How Bitshares, EOS, and TRON Implement DPoS Differently

The consensus mechanism behind a blockchain shapes its speed, security, and governance. Delegated Proof of Stake (DPoS), introduced by Daniel Larimer in 2014, was designed to address the inefficiencies of Proof of Work and mitigate the concentration risks associated with traditional Proof of Stake. By allowing token holders to vote for a limited number of delegates who validate transactions, DPoS reduces energy use and increases scalability without sacrificing security.

- DPoS Blockchain Comparison

- Early Lessons from BitShares

- Scaling Horizons with EOS.IO

- TRON’s Emphasis on Speed and Reach

- Case Studies in Action: Real-World DPoS Events

- Security and Attack Vectors: What Could Go Wrong?

- Community Governance Commentary: Who’s Really in Charge?

- How Voting Power Becomes Uneven Over Time

- Hanging in the Balance: Strengths, Weaknesses, Tradeoffs

- BitShares: High Stability, Moderate Centralization

- EOS.IO: Fast but Stagnant

- TRON: Frequent Elections, High Concentration

- A Timeline of Lessons

- Final Thoughts

- Frequently Asked Questions (FAQs)

- Glossary of Terms

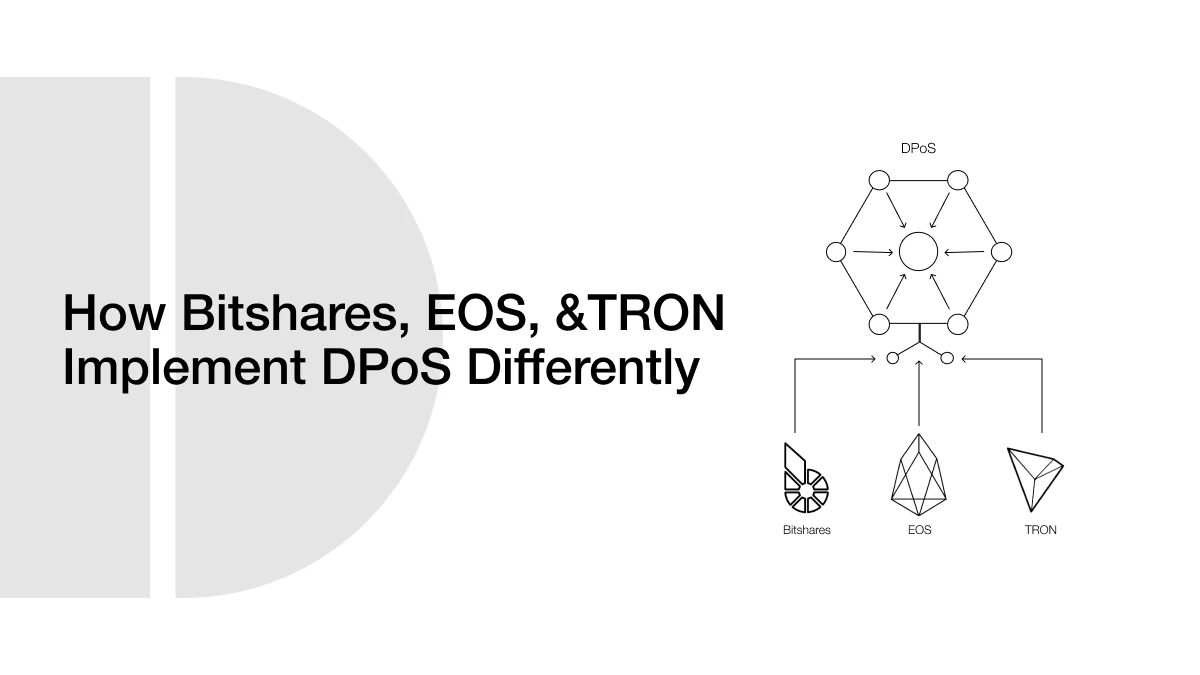

While the core idea remains consistent, real-world implementations vary widely. BitShares pioneered DPoS with a focus on performance and low-cost trading. EOS adopted it for large-scale decentralized applications, introducing a more structured governance model. TRON tailored DPoS for speed and content delivery, using Super Representatives to drive consensus. Each system interprets DPoS differently, and recent studies reveal that these choices affect decentralization, voter engagement, and network control. Understanding these differences is key to evaluating what Delegated Proof of Stake truly offers in practice.

DPoS Blockchain Comparison

| Feature | BitShares | EOS.IO | TRON |

| Launch Year | 2015 | 2018 | 2018 |

| Delegates | ~25–50 Witnesses | 21 Block Producers | 27 Super Representatives |

| Block Time | 2 seconds | 0.5 seconds | 3 seconds |

| Voter Participation | ~99% (early) | Low (recently) | Moderate |

| Governance Model | Shareholder Voting | Mutual Voting, Low Turnover | Influencer-Driven |

| Known Incidents | Vote Centralization | Governance Drift | Steem Takeover |

| Use Case Focus | Trading/DEX | DApps & Enterprise | Media & Content |

Early Lessons from BitShares

BitShares became the first live testbed for DPoS when it launched in 2015. It entrusts block generation to a limited set of witnesses chosen by approval voting of shareholders. Each token holder can vote for multiple candidates, and each witness takes their turn producing a block, typically every two seconds. This streamlined process enables low fees and fast trade execution. Through daily witness rotation and a high participation rate of around 99 percent, BitShares demonstrated that a small set of trusted validators could maintain strong uptime and speed.

Despite these successes, early research identified a centralization tendency inherent in DPoS. As vote concentration increases, fewer node operators gain repeated validation power. Without mechanisms to redistribute power or incentivize broader participation, smaller stakeholders risk losing influence and slipping into a passive role. BitShares remains valuable as a proof of concept in high-performance finance applications, but its governance model carries clear political risks.

Scaling Horizons with EOS.IO

EOS.IO entered the industry in 2018, aiming to scale DPoS for high-volume smart contracts and decentralized applications. Its architecture supports 21 active block producers at any given time, with additional standby nodes to support failover and governance. Block time is fixed at 0.5 seconds, delivering high theoretical throughput.

Researchers have conducted a thorough examination of EOS, examining its decentralization and governance dynamics. A 2022 study, which analyzed data from up to 135 million blocks, revealed two distinct stages. First, the election consensus shows a concentration of votes among the top candidates. Second, at block production, active producers rotate predictably, exhibiting patterns of mutual voting between candidates and voters. A more recent study from May 2025 examined security at multiple levels, revealing low overall activity from accounts, minimal turnover among supernodes, and node vulnerabilities in contracts and behavior. These findings suggest that although EOS delivers performance at scale, the system has vulnerability to governance drift, stagnant electorates, and security weaknesses in poorly audited contracts.

TRON’s Emphasis on Speed and Reach

TRON (TRX) adopted the DPoS model but modified it to accommodate a larger number of delegates and broader influence. TRON designates 27 Super Representatives, elected by TRX holders, who each have one vote, allowing the selection of multiple candidates. This structure aims to strike a balance between increased representation and transaction speed, and TRON claims a throughput of over 2,000 transactions per second.

However, TRON’s governance model was tested in 2020 when its founder led a takeover of the Steem blockchain by mobilizing TRX voting power to replace Steem block producers. This event exposed how powerful actors can manipulate stake-weighted voting to influence or seize control of another network within hours. Although TRON continues to promote greater throughput and engagement, that incident highlights how DPoS governance, even when configured for inclusivity, can be vulnerable to coordinated political campaigns and centralized stakeholders.

Case Studies in Action: Real-World DPoS Events

| Blockchain | Real-World Incident or Improvement | Impact and Relevance |

| BitShares | Integrated into the early DeFi trend with forks like MUSE and Steem, built using the Graphene framework. | Demonstrated adaptability and technical reusability of the DPoS codebase, though centralization concerns persisted. |

| EOS.IO | EOS Network Foundation was formed in 2021, breaking away from Block.one due to unmet development promises. | Marked a major governance shift, showing how DPoS communities can restructure leadership and reclaim autonomy. |

| TRON | In 2020, TRON founder Justin Sun used TRX voting power to take control of the Steemit blockchain. | Exposed how stake-based voting can be used for hostile takeovers, raising concerns about centralization in DPoS. |

Security and Attack Vectors: What Could Go Wrong?

Each DPoS system has its own risks. These stem from how the network is constructed and how individuals utilize their voting power. While DPoS is faster and uses less energy than older systems, it still has weaknesses that can impact security and fairness.

BitShares shows a problem with vote stagnation. The same witnesses stay in power for long periods. This happens because people do not frequently change their votes. Over time, this makes the system less flexible. It also opens the door to economic vote-buying. Large token holders can support one another to maintain control. They may vote for friends or offer rewards to voters, which reduces fairness in the system.

EOS.IO has faced issues with smart contract security. Because the system supports complex applications, bugs in the code can result in significant losses. Additionally, block producer collusion is a well-documented issue. The same producers often vote for each other to ensure their own re-election. This creates a tight group that controls most of the network. It makes it hard for new participants to enter and weakens the idea of open and fair governance.

TRON presents a unique type of risk. In 2020, it used its voting power to take control of another blockchain, Steem. This demonstrated how quickly and easily a large stakeholder can alter the balance of power. Although TRON has many Super Representatives, the system remains vulnerable to coordinated takeovers. If a few people control most of the votes, they can make quick changes without much pushback.

Community Governance Commentary: Who’s Really in Charge?

Behind the technical setup of DPoS chains lies another layer, community governance. This refers to how decisions are made, who has a say, and whether changes originate from many voices or just a few. When we examine BitShares, EOS.IO, and TRON today, the stories they tell are distinctly different. BitShares started with strong developer energy. In the early years, it had an active group of builders and thinkers. Over time, however, many of those developers moved on to other projects, such as MUSE and Steem. Currently, BitShares has a significantly smaller development footprint. Most updates come from a small group of long-time contributors.

EOS.IO once had one of the most talked-about developer communities. At launch, it raised billions in funding, and people expected constant upgrades and major apps. However, problems started when the founding company, Block.One, didn’t deliver on those expectations. In 2021, frustrated members formed the EOS Network Foundation to take control of development. TRON is very different. It has always been closely linked to its founder, Justin Sun. While the network supports smart contracts and claims global developer interest, most major moves still seem to come from the top. The Steemit case in 2020 made that clear. Many users felt left out as decisions were made quickly using voting power controlled by the TRON Foundation.

How Voting Power Becomes Uneven Over Time

This chart shows how voting power can concentrate in DPoS systems. Over time, the largest stakeholder gains more control, while others slowly lose influence.

Hanging in the Balance: Strengths, Weaknesses, Tradeoffs

BitShares: High Stability, Moderate Centralization

- Delegate Turnover: Witnesses rotate daily, yet the top 10 typically remain in place for weeks at a time, indicating low structural churn.

- Voter Turnout: Historically very high (around 99% in the early years), recent estimates indicate a decline to the 70–80% range, signaling a shift toward less active governance.

- Top‑3 Stake Control: The three witnesses with the highest stake control typically hold 20–30% of total voting power, suggesting that while active, vote concentration still exists.

EOS.IO: Fast but Stagnant

- Delegate Turnover: The 21 block producers rotate predictably every round. However, studies show the same top 21 persist over long periods, indicating low turnover and stagnation.

- Voter Turnout: Recent analysis suggests voter participation is well under 50%, often hovering around 30–40%, reflecting disengaged electorates.

- Top-3 Stake Control: Data from millions of blocks reveals that the leading three producers often hold 25–35% of the total voting power, reinforcing a tendency toward clique-like consolidation.

ALSO READ: Is Delegated Proof of Stake (DPoS) the Most Scalable Consensus Mechanism Ever?

TRON: Frequent Elections, High Concentration

- Delegate Turnover: TRON holds Super Representative (SR) elections every 6 hours, offering high-frequency selection cycles. In practice, the same ~20–25 of 27 SRs remain stable over months.

- Voter Turnout: Exact participation rates vary, but TRON’s heavy reliance on staking incentives implies moderate participation, possibly 60–70% of powers staked, though many tokens remain un-staked in pools.

- Top‑3 Stake Control: The top three SRs command a significant chunk, often 30–40%, of the total voting power, exhibiting even higher centralization.

A Timeline of Lessons

A narrative emerges from this lineage. BitShares served as DPoS’s first real-world proving ground, demonstrating that small-validator models can work under economic pressure. EOS.IO then applied these principles at scale but revealed governance stagnation and operational fragility. TRON offered an even broader delegate field and throughput, yet it exposed how political capital can quickly override decentralization.

Together, they frame a roadmap for future systems: to embrace delegate-led infrastructure that delivers performance, but counterbalance this with transparent voting incentives, redundancy, reputation systems, delegate rotation, stake time-locks, and mechanisms to prevent hostile takeovers. These solutions could help future DPoS blockchains fulfill their promise of both speed and distributed trust.

Final Thoughts

DPoS remains an influential design that demonstrates how blockchain can achieve high throughput with energy-efficient consensus. BitShares taught its virtues. EOS brought scale. TRON highlighted community influence. Their experiences reveal how governance is as critical as protocol design in ensuring network resilience.

Ongoing enhancements to Delegated Proof of Stake, including reputation scoring, dynamic voting rules, anti‑collusion mechanisms, and punishment protocols, are shaping its next phase. Learning from BitShares, EOS, and TRON provides insight for future blockchain architects who aim to design systems that are fast, democratic, trustworthy, and resilient to centralizing forces as adoption grows.

Frequently Asked Questions (FAQs)

- What is DPoS in simple words?

DPoS stands for Delegated Proof of Stake. It’s a way blockchains choose people (called delegates) to check transactions. Instead of everyone doing the work, only a few trusted ones do it. People who own tokens vote for who they trust.

- How is DPoS different from other systems?

DPoS is faster and uses less energy than older systems, such as Proof of Work. It also gives token holders the power to vote, making it more akin to a community decision.

- Can DPoS systems become unfair?

Yes. If only a few people consistently receive votes, they can accumulate too much power. This makes the system less fair and less open to new people.

Glossary of Terms

DPoS (Delegated Proof of Stake)

A system where token holders vote for a few people (delegates) to check and confirm transactions on the blockchain.

Delegate

A person or group chosen by votes to add blocks and keep the network working.

Validator

Another word for delegate; checks if transactions are correct.

Witness

The term used in BitShares for a validator or delegate.

Block Producer

A validator in EOS who creates blocks on the blockchain.

Super Representative (SR)

TRON’s name for delegates who run and manage the network.

Voting Power

The strength of someone’s vote, often based on how many tokens they hold.

Governance

The way decisions are made in a blockchain, like who gets to validate or update the system.

Vote Centralization

When only a few people or groups always win votes and control most of the network.