Cross-Chain DPoS Staking: How Delegates are Expanding to Multi-Chain Platforms

Over the past few years, Delegated Proof of Stake (DPoS) has played a major role in improving the efficiency of blockchain consensus and in cross-chain DPoS staking. Unlike Proof of Work, which depends on computational power, or Proof of Stake, which relies on validator selection through token holding, DPoS allows token holders to vote for a limited number of delegates. The aforementioned delegates will produce blocks, validate transactions, and be involved in governance decisions. It reduces congestion and provides higher throughput while still being democratic in governance.

- Fundamentals of DPoS Consensus

- How DPoS Differs from PoS and PoW

- Role of Delegates in Governance and Block Production

- What is Cross-Chain DPoS Staking?

- Definition and Core Purpose

- How Cross-Chain DPoS Staking Works

- Key Components

- The Shift Toward Cross-Chain Functionality

- Why DPoS Needs Interoperability

- Evolution of Interoperable DPoS Chains

- Validator Synchronization Across Chains

- Architecture of Cross-Chain Staking Systems

- Staking Contracts and Interchain Communication

- Validator Identity and Key Management

- Consensus Coordination Across Chains

- Delegate Operations on Multi-Chain Platforms

- Multi-Chain Staking Workflow

- Reward Aggregation and Distribution

- Risk Management and Slashing

- Delegate Responsibilities Across Chains

- Cross-Chain Governance and DAO Integration

- Unified Governance Across Networks

- Inter-Chain DAO Communication

- Voting and Consensus Uniformity

- Real-World Implementations

- Cosmos Hub and Interchain Security

- Polkadot and Parachain Validators

- Avalanche Subnets and Shared Validation

- Emerging Multi-Chain DPoS Frameworks

- Technical Challenges and Future Prospects

- Security Vulnerabilities in Bridges

- Latency and Finality Bottlenecks

- Evolution Toward Modular DPoS Layers

- Conclusion

- Frequently Asked Questions About DPoS Staking

- What is cross-chain DPoS staking?

- How is cross-chain DPoS different from normal DPoS?

- What are the benefits of cross-chain DPoS?

- What are the main challenges of implementing cross-chain DPoS?

- Which blockchain networks use cross-chain DPoS?

- Article Summary

However, a traditional DPoS architecture was designed for separate blockchains. Each network had a separate set of validators, governance rules, and token economy. This became a limitation as the blockchain ecosystem began to grow and interact with each other. The asks for cross-chain DPoS staking interoperability brought into the frame newer challenges, such as how to enable validators to serve on more than one chain while maintaining decentralization and security.

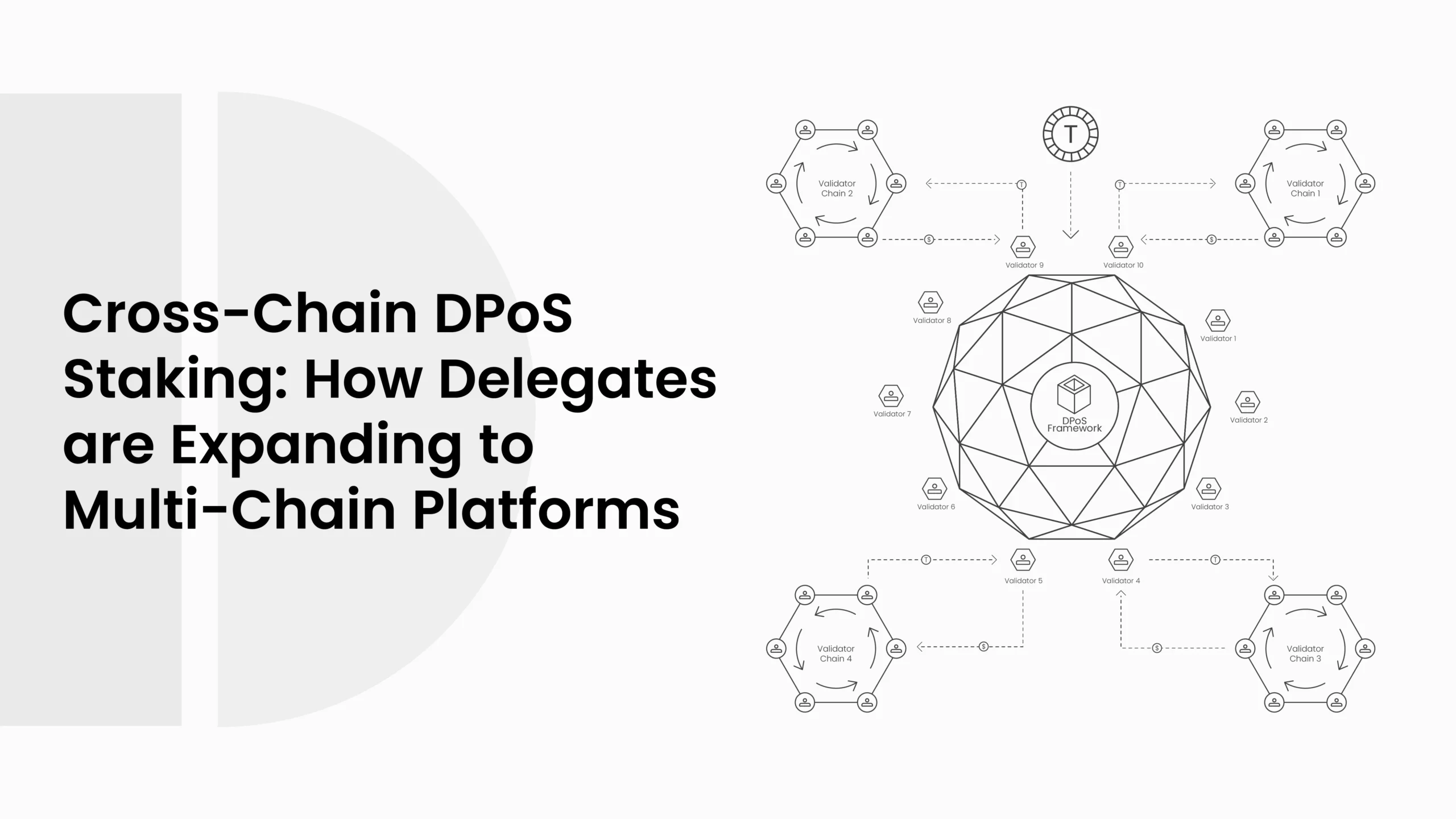

Cross-chain delegation proof of stake (DPoS) staking has emerged as a solution to this problem. Cross-chain DPoS staking extends an existing DPoS staking model across multiple chains rather than a single blockchain, thereby enabling validators to secure numerous networks simultaneously. Cross-chain DPoS staking theoretically enables a bridging mechanism and shared-security models in which a single delegate can validate blocks, earn staking rewards, and govern multiple mutually connected blockchains. This improves liquidity for staking tokens in liquid markets, validator utilization, and governance of multi-chain interplays across various networks.

Currently, systems such as Cosmos, Polkadot, and Wanchain are designing frameworks in which DPoS validators are not limited to a single network. This is a transition towards shared infrastructure that interconnects ecosystems. This transition is a significant milestone towards a complete building block for a multi-chain blockchain, where validators and token holders interact collaboratively and independently across chains.

Fundamentals of DPoS Consensus

How DPoS Differs from PoS and PoW

DPoS was developed in order to combat the drawbacks of older systems, which are transaction speed and energy consumption. PoW (Proof of Work) requires miners to validate blocks by solving cryptographic puzzles, which uses a lot of electricity, while PoS (Proof of Stake) requires validators to be chosen based on how many tokens they have and locked on the network. While PoS was more efficient, PoS left small participants without meaningful influence in the protocol.

Delegated Proof of Stake introduced a more democratic system. Token holders vote for a small number of delegates who represent the network. These delegates are responsible for block production and validation. This not only improves transaction finality but also adds a governance layer where community members can remove underperforming delegates through voting.

| Parameter | PoW | PoS | DPoS |

| Block Producers | Miners | Validators | Delegates |

| Consensus Speed | Slow | Moderate | Fast |

| Governance Layer | External | Partial | On-chain |

| Energy Use | High | Medium | Low |

Because only a few delegates are engaged in each validation round, Delegated Proof-of-Stake (DPoS) has quicker block confirmation. In this scheme, accountability and reputation are prioritized; delegates that behave inadequately or dishonestly can be removed by token holders. As a result, the DPoS creates a stable and predictable network that handles a substantially greater volume of transactions.

ALSO READ: How DPoS Validators Power On-Chain Oracles: A Technical Overview

Role of Delegates in Governance and Block Production

Delegates, or block producers, are core actors within the DPoS network. Not only do delegates validate each transaction, but they also play a central role in governance, such as voting on proposals, changing parameters of the system, and otherwise coordinating upgrades to the network. Each delegate must also demonstrate, to token holders, a level of uptime, security, and reliability in their performance, in other words, providing trust for the token holders in their role.

In most DPoS systems, block production follows a round-based schedule. Delegates take turns signing blocks, ensuring equal participation. Rewards earned from block validation are distributed proportionally between delegates and voters, encouraging active participation from the community. When applied to cross-chain DPoS staking systems, these same principles need to be extended so that delegates can operate in multiple environments with different block intervals and governance rules.

Delegates also help stabilize token economies. Because staking locks tokens for a defined period, the network reduces liquidity volatility. The process aligns long-term holders with network security goals. In cross-chain versions of DPoS, this staking logic becomes more complex. Tokens may be staked on one chain but represent voting power or collateral across others. Managing this safely requires new smart contract designs and bridging protocols.

What is Cross-Chain DPoS Staking?

Cross-chain DPoS staking allows users to participate in staking and earn rewards across multiple blockchains through interoperability protocols. It combines Delegated Proof-of-Stake (DPoS), where token holders delegate their tokens to a smaller group of validators, with cross-chain DPoS staking technology, enabling participation in different blockchain ecosystems from a single point. This allows for more flexible portfolio diversification and access to various staking opportunities without managing multiple wallets.

Definition and Core Purpose

Cross-chain DPoS staking refers to the process where a delegate uses shared or wrapped stake assets to participate in block validation across multiple chains. It combines the governance flexibility of DPoS with the interoperability standards of modern blockchain design. The main goal is to create a shared validator infrastructure where the same set of delegates secures multiple networks that trust each other through cryptographic proof and interchain communication.

The purpose of this expansion is to avoid validator fragmentation. Rather than having unique validator sets for each blockchain separately, cross-chain DPoS staking creates a consolidated validator layer. A shared validator layer encourages decentralization and increases the security of the whole ecosystem because validators are responsible for performance across chains.

How Cross-Chain DPoS Staking Works

- Delegation: Users (delegators) delegate their tokens to a select number of validators they believe will perform well. These validators are responsible for processing transactions and securing the network.

- Cross-chain communication: Interoperability protocols or liquid staking derivatives connect different blockchains, allowing the staked assets on one chain to be used or represented on another.

- Token representation: A liquid staking provider might stake assets on Chain A for a user and provide them with a liquid staking derivative token on Chain B. This derivative represents their staked position and can be used in other applications like DeFi.

- Reward distribution: The delegator shares in the staking rewards earned by their chosen validator, minus any fees.

Key Components

To function correctly, cross-chain DPoS staking uses a combination of network and consensus tools. The key components include bridge validators, cross-chain smart contracts, and message relay protocols. Bridge validators confirm events between chains. Smart contracts manage the stake-locking and delegation logic. Relay protocols transport transaction data and governance instructions across ecosystems.

| Component | Description | Example Protocol |

| Bridge Validator | Verifies cross-chain block information | Cosmos IBC Validators |

| Cross-Chain Smart Contract | Manages locked or mirrored stake | Polkadot Parachain Contracts |

| Relay Protocol | Transfers validator data between chains | LayerZero, IBC, XCMP |

Each of these layers ensures that staking information remains consistent. If a delegate is slashed or goes offline on one network, the penalty can propagate through the bridge to the other connected networks. It keeps the system balanced and transparent even when multiple blockchains interact in real time.

The Shift Toward Cross-Chain Functionality

The blockchain industry is moving fast toward interoperability. In the early years, each network worked independently, with its own consensus and community. But this model soon became restrictive. Assets could not move freely between blockchains, and governance stayed locked within small ecosystems. As decentralized finance and multichain protocols grew, DPoS networks started adopting cross-chain DPoS staking mechanisms to extend their reach and participation.

Why DPoS Needs Interoperability

Delegated Proof of Stake systems rely heavily on active participation and token liquidity. However, when tokens stay locked in one network, it limits both liquidity and governance expansion. Validators and delegates could only work within one environment, even if they could contribute across others. Interoperability removes that barrier.

Through cross-chain DPoS staking, a validator can secure multiple chains while using the same base token. This helps expand validator income sources and stabilizes governance distribution across ecosystems. It also allows smaller blockchains to share validator sets from larger networks, gaining security and credibility faster.

ALSO READ: Can DPoS and Tendermint Work Together for a Faster Blockchain?

Evolution of Interoperable DPoS Chains

Projects like Cosmos, Polkadot, and Wanchain have spearheaded cross-chain DPoS staking. Cosmos invented the general concept of the Inter-Blockchain Communication (IBC) protocol. IBC enables independent blockchains, termed zones, to communicate with a central blockchain network called Cosmos Hub. Also, the same validator set can secure multiple zones, which provides shared security and limits fragmentation.

Polkadot operates as a relay chain model, where parachains depend on nominated validators to achieve consensus. Validators are responsible for assuring block production across parachains, allowing each chain to remain updated nearly instantaneously remain update via robot calls. Wanchain invented a bridge node model where DPoS delegates act as bridge verifiers, facilitating links between Ethereum, Bitcoin, and others, which allows for increased interoperability at the consensus layer.

Validator Synchronization Across Chains

Cross-chain DPoS staking requires a high level of synchronization. Validators must verify state changes across multiple networks without double-signing or losing consistency in their own experience. Interchain relay protocols like IBC and XCMP (Cross-Chain Messaging Passing) are used to transmit signed messages between networks. The messages may contain a staking update from validators or governance votes.

Each participating network retains the local consensus that synchronizes with other networks; however, the global coordination happens through bridge verifiers that compare block headers and signatures. This comparison assures that while all chains remain independent, the validator’s verification status remains shared across all chains.

Architecture of Cross-Chain Staking Systems

The architecture of cross-chain DPoS staking combines networking, consensus, and execution layers. It builds an environment where validator actions can be mirrored or extended across multiple ecosystems without losing the deterministic nature of blockchain consensus.

Staking Contracts and Interchain Communication

Cross-chain DPoS staking starts at the staking contract layer. A staking contract on the main chain locks the tokens and records the validator’s address. When a connected network needs validation, the staking information is transmitted using cross-chain communication protocols. The secondary chain recognizes the validator through a proof-of-stake mirror, a synthetic representation of the original stake.

Smart contracts on both ends verify the authenticity of the validator before allowing participation. Once verification is done, the validator can begin block production on the connected chain. The earned rewards are recorded and later synchronized back to the main network, maintaining consistent accounting.

Validator Identity and Key Management

Cross-chain validation requires advanced cryptographic handling. Validators maintain separate keys for each chain but often link them to a single cryptographic identity. This identity is verified through multi-signature or threshold signature schemes (TSS). The system maps the validator’s identity across chains using cryptographic proofs, so that reputation and performance metrics remain unified.

When a validator misbehaves, such as by signing conflicting blocks, these proofs allow slashing mechanisms to activate across every connected network. This design maintains security while still giving validators the flexibility to operate in multiple consensus environments.

Consensus Coordination Across Chains

Cross-chain DPoS staking relies on coordination mechanisms that verify and finalize state changes across networks. This includes block finality proofs, relay checkpoints, and cross-consensus validation (XCV) models. Each connected network submits periodic block headers to the main chain for verification.

Consensus layers like Tendermint or GRANDPA (used by Polkadot) confirm the finality of each block before it becomes part of the shared state. This ensures that all validator actions are cryptographically verifiable across different networks.

| Layer | Function | Technologies Used |

| Network Layer | Transfers staking data and messages | IBC, XCMP, LayerZero |

| Consensus Layer | Verifies finality across chains | Tendermint, GRANDPA |

| Execution Layer | Handles smart contracts and staking logic | CosmWasm, Substrate |

| Governance Layer | Collects and executes proposals | DAO and on-chain modules |

This architecture provides the foundation for secure cross-chain staking, where each layer works together to maintain validator accountability and reward distribution accuracy.

Delegate Operations on Multi-Chain Platforms

Operating as a delegate across multiple blockchains is both a technical and strategic responsibility. A cross-chain delegate manages staking, voting, governance, and compliance across different ecosystems while maintaining synchronized uptime and signing behavior.

Multi-Chain Staking Workflow

The process begins when a delegate locks tokens on the home chain, usually through a staking contract. These tokens represent validator credibility and collateral. The same stake is mirrored to other connected chains using bridging protocols. Once verified, the delegate starts producing blocks on each network in rotation or parallel, depending on the design.

Rewards earned from each network are reported back to the main staking contract. The delegate’s overall yield becomes an aggregation of all connected ecosystems. This helps maintain efficiency, as the delegate does not need to split stake into multiple separate pools.

Reward Aggregation and Distribution

Cross-chain DPoS staking also changes how rewards are managed. In a traditional DPoS network, rewards are distributed by the main contract after each round. In a cross-chain system, the aggregation process collects earnings from multiple networks and merges them into a unified payout model.

For example, if a delegate participates in both a main hub and a parachain, rewards are calculated separately but synchronized through cross-chain messages. This ensures that token holders and voters receive accurate returns regardless of where their validator is active.

The accounting system also tracks transaction fees and governance bonuses from connected networks, improving overall yield visibility.

Risk Management and Slashing

Cross-chain validation increases complexity, which brings additional risks. Validators must manage node uptime and prevent double-signing incidents. Downtime on one chain can trigger slashing penalties across others if the protocol applies shared-security rules.

Bridges also introduce risk vectors like replay attacks or data mismatches. Therefore, slashing logic must include multi-signature verification and block height synchronization. When implemented correctly, this system builds trust in the delegate layer, reducing manipulation and ensuring reliable consensus.

ALSO READ: How Slashing Designs Help Build Trust in Custom DPoS Chains

Delegate Responsibilities Across Chains

| Function | Description | Tools Used |

| Staking Management | Delegate tokens across multiple blockchains | Multi-wallet staking dashboards |

| Governance Participation | Vote and manage proposals across ecosystems | DAO gateways |

| Performance Monitoring | Maintain uptime and latency compliance | Validator monitoring tools |

| Security Enforcement | Prevent slashable actions and key misuse | Slashing trackers and audit nodes |

Cross-Chain Governance and DAO Integration

Cross-chain DPoS staking not only connects validation but also integrates governance structures across multiple blockchains. Governance is one of the most complex elements to synchronize because it includes proposal creation, voting, and execution. Each connected network might have different governance modules or timelines. To solve this, interoperability protocols have introduced ways for delegates and token holders to vote across networks using unified DAO frameworks.

Unified Governance Across Networks

In a cross-chain environment, delegates hold voting power that extends beyond one blockchain. For example, a validator elected on a primary chain can also vote on governance decisions on a connected parachain or sidechain. The unified governance system collects votes from all chains and executes decisions based on combined outcomes.

This model enables shared upgrades or policy changes. A change in consensus parameters on one chain can trigger automatic updates in connected ecosystems through governance relays. It ensures that system upgrades, fee adjustments, or staking policy changes remain consistent across all participating blockchains.

Inter-Chain DAO Communication

DAO communication across chains works through message-passing protocols and governance bridges. When a proposal is submitted on one chain, it generates a transaction packet that includes proposal metadata and voting conditions. This packet is broadcast through relays like IBC or LayerZero and replicated on other connected chains. Token holders and delegates from different ecosystems can then participate in the voting process.

After the voting period ends, the results are transmitted back to the main governance hub. The hub aggregates all the votes and determines if the proposal has passed. Once approved, smart contracts execute the decision automatically across the affected blockchains.

This process builds an interlinked ecosystem where governance decisions no longer stay isolated within one network.

Voting and Consensus Uniformity

Cross-chain voting needs uniformity to prevent manipulation and conflicting results. Validators rely on synchronized block heights and shared timeframes to verify votes. Finality checkpoints ensure that only confirmed votes are counted. Each validator’s vote signature is verified across chains, maintaining fairness and preventing duplicate entries.

As these governance systems evolve, they create what can be described as a meta-governance layer, where the entire ecosystem of connected chains can coordinate under one distributed decision system. It forms the political structure of future multi-chain networks.

Real-World Implementations

Cross-chain DPoS staking is not just theoretical. Several blockchain ecosystems already use it in active environments, showcasing how multi-chain validators can improve scalability, security, and governance.

Cosmos Hub and Interchain Security

Cosmos has developed one of the most complete models for cross-chain DPoS through its Interchain Security (ICS) system. Validators on the Cosmos Hub not only secure the hub itself but also validate other connected chains known as consumer chains. These chains share the same validator set, which receives a portion of transaction fees and rewards from each network.

This system creates shared security while still allowing independent token economies. Validators benefit from multiple revenue streams while maintaining governance participation across zones. It reduces the fragmentation that previously existed between different DPoS-based Cosmos networks.

Polkadot and Parachain Validators

Polkadot applies the relay chain and parachain structure. Validators on the relay chain are nominated by token holders through DPoS-style staking. These validators then secure multiple parachains connected to the relay chain. Each parachain maintains its own logic, smart contracts, and assets, but shares the relay chain’s consensus.

Nominators earn rewards proportional to their stake, while validators receive incentives for cross-parachain validation. This setup allows Polkadot to scale horizontally, adding new parachains without compromising speed or security.

Avalanche Subnets and Shared Validation

Avalanche uses subnets as customizable blockchains that share the same validator set. Every validator on the Avalanche primary network can choose to validate one or more subnets by staking AVAX tokens. This creates a flexible cross-validation structure similar to DPoS, where validators act as shared security providers across subnets.

It allows new projects to launch dedicated blockchains while still depending on a core set of validators. The design aligns with the same goals of cross-chain DPoS, shared governance, scalable participation, and unified security.

Emerging Multi-Chain DPoS Frameworks

New protocols like Octopus Network and LayerZero are introducing hybrid frameworks. Octopus uses DPoS-style validators to secure multiple appchains under the NEAR ecosystem. LayerZero enables message passing between independent blockchains using relayers and oracles, giving DPoS validators access to cross-chain governance and data validation opportunities.

Technical Challenges and Future Prospects

While cross-chain DPoS staking has major advantages, it also brings complex challenges. Validator synchronization, bridge security, and latency all become critical factors in maintaining stable consensus.

Security Vulnerabilities in Bridges

Bridges are often the weakest point in cross-chain systems. Since they handle message passing and stake mirroring, any vulnerability can lead to double-spending, validator impersonation, or stolen funds. Attackers may exploit bridge oracles or intercept transaction packets during transmission.

Protocols now use cryptographic proofs like Merkle inclusion proofs or light client verification to confirm data authenticity between chains. Some systems also apply threshold signature schemes (TSS) to prevent individual bridge operators from gaining control over locked funds.

Latency and Finality Bottlenecks

Cross-chain operations depend on block finality from multiple chains. Different networks may have varying block times or confirmation delays. If one chain finalizes a block slower than others, synchronization issues can appear. This can delay staking updates, reward distribution, or governance execution.

New consensus coordination methods like asynchronous message queues and finality relays are helping reduce these delays. They confirm cross-chain data without waiting for full block finality, improving responsiveness.

Evolution Toward Modular DPoS Layers

The future of cross-chain DPoS will likely become modular. Instead of building all functions into one network, developers will design staking-as-a-service layers that operate independently. These modules handle validator identity, slashing, and governance logic while connecting to multiple client chains.

It allows a more flexible model where validators act as service providers for many chains simultaneously. This modular design could lead to the emergence of global validator hubs that supply security to the entire Web3 ecosystem.

Conclusion

Cross-chain DPoS staking represents the next generation of blockchain coordination. By merging validator operations and governance across networks, it introduces a scalable, flexible, and interconnected model for securing decentralized systems. Validators become universal actors, capable of maintaining consensus across many ecosystems while operating under shared governance.

Although challenges remain, especially around security, latency, and coordination, the foundation is already set. The ongoing research in interoperability and modular staking shows that the future of DPoS is not about one network outperforming another, but about how all networks can operate together as one.

Frequently Asked Questions About DPoS Staking

What is cross-chain DPoS staking?

Cross-chain DPoS staking is a system that allows delegates or validators to participate in consensus and governance across multiple connected blockchains using shared staking and interoperability protocols.

How is cross-chain DPoS different from normal DPoS?

Traditional DPoS operates within one blockchain, while cross-chain DPoS extends the validator’s role across multiple networks. It uses bridges and smart contracts to coordinate staking and governance across these chains.

What are the benefits of cross-chain DPoS?

It improves validator efficiency, enhances liquidity, strengthens governance participation, and creates a unified ecosystem for decentralized coordination.

What are the main challenges of implementing cross-chain DPoS?

Security vulnerabilities in bridges, latency in message passing, and complex validator key management are some of the main challenges faced by multi-chain DPoS systems.

Which blockchain networks use cross-chain DPoS?

Cosmos (through Interchain Security), Polkadot (through parachains and the relay chain), and Wanchain (through bridge nodes) are among the leading ecosystems using cross-chain DPoS principles.

Article Summary

Cross-chain DPoS staking marks a significant evolution in blockchain consensus. It extends the traditional Delegated Proof of Stake model to multi-chain environments, allowing validators to secure and participate across several connected blockchains. Through interoperability protocols such as IBC, XCMP, and LayerZero, validators can validate transactions, earn rewards, and participate in governance decisions across different networks using shared security models.

The system depends on bridge validators, smart contracts, and relay mechanisms that synchronize data and maintain validator accountability. This new structure enhances liquidity efficiency, decentralization, and the reach of governance. However, it also poses technical challenges, including bridge vulnerabilities, latency issues, and complex key management.

Despite these challenges, cross-chain DPoS staking represents a strong direction for blockchain evolution. By building shared validator infrastructure and unified governance, it moves closer to a truly connected Web3 ecosystem where multiple networks function together under a single interoperable framework.