Bridging Governance: How DPoS Chains Can Integrate with DAOs

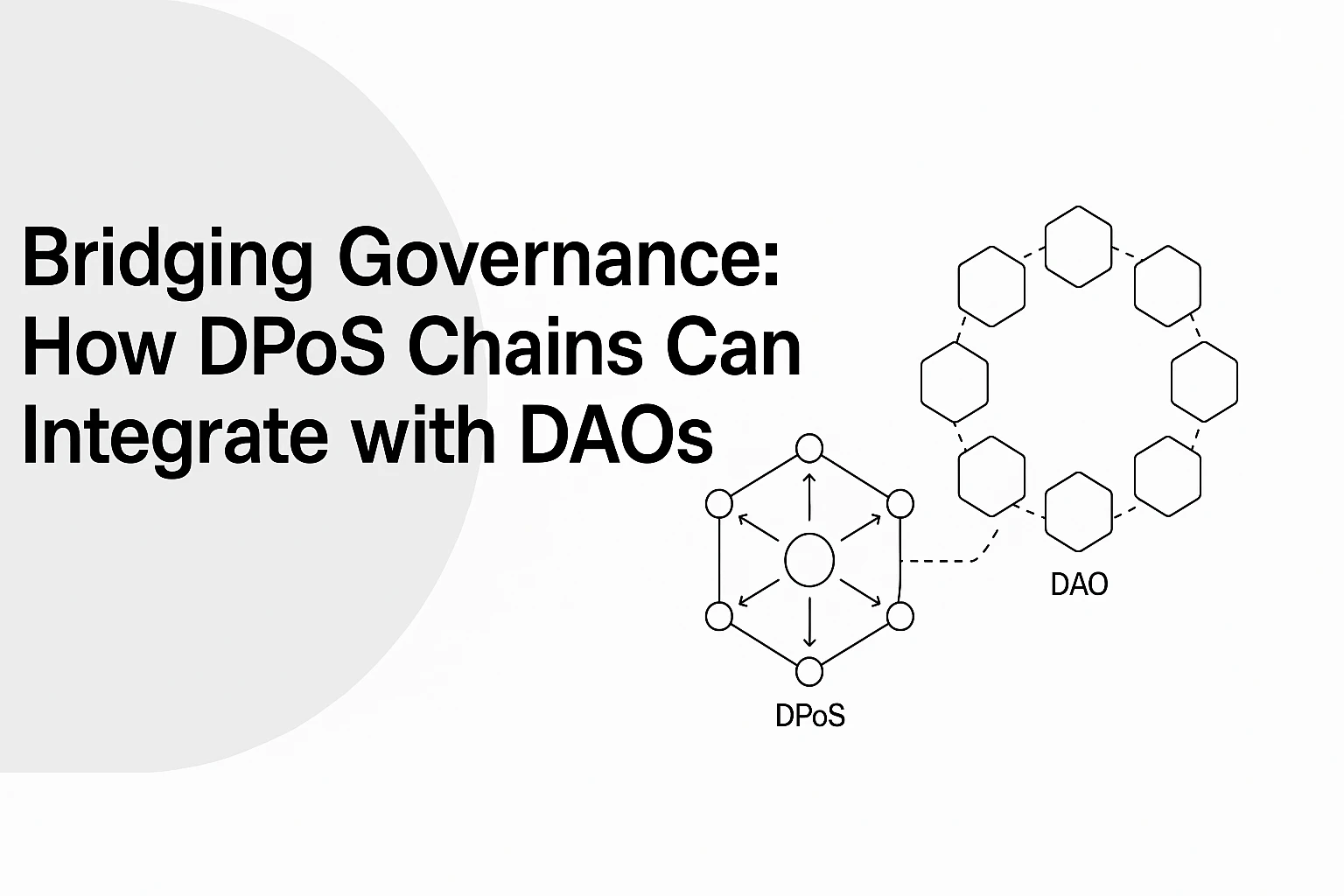

Blockchain today is more than just coins. It is about new ways of making decisions together. Two big ideas in this space are Delegated Proof of Stake (DPoS) and Decentralized Autonomous Organizations (DAOs).

- What is Delegated Proof of Stake (DPoS)?

- How DPoS Works in Simple Terms

- Why DPoS Governance is Different from PoW and PoS

- What is a DAO?

- The First DAO and Its Problems

- Modern DAOs and How They Work

- Why DAOs Matter for Governance

- Why Connect DPoS Chains with DAOs?

- Shared Goals Between the Two Systems

- Problems They Can Solve Together

- Models for Integration

- DAO-Managed Validator Selection

- DAO-Controlled Treasuries on DPoS Chains

- Hybrid Governance: On-Chain + Off-Chain

- Case Studies and Early Examples

- Challenges of Bridging DPoS and DAOs

- Technical Issues

- Social Issues

- Legal and Regulatory Issues

- Future of Governance in Blockchain

- Role of AI and Automation in DAOs and DPoS

- Will Nation States Accept DAO-style Governance?

- Can This Model Scale Beyond Crypto?

- Conclusion: Why This Matters for the Next Decade

- Frequently Asked Questions About Bridging Governance

- What is Delegated Proof of Stake (DPoS) in simple words?

- What is a DAO and how does it work?

- Why would DAOs and DPoS chains work well together?

- What are examples of DAOs?

- What are the main problems with DAOs and DPoS integration?

- Can DAOs and DPoS governance work outside of crypto?

- Glossary of Key Terms

DPoS is a way for blockchains to decide who adds new blocks. Instead of everyone competing like in Bitcoin, people vote for a small group of delegates who do the work. This makes things fast and cheap.

DAOs are like online communities that run with smart contracts. People join, get tokens, and use them to vote on what the group should do. They are not controlled by a boss or a company. Instead, rules are written in code.

Both systems want to be fair and decentralized, but they are not perfect. DPoS is fast, but sometimes looks too centralized. DAOs are open but can be slow or messy. The question is, what if everyone joins them together? This blog will explore how DPoS and DAOs can connect, why it matters, and what problems they may solve.

ALSO READ: Hybrid Governance Models: Blending DPoS with Traditional PoS

What is Delegated Proof of Stake (DPoS)?

How DPoS Works in Simple Terms

In DPoS, people who own tokens get to vote. They do not vote on every single block. Instead, they choose a smaller group of people called delegates or validators. These validators are the ones who add new blocks to the chain.

Think of it like an election. Citizens vote for representatives, and those representatives make decisions. In the same way, token holders vote for validators, and validators secure the blockchain.

DPoS makes blockchains run faster. It also costs less energy than Bitcoin’s Proof of Work (Nakamoto, 2009). This is why many newer blockchains like EOS and TRON use it.

But there is a problem. Because only a few validators get picked, sometimes power is in the hands of only a small group. If these validators act badly or form a cartel, the whole system can be at risk (Wang et al., 2019).

Why DPoS Governance is Different from PoW and PoS

To understand Delegated Proof of Stake (DPoS) better, let’s compare it with the other models. Proof of Work (PoW) is what Bitcoin uses. It requires huge computer power. Proof of Stake (PoS) is what Ethereum uses now. People lock their coins and become validators.

DPoS is different because it mixes the idea of staking with voting. Instead of everyone running their own node, people just vote for a smaller group. This makes the system faster, but also less spread out.

| Feature | PoW | PoS | DPoS |

| Speed | Slow | Medium | Fast |

| Energy use | Very High | Low | Very Low |

| Who decides | Miners | Stakers | Delegates |

This table shows why many small and medium blockchains prefer DPoS. It is cheaper, quicker, and easier to scale. But the trade-off is that power can get concentrated in a small set of validators.

What is a DAO?

The First DAO and Its Problems

The first DAO launched in 2016 on Ethereum. It was meant to be a venture fund where investors use Ether to vote on which projects get money. But soon after launch, a hacker found a weakness in the code and stole about $50 million worth of ETH.

That was a big failure. However, it also demonstrated to the world that DAOs can be effective. Since then, new DAOs have fixed many of the old problems.

Modern DAOs and How They Work

A DAO is like an online club. Members buy or earn tokens, and those tokens act like voting shares. Members use them to decide what projects to fund, what rules to change, or what direction the group should take (Buterin, 2014; DuPont, 2019).

The rules are coded into smart contracts. That means no manager, no CEO, no central authority. Everything runs by code, and everyone with tokens can take part.

Today, DAOs are running a wide range of projects. Some manage billions in assets. Others run DeFi protocols like Uniswap. There are also DAOs for art, gaming, or even buying rare items like the U.S. Constitution copy in 2021 (ConstitutionDAO).

Why DAOs Matter for Governance

DAOs are important because they give power to communities. Anyone can join, propose ideas, and vote. This makes them transparent and global. They also reduce trust problems since rules are written in code and actions happen automatically.

ALSO READ: Why Some DPoS Chains Thrive While Others Fade Away

| DAO | Main Goal | Blockchain Base |

| MakerDAO | Stablecoin system | Ethereum |

| Uniswap DAO | Decentralized trading | Ethereum |

| BitDAO | Community treasury | Ethereum |

These examples show how DAOs are not just ideas anymore. They are running real money and real systems.

Why Connect DPoS Chains with DAOs?

Shared Goals Between the Two Systems

DPoS and DAOs may appear different, but at their core, they share the same vision. Both want to give power to the people, not to a boss or a big company. DPoS lets token holders choose validators. DAOs let token holders vote on rules and spending.

Both depend on voting, tokens, and community trust. Both use blockchain as the base. And both want to be fairer than old systems where power is in just a few hands (De Filippi & Hassan, 2021).

Problems They Can Solve Together

But each one has problems too. DPoS is very fast, but it is too centralized. In some chains, only 20 or 30 validators control everything. That can feel like an old-style company board.

DAOs are very open, but sometimes too slow. If everyone has to vote on every small thing, nothing gets done.

By mixing them, they can balance. A DAO can make validator elections more fair. A DPoS chain can give DAOs a fast and cheap place to run their votes and smart contracts.

| DAO Strength | DPoS Strength | How They Fit |

| Open and fair voting | Fast block confirmation | Speed + democracy |

| Community treasury | Efficient delegate model | Shared resources |

| Global access | Low fees | More users included |

Together, they can cover each other’s weak spots.

Models for Integration

So how can everyone join them? It is not just theory; there are models that people are already testing.

DAO-Managed Validator Selection

One idea is to let DAOs manage validator elections on a DPoS chain. Instead of a few whales deciding who gets power, the DAO community votes through smart contracts. This makes the validator choice more open. It can also stop abuse if one group tries to control too many nodes (Hsieh et al., 2018).

DAO-Controlled Treasuries on DPoS Chains

Another way is money. Many blockchains have community funds or treasuries. A DAO can manage this fund on top of a DPoS chain. People propose what to spend it on. Then, token holders vote, and the smart contract releases money to the winners. This makes treasury use more transparent and less political.

Hybrid Governance: On-Chain + Off-Chain

A third model is mixing both styles. Some decisions happen on-chain with automatic code. Others happen off-chain in forums, Discord, or community calls. This “hybrid governance” lets people talk and debate before the code executes. It also makes the system more flexible because not everything can be solved by code alone.

| Model | Who Decides | Benefit | Risk |

| Validator Voting DAO | Token holders | More fairness | Low turnout |

| Treasury DAO | DAO community | Transparent funds | Attack risk |

| Hybrid DAO + DPoS | Both sides | Balanced governance | Complex setup |

This table shows that there is no perfect model. Each one has benefits but also risks. But trying them is the only way to learn.

Case Studies and Early Examples

The idea of joining DPoS and DAOs is not just a theory. Some projects have already tried it, in small ways.

One good example is Aragon. Aragon builds tools for DAOs, like voting systems and dispute resolution. In some experiments, Aragon DAOs were linked with proof-of-stake and delegated systems. Communities used Aragon smart contracts to run elections for validators, instead of leaving it only to token whales (De Filippi & Hassan, 2021).

Another case is EOSIO. EOS is a famous DPoS chain with 21 main validators. Many critics said it was too centralized. Some EOS projects started building DAO-like voting tools to make validator elections more fair. The community tried to add more transparency to who gets picked and how rewards are given (Hsieh et al., 2018).

In Cosmos, many sub-projects also test DAO integration. Cosmos chains use proof-of-stake but with flexible modules. Some DAOs inside Cosmos manage treasuries, staking pools, or validator selection. It shows how DAO rules can be added on top of validator-based governance.

These examples are still early. But they prove that DAOs and DPoS can work together in practice, not just on paper.

| Project | Type | Integration Focus | Status |

| Aragon | DAO framework | Validator voting | Tested |

| EOSIO | DPoS chain | Fair validator elections | Ongoing |

| Cosmos DAOs | Mixed chains | Treasury and staking pools | Active |

Challenges of Bridging DPoS and DAOs

Even with good ideas, mixing DPoS and DAOs is not easy. There are many challenges.

Technical Issues

The first problem is technical. DAOs use smart contracts. DPoS chains need validators to process blocks. For smooth integration, the contracts and validator systems must talk to each other. This is not simple. Bugs in code or weak cross-chain tools can break everything.

Also, smart contracts cannot solve every case. If an oracle gives wrong data, or if the rules in code are too strict, the system may stop working. These are risks that need more research.

Social Issues

Then comes the human side. DAOs work only if people vote. But in many DAOs, turnout is very low. People hold tokens but do not bother to vote. In DPoS, too, most power often ends up in a few wallets.

So the same risk appears again: power going back to a small group. Without a strong community culture and incentives, the idea of shared governance might not really happen.

Legal and Regulatory Issues

Another challenge is the law. Are DAOs even legal? Some countries do not know how to treat them. Who is responsible if something goes wrong?

If a DAO manages validators or treasury funds on a DPoS chain, governments may want someone accountable. But DAOs are designed to have no single leader. This creates a clash between blockchain ideas and real-world laws (Atzori, 2017).

| Challenge | Example | Why It Matters |

| Technical | Smart contract bugs | Can break governance |

| Social | Low voter turnout | Power gets centralized |

| Legal | No clear rules for DAOs | Risk of lawsuits or bans |

These issues show that the road is not smooth. But with careful design, they can be solved step by step.

ALSO READ: How Yield Wars Between Validators Distort DPoS Ecosystems

Future of Governance in Blockchain

The future of blockchain will not only be about speed and low fees. It will be about governance. Who makes decisions, how funds are used, and how rules get changed. This is where DPoS and DAOs can together make a big impact.

Role of AI and Automation in DAOs and DPoS

As tech grows, DAOs may start to use AI. Machines could help with proposal filtering, fraud detection, and even predicting voter behavior. If added to DPoS chains, this could make governance faster and smarter. But it also raises new risks. Who controls the AI? Can it be trusted (Faraj et al., 2018)?

Will Nation States Accept DAO-style Governance?

Right now, most governments do not know how to treat DAOs. Some ignore them. Some ban them. Others try to regulate them like companies. In the future, if DAOs keep growing, states will have to decide. They might accept DAO governance as a real legal form, or they might fight it (Atzori, 2017).

DPoS chains could help by making governance more practical and closer to the way voting already works in the real world. This might make it easier for governments to understand and accept.

Can This Model Scale Beyond Crypto?

If DAOs and DPoS work well together, they might go beyond blockchain. Imagine online communities, co-ops, even cities using this model. DPoS gives efficiency. DAOs give openness. Together, they could manage not just digital assets but maybe also social and economic projects (De Filippi & Hassan, 2021).

| Area | How It Could Work | Possible Benefit |

| Crypto chains | Validator elections | Fairer governance |

| Online communities | DAO decision-making | Stronger voice |

| Local projects | Hybrid governance | Transparency |

| National systems | DAO + DPoS voting | Faster democracy |

ALSO READ: Token Concentration and Power in DPoS: Can Whales Dictate Validator Outcomes?

Conclusion: Why This Matters for the Next Decade

DPoS and DAOs are two sides of the same dream. Both want a world where power is not stuck in a few hands. Both want rules made by communities, not by bosses.

DPoS gives speed, scale, and efficiency. DAOs give fairness, openness, and shared control. Together, they can cover each other’s weak points. Yes, there are risks. Technical bugs, low voter turnout, and unclear laws. But the benefits are too big to ignore.

If these two systems keep joining, they could shape the way blockchains work for the next decade. They may even change how groups, companies, and maybe governments organize in the future. The bridge between DPoS and DAOs is not just about blockchain. It is about the future of governance itself.

Frequently Asked Questions About Bridging Governance

What is Delegated Proof of Stake (DPoS) in simple words?

DPoS is a way blockchains run faster. People who own tokens vote for a small group of validators. These validators add new blocks and confirm transactions.

What is a DAO and how does it work?

A DAO is a digital group run by code. Members hold tokens and use them to vote on decisions. The rules are written in smart contracts, not managed by a boss.

Why would DAOs and DPoS chains work well together?

Because they fix each other’s weak points. DPoS is fast but too centralized. DAOs are open, but too slow. Together, they bring speed and fairness.

What are examples of DAOs?

Some famous DAOs are MakerDAO, Uniswap DAO, and BitDAO. They run things like stablecoins, exchanges, and community funds.

What are the main problems with DAOs and DPoS integration?

The biggest issues are technical bugs in smart contracts, low voter turnout in DAOs, and unclear legal rules for how DAOs should be treated.

Can DAOs and DPoS governance work outside of crypto?

Yes, in theory. They could manage online groups, co-ops, and even local projects. The idea is still new, but it can grow beyond blockchain.

Glossary of Key Terms

Delegated Proof of Stake (DPoS): A blockchain system where token holders vote for a small group of validators to confirm blocks.

DAO (Decentralized Autonomous Organization): A community that runs on smart contracts, where members use tokens to vote on decisions.

Validator: A node in a blockchain that confirms transactions and creates blocks.

Smart Contract: Code on blockchain that runs automatically when conditions are met.

Treasury: A pool of shared funds in a blockchain or DAO, managed by community votes.