make decisions on behalf of the class. In blockchain, delegates do the same job. They verify and add transactions for everyone else.

ALSO READ: How DPoS Can Reshape Mobility Governance with Mobility-as-a-Service (MaaS)?

Because only a small group of delegates is responsible for confirming transactions, the process is much quicker. Networks like EOS and TRON use DPoS to reach thousands of transactions per second. This is much closer to what HFT needs.

Why DPoS is Known for Speed and Low Fees

DPoS is fast primarily because it reduces the number of people involved in decision-making. PoW involves the competition of thousands of miners to solve puzzles. In PoS, hundreds or thousands of validators can remain in its system. In DPoS, there are only a few active participants (say, 21 delegates in EOS). This smaller group can make decisions much quickly

Another benefit is cost. Because DPoS does not require high energy use like PoW, transaction fees are much lower. In some DPoS networks, fees are close to zero. For HFT, where traders place thousands of orders per second, low fees are very important.

Real-World Examples of DPoS Blockchains

- EOS: One of the earliest big DPoS blockchains, with thousands of transactions per second.

- TRON: Used by many digital assets and decentralized apps, and is also reputed to have a high throughput.

- Lisk: a DPoS blockchain, with an emphasis on developer-friendly features.

These examples demonstrate that DPoS is already operational in real-world systems. But the big question is whether this performance is enough for the extreme demands of high-frequency trading.

The Problem: Why Blockchains Struggle with HFT

High-frequency trading differs significantly from traditional trading. It requires a system that can process thousands of transactions per second with very low delay. In traditional markets, trades happen in microseconds. A single second can mean the difference between profit and loss.

Blockchains today face limits that make HFT very difficult.

Transaction Processing Speeds

Bitcoin processes around seven transactions per second. Ethereum, even after upgrades, handles roughly 20–30 transactions per second on its base layer. These numbers are very small compared to the needs of HFT, where thousands of trades must be confirmed every second.

Network Congestion

When too many people use a blockchain simultaneously, the network becomes congested. This is called congestion. Congestion makes fees rise and slows down confirmation times. For HFT, even a slight delay can render the system useless.

Latency Matters in Finance

Latency is the time delay when a transaction takes to move between two points. In HFT, the lowest possible latency is required. For example, Wall Street firms spend millions of dollars on faster internet cables to save milliseconds in latency. Any blockchain that requires even a few seconds to confirm cannot rival traditional financial networks.

Smart Contract Delays

Another problem is that blockchain trades often involve smart contracts. Smart contracts are such things as programs that run automatically. Although they are effective, they increase steps and delays. This slows down the blockchains compared to centralized exchanges in terms of high-velocity orders.

ALSO READ: How Decentralized Social Media Could Use DPoS for Content Moderation

Here’s a simple comparison:

| System | Transactions Per Second (TPS) | Average Confirmation Time | Suitable for HFT? |

| Bitcoin (PoW) | ~7 TPS | 10 minutes | No |

| Ethereum (PoS) | ~20–30 TPS | ~12 seconds | No |

| EOS (DPoS) | ~3,000+ TPS | ~1 second | Closer |

| Traditional HFT Systems | 100,000+ TPS | Microseconds | Yes |

This table shows that while DPoS is faster, it is still far behind the traditional systems that HFT traders use today.

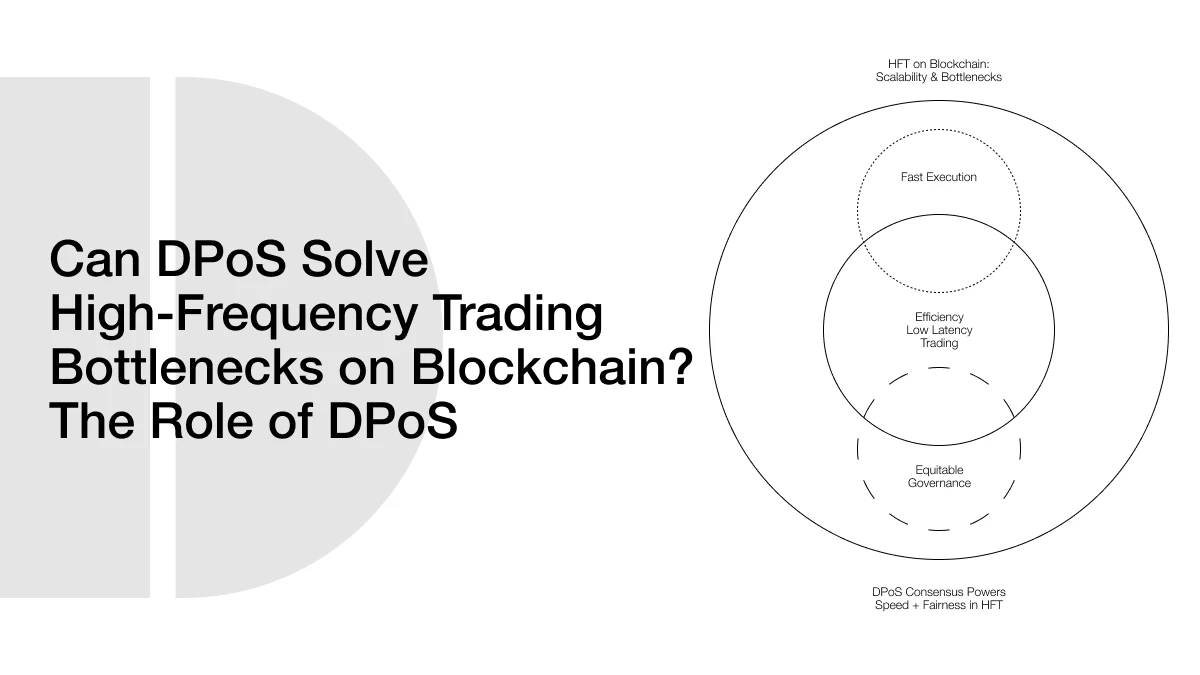

Can DPoS Handle High-Frequency Trading Loads?

Delegated Proof of Stake has been designed to improve blockchain speed. But can it really match the demands of high-frequency trading? Let’s look deeper.

Block Production in DPoS

In DPoS, only a small group of delegates or validators is chosen to confirm transactions. Because there are fewer people involved in the decision-making process, it is faster. Blocks are produced in a fixed order, which reduces wasted time and ensures efficiency. This is very different from Proof of Work, where many miners compete to solve puzzles.

Low Latency and High Throughput

DPoS can process thousands of transactions per second, and confirmation typically occurs within one second. This is much faster than most blockchains. For HFT, this is a big advantage because it reduces waiting time. Traders want their orders confirmed instantly, and DPoS comes closer to that goal.

Cost Benefits of DPoS for HFT

In HFT, traders often place thousands of small orders. If each order costs a high fee, the system becomes too expensive. With DPoS, fees are very low or even close to zero on some blockchains. This makes it more practical for frequent trading.

Limitations of DPoS in HFT

Even with speed, there are concerns. Because only a few delegates control the system at a time, power can become centralized. If delegates act unfairly or form a cartel, it may harm the fairness of the system. There is also the question of whether current DPoS networks can scale to the millions of trades that happen in global financial markets every second.

Here’s another comparison:

| HFT Needs | DPoS Capabilities | Gap |

| 100,000+ TPS | 3,000–10,000 TPS (depending on network) | Still much lower |

| Microsecond confirmation | ~1 second confirmation | Too slow for Wall Street HFT |

| Very low fees | Almost zero fees | Match |

| Decentralization & fairness | Risk of validator cartels | Weakness |

From this table, it is clear that DPoS is a step forward but not a full solution. It offers speed and low cost, but it is not yet ready to match the performance of traditional high-frequency trading systems.

Case Studies: DPoS in Action

To determine if DPoS can effectively handle high-frequency trading (HFT), it is helpful to examine blockchains that already utilize it. Three well-known DPoS networks are EOS, TRON, and Lisk.

EOS Performance

EOS was one of the first blockchains to promote itself as “the fastest blockchain.” It uses 21 elected block producers to validate transactions. EOS has claimed to handle more than 3,000 transactions per second in real-world tests. This makes it one of the most scalable blockchains to date. However, some critics say that EOS struggles with centralization because only a small group of validators has control.

For HFT, EOS shows that DPoS can achieve high throughput. However, whether this speed can keep pace with the needs of traditional financial systems remains debatable.

TRON Adoption

TRON is another blockchain that uses DPoS. It focuses on digital entertainment and decentralized applications. TRON has also achieved thousands of transactions per second with very low fees. In fact, TRON is one of the most active blockchains by daily transactions.

For traders, the big advantage is that TRON’s low fees and quick confirmation times enable the seamless transfer of assets without delay. This is a feature that high-frequency trading would require.

Lisk and Developer Tools

Lisk also uses DPoS but focuses more on developers. It enables people to create their own blockchains using JavaScript, making it easier to build applications. While Lisk is not as fast as EOS or TRON, its DPoS system still offers better speed and cost efficiency than Proof-of-Work blockchains.

Case Study Insights

From these examples, it’s evident that DPoS networks have already demonstrated that faster transactions are possible. But even the best-performing DPoS blockchains are still far behind the 100,000+ TPS that financial institutions use for high-frequency trading.

Technical Bottlenecks Beyond Consensus

Even if DPoS is fast, consensus is only part of the problem. High-frequency trading requires more than just a good voting system. Other bottlenecks slow down blockchains.

Network Latency

Delegates in DPoS may confirm blocks quickly, but if nodes are spread across the globe, messages still take time to travel. For financial markets, where trades happen in microseconds, even a one-second delay is too much.

Order Matching Complexity

In financial trading, matching buy and sell orders is a complex process. Centralized exchanges have special systems designed just for order matching. On blockchains, order matching often relies on smart contracts, which are slower than traditional methods. This creates another bottleneck.

Smart Contract Execution

Smart contracts make blockchains more automated, but they introduce additional steps. Each computation performed by a smart contract consumes resources. This implies that although fast consensus is achieved, transactions will get delayed when too many contracts operate simultaneously.

Data Storage and Bandwidth

High-frequency trading creates a huge amount of data. Blockchains must store this data permanently, which can lead to storage and bandwidth issues. If every trade must be recorded forever, the blockchain becomes too large and too quickly.

Here’s a summary table:

| Bottleneck Factor | Impact on HFT | Why It Matters |

| Network Latency | Slows down global trade confirmation | HFT needs microseconds, not seconds |

| Order Matching | Smart contracts add delays | Slows down trade execution |

| Smart Contract Execution | Extra computational load | Reduces system speed during peak demand |

| Data Storage & Bandwidth | Blockchain grows too large | Makes long-term HFT impractical |

This indicates that even if DPoS addresses some issues, there are deeper technical challenges that still render blockchain-based high-frequency trading very difficult.

ALSO READ: Token Holder Cartels: Can DPoS Stop Concentrated Power Structures?

Comparing DPoS with Other Emerging Solutions

High-frequency trading needs more than one fix. It helps to compare DPoS with other methods that blockchains are using to increase their speed. The two key ideas discussed today are Layer-2 rollups and hybrid designs that combine different consensus methods.

DPoS vs. Layer-2 Rollups

Layer-2 (L2) rollups move most work off the main chain. They roll up many trades into one batch and then post a proof back to Layer 1. There are two main types. Optimistic rollups assume the batch is valid unless someone challenges it. Zero-knowledge (ZK) rollups create a mathematical proof that the batch is valid. Both can give very high throughput and much lower fees. Many teams also use validity proofs or fraud detection mechanisms to maintain strong security. This off-chain batching is particularly beneficial for fast-moving markets.

DPoS speeds up transactions on the base chain by utilizing a small, elected set of validators. This reduces wait time per block and keeps fees low. It is simple to reason about and easy for users. However, it may still be slower than the best L2 systems during peak trading periods.

Hybrid Consensus (DPoS + BFT, Sharding, and More)

Some newer designs combine DPoS with BFT-style finality or utilize sharding to distribute work across multiple groups. These hybrids aim to achieve both low latency and strong finality simultaneously. They also aim to scale horizontally as demand grows. In simple words, they try to “multiply lanes on the highway.” Research lines in decentralized AI, network slicing, and consensus scheduling suggest additional gains when nodes and data are coordinated more effectively (Saleh, 2024).

Centralized Exchanges as a Baseline

Centralized exchanges operate matching engines in data centers located near major internet hubs. They control hardware, networks, and software from end to end. That is why they can achieve microsecond latencies and over 100,000 TPS on internal systems. This remains beyond the capabilities of any public blockchain today, regardless of its design.

DPoS vs Layer-2 vs Centralized Systems

| System Type | Typical Throughput | Typical Finality/Latency | Fees | Trust Model | Fit for HFT Today |

| DPoS L1 | Thousands TPS | ~1 second | Very low | Elected validators | Better, but not enough |

| L2 Optimistic Rollups | Tens of thousands TPS (batched) | Fast execution; delayed finality if challenged | Low | Off-chain operators + fraud proofs | Closer for retail speed |

| L2 ZK Rollups | Tens of thousands TPS (batched) | Fast with validity proofs | Low | Cryptographic proofs | Strong security + speed |

| Hybrid (DPoS + BFT/Shards) | Scales with shards | Sub-second to seconds | Low | Mixed (committee + shards) | Promising path |

| Centralized Exchange | 100,000+ TPS | Microseconds | Exchange fees | Single operator | Yes, industry standard |

DPoS provides a significant speed boost at Layer 1. Rollups push speed even further by moving work off-chain and posting proofs back. Hybrids may combine both worlds. Academic work also shows that smarter scheduling, data sharing, and decentralized AI can enhance throughput and resilience in conjunction with these designs.

Risks and Criticisms of Using DPoS for HFT

Speed matters in markets, but so do fairness, security, and trust. DPoS changes who makes blocks and how quickly they are produced. This brings its own set of risks that HFT firms, exchanges, and regulators must weigh.

Centralization and Cartels

DPoS relies on a small set of active validators. This is why it is fast. But a small set can also coordinate in ways that hurt the market. If a few delegates control block order or censor some transactions, price discovery can get skewed. This “cartel” risk is one of the most common worries in DPoS debates. Research on governance warns that speed-focused designs must be vigilant for power concentration and incorporate checks and audits to ensure honest behavior.

Fair Ordering and MEV

In any public chain, block producers can influence transaction order. This creates MEV (miner/validator extractable value). With HFT, tiny ordering advantages can be huge in dollar terms. If delegates can reorder trades, frontrun, or delay some orders, users may lose trust. Solutions like fair ordering, auction-based sequencing, or encrypted mempools can help, but they add complexity and sometimes latency.

Security Trade-offs for Speed

By using small committees and tight schedules, DPoS reduces latency. But smaller sets can be easier to attack or collude if incentives break. Designs that incorporate BFT finality, slashing, and robust auditing can enhance safety. Still, when HFT volumes spike, even small security events can trigger big losses. That is why strong, verifiable controls are key (Saleh, 2024).

Compliance and Oversight

Financial markets run under strict rules. Firms must prove best execution, fair access, and proper record-keeping. DPoS chains require clear logs, robust identity layers when necessary, and tools for surveillance that do not compromise user privacy. Research directions in privacy-preserving analytics and decentralized AI demonstrate how anomaly detection and audit trails can operate with reduced data leakage, while still providing watchdogs with the necessary signals.

Practical Deployment Risks

Even if the chain is fast, the full trading stack matters. You still need low-latency gateways, fast order routers, stable APIs, and safe key management. You need disaster recovery and capacity plans for sudden volume shocks. If any one layer falls behind, your end-to-end speed drops. This is why many teams test hybrid paths: run matching off-chain for speed, settle on-chain for finality.

Future Research and Innovations

Even though DPoS makes blockchains faster, more work is needed before high-frequency trading can truly move on-chain. Researchers and developers are exploring new ways to close the gap between DPoS speed and the extreme demands of Wall Street-style trading.

AI and Predictive Algorithms in DPoS

One promising idea is to use artificial intelligence (AI) to optimize block scheduling. For example, predictive algorithms could forecast traffic spikes and assign delegates more efficiently. Studies in blockchain and AI suggest that combining machine learning with consensus scheduling can improve both throughput and resilience.

Decentralized AI for Real-Time Order Routing

Another future direction is decentralized AI for order routing. Imagine a system where AI agents, spread across multiple nodes, route trades to the fastest available delegates in real-time. This could reduce congestion and improve fairness while maintaining the system’s decentralization.

Privacy-Preserving DPoS

Financial trading requires both speed and privacy. Researchers are developing privacy-preserving consensus models that utilize advanced cryptography, such as zero-knowledge proofs. These could help traders conceal their strategies while still maintaining transparency for audits.

Hybrid Models

Hybrid consensus systems that mix DPoS with BFT (Byzantine Fault Tolerance) or sharding may deliver the best of both worlds. Sharding divides the blockchain into smaller parts, allowing multiple transactions to run in parallel. BFT adds stronger finality guarantees. Combining these with DPoS may give both speed and trust.

ALSO READ: DPoS Governance Insurance: Can Delegators Hedge Against Delegate Failure?

Future Research Ideas for DPoS in HFT

| Innovation | Goal | Why It Matters for HFT |

| AI Scheduling | Optimize delegate rotation | Reduces latency and improves load balance |

| Decentralized AI Routing | Real-time trade distribution | Keeps order flow fast and fair |

| Privacy-Preserving Consensus | Use cryptography for secrecy | Protects trader strategies and market integrity |

| Hybrid DPoS + BFT | Mix speed with stronger trust | Combines low latency with finality |

| Sharding with DPoS | Split work into smaller chains | Increases throughput massively |

Conclusion: Is DPoS the Answer to HFT Bottlenecks?

Delegated Proof of Stake clearly enhances blockchain performance compared to older systems, such as Proof of Work and Proof of Stake. It brings faster transactions, lower fees, and smoother confirmation times. These are all major benefits for high-frequency trading.

But there are still limits. Even the fastest DPoS blockchains only reach a few thousand transactions per second, while traditional HFT systems run in the hundreds of thousands with microsecond latency. DPoS can close part of the gap, but not the entire distance.

The bigger challenge is not only achieving consensus but also ensuring order matching, minimizing network latency, managing data storage, and adhering to compliance requirements. DPoS solves some of these issues but leaves others untouched.

The most likely future is a mix of both. DPoS may be part of the solution, particularly for decentralized finance platforms seeking to provide faster trading. However, for HFT to fully move on-chain, hybrid consensus, Layer 2 scaling, and advanced AI tools will all need to come together.

So, can DPoS solve high-frequency trading bottlenecks? The answer is: it helps a lot, but it is not enough by itself. DPoS will play a role, but complete solutions will come from combining DPoS with other technologies that boost speed, fairness, and trust.

Frequently Asked Questions About DPoS Solving High-Frequency Trading Bottlenecks

What is DPoS in blockchain?

Delegated Proof of Stake (DPoS) is a consensus system where token holders vote for a small group of delegates to confirm transactions. This makes blockchains faster and cheaper than Proof of Work or Proof of Stake.

Why is high-frequency trading hard on blockchains?

Because blockchains are slower than traditional financial systems. HFT requires thousands of trades per second and confirmation times in microseconds. Most blockchains are too slow for this.

Is DPoS faster than PoW and PoS?

Yes. DPoS can handle thousands of transactions per second, while PoW handles around 7 TPS and PoS about 20–30 TPS. However, DPoS is still much slower than traditional HFT systems.

Can DPoS blockchains replace centralized trading systems?

Not yet. Centralized exchanges are still much faster. DPoS is a step forward, but a full replacement will require additional scaling solutions.

What are the risks of using DPoS in finance?

The primary risks are centralization, where a few delegates control the system, and fairness issues, such as transaction ordering. These can affect trust in financial markets.

Glossary of Key Terms

Blockchain – A digital ledger system where transactions are recorded and stored across many computers in a secure, tamper-proof way.

Consensus Mechanism – The method by which blockchains agree on which transactions are valid. Examples include Proof of Work, Proof of Stake, and Delegated Proof of Stake.

Delegated Proof of Stake (DPoS) – A consensus method where token holders vote for a small group of delegates who validate and confirm transactions. Known for speed and low cost.

High-Frequency Trading (HFT) – A form of trading that uses algorithms and powerful computers to execute thousands of trades in fractions of a second.

Latency – The time delay between sending a transaction and it being confirmed on the blockchain.

Throughput (TPS) – The number of transactions a blockchain can process per second.

Smart Contracts – Self-executing programs on a blockchain that automatically enforce rules or agreements.

Validator Cartel – When a small group of validators or delegates collude to control block production in a DPoS system.

Layer-2 Rollups – Blockchain scaling solutions that batch transactions off-chain and post proofs to the main blockchain to improve speed and reduce fees.

Sharding – A method of splitting a blockchain into smaller parts, or “shards,” so transactions can be processed in parallel.

Miner/Validator Extractable Value (MEV) – The profit validators can gain by reordering or inserting transactions into blocks.