Token Concentration and Power in DPoS: Can Whales Dictate Validator Outcomes?

In the world of blockchain and crypto, there is a group of players people often call whales. A whale is someone who holds a very large number of tokens. They can be an individual, a group, or even a company. Because they have so many tokens, their decisions can move markets, change governance, and sometimes control the whole system.

- How DPoS Governance Works

- Simple Comparison of PoW vs PoS vs DPoS

- Token Concentration: When a Few Hold the Most Power

- Example Token Concentration in a DPoS Network

- Whales Controlling Validator Outcomes

- Direct Control Over Block Producers

- Side Deals and Vote Buying

- Governance Capture by a Few

- Price Volatility Linked to Whale Actions

- Whale Actions and Market Reactions

- Case Studies of Whale Dominance

- WLFI and High Concentration

- Pi Network Whales

- Meme Coin Experiments (TRUMP Token)

- Institutional Investors and OTC Deals

- Community Growth vs Whale Power

- Retail vs Whale Influence in DPoS

- Technical Analysis of Whale Activity

- Decentralization Challenges in Whale-Dominated DPoS

- Solutions: Can Tokenomics Fix Whale Dominance?

- Fair Token Distribution

- Lockup Periods and Staking Caps

- Incentives for Small Holders

- Key Takeaways

- Conclusion

- Frequently Asked Questions About Token Concentration and Power in DPoS

- What is token concentration in DPoS?

- How do whales affect validator elections?

- Do whale actions also impact token prices?

- Can DPoS still be decentralized if whales dominate?

- What can projects do to stop whale dominance?

- What should small holders do in whale-heavy networks?

- Glossary of Key Terms

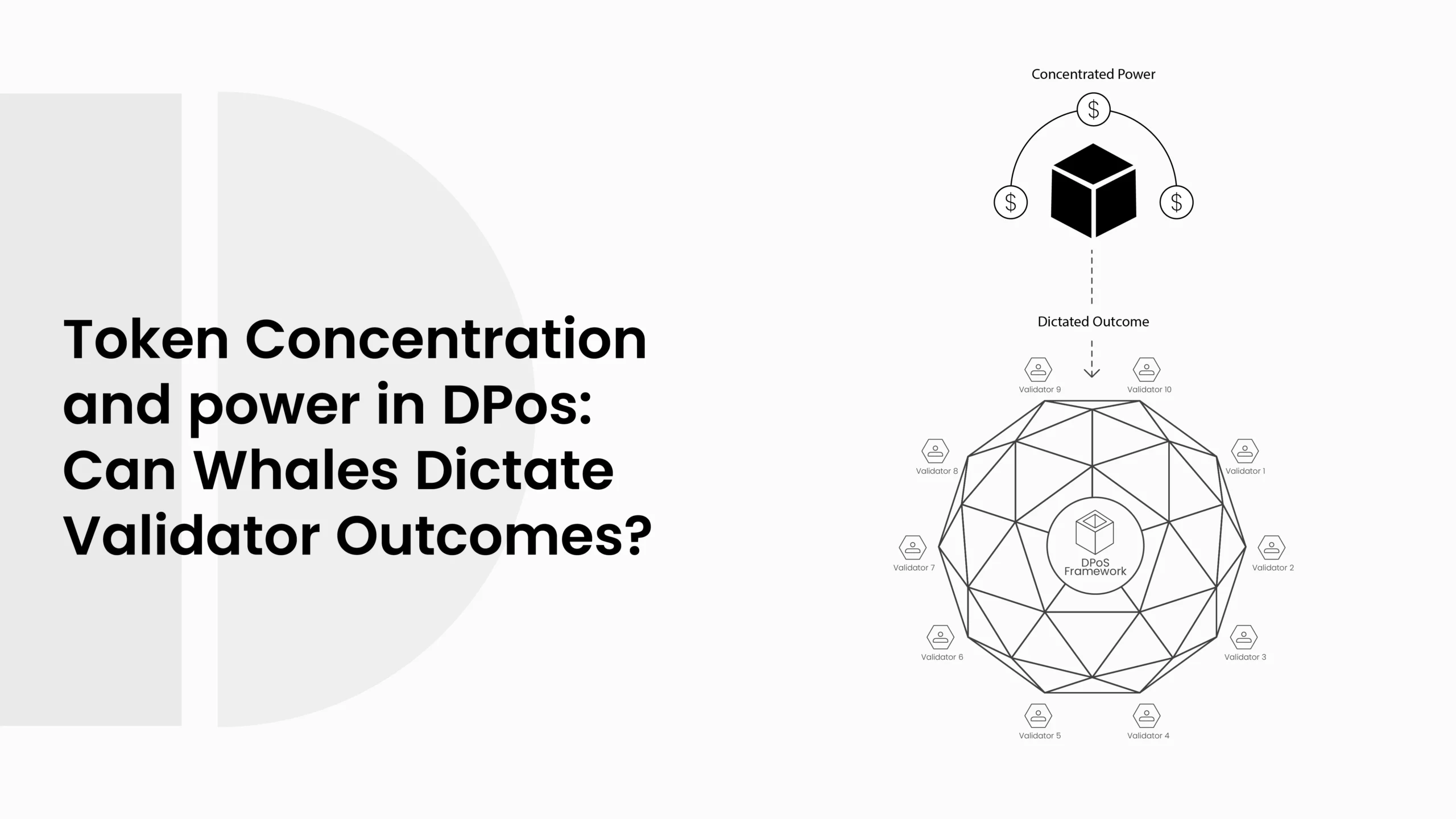

In Delegated Proof of Stake (DPoS), the influence of whales is even more powerful. DPoS is built to be fast, cheap, and community-driven. But it depends a lot on token voting. The more tokens someone owns, the more voting power they have. This means whales, who hold a huge share of the supply, can often decide which validators are chosen and what direction the network takes.

Many people see DPoS as the future of blockchain governance because it is fast and efficient. But when whales take over, the fairness and decentralization start to fade. Instead of many voices being heard, the system can turn into just a few whales making the rules. This blog will look at how token concentration gives whales this power, how it changes validator outcomes, and why retail holders often feel left out.

ALSO READ: DPoS as an Economic Laboratory: Incentives, Rewards, and Risks

How DPoS Governance Works

To understand whale power, it’s a must to first look at how DPoS works.

Delegated Proof of Stake differs from Proof of Work (PoW), where miners compete with machines, and also differs from normal Proof of Stake (PoS), where all token holders validate directly. In DPoS, token holders don’t validate blocks themselves. Instead, they vote for special members called validators, or sometimes “delegates.”

Here is how it works in a simple way:

- Token holders lock or stake their tokens.

- They vote for delegates or validators they trust.

- The validators who get the most votes are selected to produce blocks.

- Validators earn rewards for producing blocks. These rewards may be shared with the people who voted for them.

The more tokens you hold, the more weight your vote carries. If you hold 10,000 tokens, your vote counts more than someone holding 100 tokens. This design makes voting power uneven from the very beginning. In theory, it rewards those who have invested more, but in practice, it can hand over too much control to the biggest holders.

Simple Comparison of PoW vs PoS vs DPoS

| Feature | PoW | PoS | DPoS |

| Energy use | High | Medium | Low |

| Decision making | Miners | Token holders | Token holders + Delegates |

| Speed | Slow | Faster | Fastest |

| Risk of whales | Low | Medium | High |

This table shows why DPoS, while good in speed and efficiency, creates a higher risk of whales dominating. Since votes are directly linked to tokens, whales can easily influence validator outcomes by simply staking large amounts.

Token Concentration: When a Few Hold the Most Power

Now let’s talk about token concentration. Token concentration means that a small group of wallets or addresses holds a very large share of the total token supply. Instead of thousands of small holders each having a fair slice, most of the tokens sit in the hands of only a few.

In traditional markets, like stocks, this would be like a few giant investors owning more than half the shares in a company. They could control board decisions, push out smaller investors, and dictate the company’s direction. In crypto DPoS systems, it is the same idea.

For example, some DPoS projects have shown that the top 10 wallets alone can hold over 40% of the token supply. This means those wallets have enough voting power to decide who becomes a validator. Smaller holders can still vote, but their votes barely move the results. It feels like shouting into a storm, where only the voices of the whales are heard.

The risk here is centralization. DPoS is promoted as a decentralized governance system, but if most of the control rests in the hands of whales, then the system is no longer truly decentralized. It is just centralized in a different way.

Example Token Concentration in a DPoS Network

| Addresses | % of Token Supply | Impact on Governance |

| Top 10 wallets | 45% | Can decide validator results |

| Next 50 wallets | 25% | Influence but less |

| All other wallets | 30% | Small role in voting |

This table is merely an example, but it clearly illustrates the problem. With 45% in the top 10 wallets, those few addresses can completely dominate validator elections. Even if thousands of small users try to vote for change, their collective weight may still not be enough to beat whale power.

This makes token concentration one of the biggest challenges in DPoS. It raises important questions: Can people really call it decentralized if a few wallets control most of the supply? Can retail holders trust that their votes matter? And what happens to validator outcomes when whales decide to use their power for self-interest instead of community growth?

ALSO READ: Sustainability of DPoS in a Multi-Chain Future: Will DPoS Scale or Fade?

Whales Controlling Validator Outcomes

In DPoS, validators are the backbone of the network. They create blocks, confirm transactions, and keep the chain running smoothly. However, the way validators are chosen makes the system highly susceptible to whale control.

When token holders vote, the biggest wallets have the loudest voice. A whale with millions of tokens can vote for a validator and almost guarantee their win. This means validator elections are not always about skill, honesty, or community trust. They can just be about which whale is backing who.

Sometimes whales even form groups with validators. These are like behind-the-scenes deals where a validator promises to share rewards or give benefits if the whale supports them with votes. Smaller holders cannot compete with that kind of power.

Direct Control Over Block Producers

Whales can directly control which validators get selected. If one whale or a few whales decide to put their votes behind certain names, those validators are almost guaranteed to win. This is the opposite of community-driven governance.

Side Deals and Vote Buying

Vote buying is another common problem. A validator may cut private deals with whales. For example, they may agree to share a large percentage of block rewards if the whale helps elect them. This practice prioritizes validators serving whales over the community.

Governance Capture by a Few

When whales have this much influence, it creates something called governance capture. Instead of decisions being made by thousands of voices, they are made by a few powerful wallets. This is dangerous because if the whales have bad intentions, they can steer the network in ways that hurt everyone else.

Price Volatility Linked to Whale Actions

The power of whales is not just about validator voting. It is also about price and market moves.

Whales can shake the price of tokens just by making one big decision. If they buy a lot of tokens at once, the price goes up fast. Retail holders may think demand is growing and follow the trend. But if the whale sells later, the price can crash, and small holders end up losing money.

Liquidity is also key. In many cases, whales add or remove liquidity from exchanges. If they pull liquidity out, it makes the market weaker, and prices can drop hard. These moves scare retail holders, and many start selling out of fear, which makes the drop even worse.

All of this links back to validator voting. When prices go up, whales can buy even more tokens and get stronger in governance. When prices fall, smaller holders lose tokens or stop voting, which again makes whales more dominant.

Whale Actions and Market Reactions

| Whale Action | Market Effect | Governance Impact |

| Token Accumulation | Prices rise | Whales gain more voting power |

| Token Dump | Prices fall | Retail loses trust and influence |

| Liquidity Withdrawal | Panic selling happens | Validator pool becomes unstable |

This table shows how whale market activity is not just about profit. It always has a governance side too. Every time whales make a move, it changes not just the token price but also who has power in validator elections.

Case Studies of Whale Dominance

To really understand how big whales can shape DPoS systems, it helps to look at real cases. Some well-known tokens and networks have already faced problems with whale dominance.

WLFI and High Concentration

One strong example is WLFI, where more than half of the purchases come from just a few wallets. Reports show that about 56% of the supply sits with only 64 addresses. That kind of concentration means validators are not being picked by a wide community. Instead, they are chosen based on the decisions of a few powerful holders. The whole network’s stability depends on what those wallets want to do.

Pi Network Whales

Another example is the Pi Network. Whales here moved millions of tokens off exchanges to reduce supply. This had a direct effect on the price because supply became lower, and that pushed values up. For some users, it looked like a healthy signal. But in truth, it created even more centralization. By holding so much supply outside of exchanges, whales gained huge control over both governance and price. The community is left depending on their actions.

Meme Coin Experiments (TRUMP Token)

Meme tokens often show how wild whale activity can be. A token like TRUMP saw large speculative trades where whales made huge profits in a few hours. This kind of trading does not help the community or governance. Instead, it shows how whales can create hype, drive prices, and then leave smaller holders with losses. While not all meme tokens use DPoS governance, the same risk exists in any token system where whales hold a big share.

These case studies make the point very clear. When tokens are concentrated, whales do not just hold wealth. They hold the power to decide validator outcomes, governance decisions, and even the mood of the community.

ALSO READ: Latency and Finality in DPoS: Why Speed Comes with Trade-Offs in Security

Institutional Investors and OTC Deals

Whales are not always just random rich people in crypto. Many times, they are big institutions. These can be funds, private investors, or even companies. Unlike retail users, these players do not always buy tokens directly on exchanges. They use something called OTC trades, which means “over the counter.”

In an OTC trade, two sides agree on a deal privately. For example, an institution may want to buy 10 million tokens. If they buy that on a public exchange, the price will jump fast and cause panic or hype. So instead, they make a private deal with another whale or the project team itself.

This method hides the real size of the whale’s move from retail eyes. It allows whales to get huge voting power without shaking markets too much. But for the DPoS community, it creates more hidden centralization. By the time retail holders find out, the whales may already be quietly controlling validators.

This also shows why institutional whales have a special advantage. They can get tokens in bulk, at lower prices, and then use those tokens to guide validator elections. Retail holders are left only with a small leftover role in governance.

Community Growth vs Whale Power

DPoS projects often talk about community growth and decentralization. The idea is that everyone can take part, vote, and help build the network together. But when whales are too powerful, the community’s voice becomes small.

Whale dominance creates a system where many small holders feel like their votes don’t matter. This lowers participation. Why vote if the outcome is already decided by whales? This can hurt engagement and long-term growth of the project.

Projects that ignore this risk sometimes end up being too centralized, and this scares away new users. People want fairness, and they want to know their role counts. If it becomes clear that validator outcomes are just decided by a few rich players, retail users may leave for other blockchains.

On the other hand, some projects are trying to fight this problem. They add staking pools, caps, or incentives for small holders to join governance. But these solutions are still small steps. The balance between whales and retail voices is not easy to solve.

Retail vs Whale Influence in DPoS

| Factor | Retail Users | Whales |

| Voting weight | Small | Very high |

| Market effect | Weak | Strong |

| Governance input | Limited | Overwhelming |

| Role in growth | Community building | Validator control |

This table shows how unbalanced the system is. Retail users help with community growth, marketing, and small governance input. But whales dominate validator results and can steer the project in directions that may not match community wishes.

Technical Analysis of Whale Activity

One way retail users and analysts try to understand whales is through technical analysis. Even though whale activity is hard to see directly, it often shows up in price charts and market signals.

Two common tools are RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence).

RSI helps measure if a token is overbought or oversold. If whales are buying heavily, RSI usually goes high, showing the token may be overbought. When whales sell big, RSI may crash down, showing oversold conditions.

MACD is used to look at trends and momentum. It can give signals if whales are driving a strong bullish or bearish move. Traders often watch these lines to guess if whales are entering or leaving the market.

But here’s the truth: technical analysis is never perfect when whales are involved. Whales can break trends fast. A big sell can ruin a bullish chart in seconds. A huge buy can create a fake pump. That is why small holders who only follow technical signals sometimes get trapped.

Another problem is mixed signals. For example, in the Pi Network, technical analysis has shown both bullish and bearish signs at the same time. This confusion happens because whales may be playing different strategies; some are buying, some are selling. For retail users, it creates uncertainty and risk.

So while technical tools are helpful, they cannot fully protect against whale power. In DPoS, especially, where whales also control validator elections, price signals are only half the story. Governance signals matter too, but they are much harder to track on a chart.

Decentralization Challenges in Whale-Dominated DPoS

Decentralization is supposed to be the heart of blockchain. It means no single person or group can control the network. Everyone gets a fair chance to take part. But in whale-dominated DPoS, this principle becomes weak.

When whales hold too many tokens, the validator elections are no longer fair. The whales decide the outcome, and the rest of the community just watches. This is dangerous because it makes the blockchain act more like a private club than a decentralized network.

Another problem is validator cartels. Sometimes whales join forces to elect a group of validators they control together. This cartel can share rewards between itself and block out new competition. It makes it very hard for smaller validators or new community-backed delegates to rise.

If this continues, users may lose trust in DPoS systems. They may move to other networks that feel fairer, even if they are slower or more expensive. That is why whale dominance is not only a governance problem, but also a survival issue for projects.

ALSO READ: How DPoS Chains Handle Network Upgrades Compared to PoS and PoW Chains

Solutions: Can Tokenomics Fix Whale Dominance?

Some projects are trying to solve the problem of whale dominance through tokenomics, which means the way tokens are created, shared, and used. While there is no perfect answer, there are a few approaches being tested.

Fair Token Distribution

The first step is fair distribution. If tokens at launch are spread to many wallets instead of just a few, the chance of whales forming is lower. Airdrops, community sales, and smaller purchase limits can help. But often projects ignore this and sell huge blocks to early investors.

Lockup Periods and Staking Caps

Another idea is lockup periods. This means whales cannot use all their tokens for voting right away. They must wait or stake in smaller parts over time. Staking caps are also suggested, where each wallet has a limit on how much voting weight it can use. These rules can make validator elections less controlled by one group.

Incentives for Small Holders

Some projects offer rewards for smallholders to participate. For example, bonus staking rewards for wallets with fewer tokens. This helps encourage retail users to stay active, even when whales dominate. It may not fix everything, but it creates balance and keeps more people engaged.

These solutions are still early. Many blockchains talk about them but do not fully apply them. Until stronger fixes are put in place, whales will likely continue to dominate validator outcomes.

Key Takeaways

The link between token concentration, whale activity, and DPoS governance is very clear.

- DPoS was designed for speed and efficiency, but it gives too much power to token-rich whales.

- Token concentration makes validator elections unfair because a few wallets decide outcomes.

- Whale market actions, buying, selling, liquidity moves, always affect both price and governance.

- Case studies like WLFI and Pi Network show how real whale control can reshape networks.

- Solutions exist, but they are still weak and not widely applied.

For retail users, this means they must be careful. Even if the network says it is decentralized, if whales hold most tokens, the power is not really spread.

Conclusion

Delegated Proof of Stake is one of the most popular blockchain systems today. It is fast, low-cost, and community-driven in theory. But when whales take over, the system can lose its promise of decentralization.

Whales holding big token supplies can pick validators, control governance, and even shake token prices. Retail users often end up with little voice, while whale groups and institutions decide the future of the network.

This does not mean DPoS is useless. It still has strong potential. But for it to survive long-term, projects must face the challenge of whale dominance. Better tokenomics, fair distribution, and incentives for small holders are needed. Without them, validator outcomes will always be dictated by a few instead of the many.

For retail users, the best tool is awareness. By understanding how whales shape both price and governance, small holders can make smarter choices. They can decide which projects to trust and which ones may be too controlled to stay healthy.

The future of DPoS depends on balance. If projects find ways to keep whales in check, DPoS can remain fast, fair, and community-focused. If not, then it may just become another system where power belongs only to the few.

Frequently Asked Questions About Token Concentration and Power in DPoS

What is token concentration in DPoS?

Token concentration happens when a few wallets hold most of the token supply. In DPoS, this means those wallets also have the most voting power and can decide which validators get chosen.

How do whales affect validator elections?

Whales can use their large number of tokens to vote for specific validators. Because their votes are so heavy, they often control the final outcome, leaving small holders with very little influence.

Do whale actions also impact token prices?

Yes. When whales buy big, prices rise fast. When they sell or pull liquidity, prices can drop sharply. These moves affect both token value and governance power in DPoS.

Can DPoS still be decentralized if whales dominate?

Not really. If whales control validator outcomes, the system becomes centralized in practice, even if it is called decentralized. It may act more like a private club run by a few wallets.

What can projects do to stop whale dominance?

Projects can spread tokens fairly, add staking caps, create lockup rules, and give extra rewards for small holders. These steps can help balance whale power and keep the system fairer.

What should small holders do in whale-heavy networks?

Retail users should stay aware of whale activity, use tools like RSI and MACD to track trends, and support projects that have fair tokenomics. Awareness is the best defense against whale dominance.

Glossary of Key Terms

DPoS (Delegated Proof of Stake): A consensus system where token holders vote for validators to produce blocks.

Whales: Large investors or institutions that hold a massive share of tokens.

Validator: A node or delegate chosen by votes to confirm transactions and add blocks to the chain.

Token Concentration: A situation where a small number of wallets own most of the token supply.

Governance Capture: When a small group controls decision-making, it reduces fairness in a network.

OTC Trades (Over the Counter): Private deals made outside public exchanges, often used by whales.

RSI (Relative Strength Index): A chart tool used to see if tokens are overbought or oversold.

MACD (Moving Average Convergence Divergence): A technical indicator used to track momentum and trend changes.