How DPoS Chains Handle Network Upgrades Compared to PoS and PoW Chains

A blockchain is comparable to a communal computer system that is utilized by numerous users. It handles transactions and data without the need for a centralized authority. For blockchains to work correctly, a consensus mechanism is required. Who is rewarded for adding new data blocks and how they are added are decided by this rule.

- Understanding Consensus and Upgrades

- What is Proof of Work (PoW)

- What is Proof of Stake (PoS)

- What is Delegated Proof of Stake (DPoS)

- Why Upgrades Differ in Each Model

- How PoW Chains Handle Network Upgrades

- How PoS Chains Handle Network Upgrades

- Key PoS Upgrades and Validator Roles

- How DPoS Chains Handle Network Upgrades

- DPoS Upgrades vs PoS/PoW in Real Examples

- Comparing DPoS, PoS, and PoW in Network Upgrades

- Speed of decision making

- Cost of implementing upgrades

- Risk of forks and splits

- Level of decentralization and fairness

- Side-by-Side Comparison of PoW, PoS, and DPoS Upgrades

- Obstacles and Remarks

- Challenges in PoW Upgrades

- Challenges in PoS Upgrades

- Challenges in DPoS Upgrades

- Shared Problems Across All Models

- Future of Blockchain Network Upgrades

- AI and Automation in Governance

- Role of Simulators and Academic Research

- Hybrid Consensus Models

- Global Regulation and Standards

- Toward Fully Decentralized Governance

- Conclusion

- Frequently Asked Questions About How Dpos Chains Handle Network Upgrades

- What is a network upgrade in blockchain?

- How do PoW chains like Bitcoin upgrade?

- How do PoS chains like Ethereum upgrade?

- How do DPoS chains like EOS or TRON upgrade?

- Which system is better for fast upgrades?

- Glossary of Key Terms

Blockchains are not flawless, though. They occasionally need to be improved or changed. It refers to this as a network upgrade. Because they fix bugs, increase security, and allow the blockchain to expand as more users join, upgrades are essential. A blockchain might become unsafe or too slow without updates.

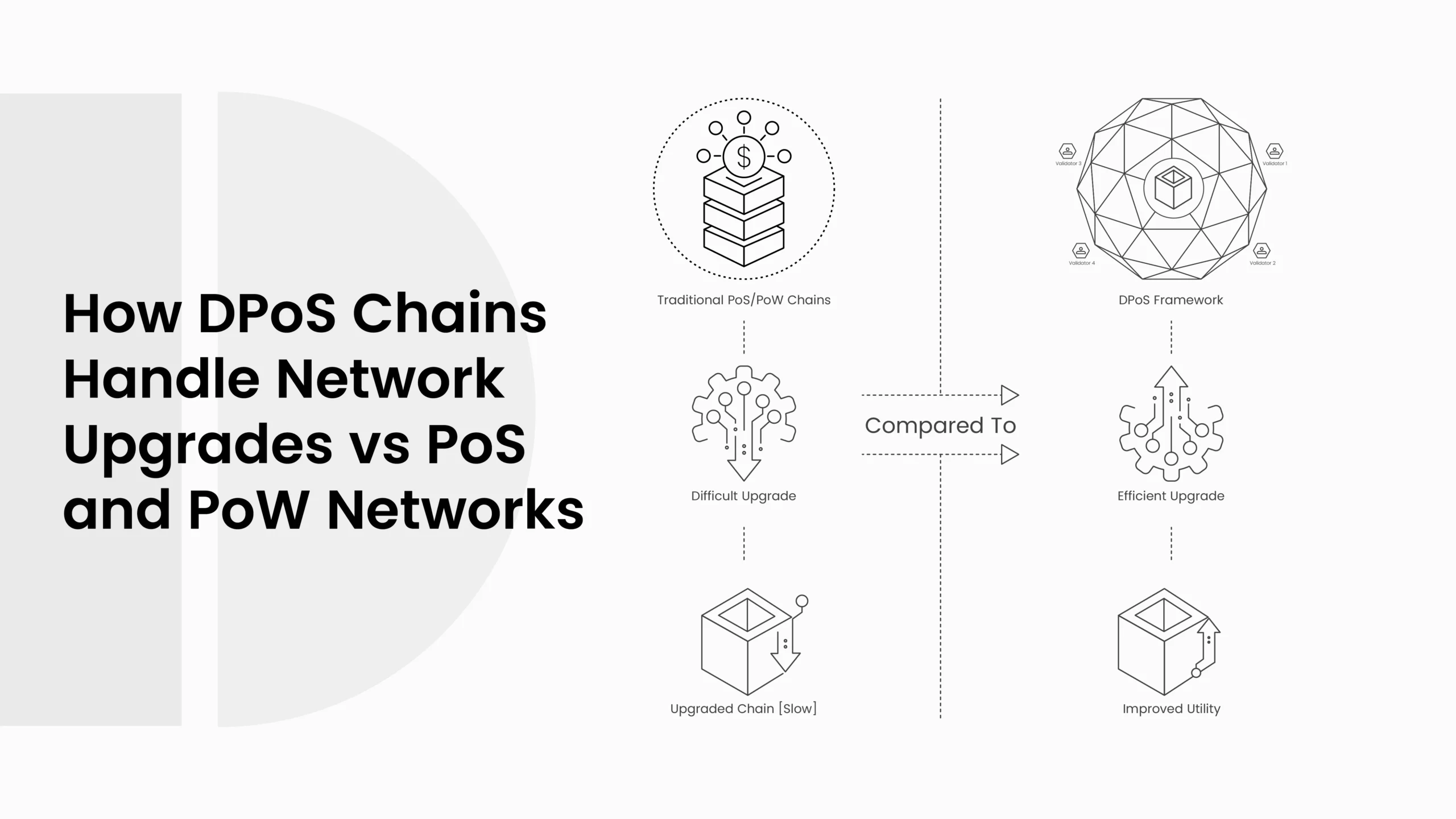

Different blockchains handle upgrades in different ways. Bitcoin and older systems that use Proof of Work (PoW) often face long debates and sometimes splits, called forks. Proof of Stake (PoS) chains use validator voting, but this can sometimes favor the rich. Delegated Proof of Stake (DPoS) chains bring in a new way. They let the community vote for a small group of delegates who can make decisions faster.

This blog will explain how these three systems handle upgrades. It will also compare them to see which one is faster, safer, and more flexible for the future.

Understanding Consensus and Upgrades

What is Proof of Work (PoW)

Proof of Work is the first consensus system used in blockchain. Bitcoin is the best-known PoW chain. In PoW, miners compete to solve complex puzzles with their computers. The one who solves it first gets to add the block and earn a reward. This system is secure but uses a lot of energy. It also makes upgrades slow because miners must agree on big changes.

What is Proof of Stake (PoS)

A more recent system is Proof of Stake. Validators are selected based on the number of tokens they stake, or lock, in the system, as opposed to miners using computers. Your chances of validating blocks increase with the number of tokens you stake. PoS consumes a lot less energy than PoW. But upgrades in PoS depend on the majority of stakers agreeing, and often the largest token holders have the most influence (Leporati & Rovida, 2024).

What is Delegated Proof of Stake (DPoS)

PoS has evolved into Delegated Proof of Stake (DPoS). It was implemented to facilitate quicker and more democratic decision-making. A smaller group of delegates, known as witnesses or block producers, is chosen by token holders in DPoS. Blocks are validated, and upgrades are decided by these delegates. Compared to PoW or even standard PoS chains, upgrades can be discussed and implemented much more quickly because the group is smaller.

Why Upgrades Differ in Each Model

Upgrades are not just about technology. They are also about governance, meaning who has the power to say yes or no. In PoW, power is with miners who invest in hardware. In PoS, it is with validators who have tokens. In DPoS, it is with elected delegates who represent token holders. Because of these differences, the way upgrades happen in each system is very different.

How PoW Chains Handle Network Upgrades

Bitcoin and the original Ethereum network chains are the longest-running Proof of Work (PoW) chains. They proved to the world that blockchain technology can be decentralized and safe. There are major challenges to PoW chains, however, with regard to network upgrades.

The miners and the larger community are the ones who mostly decide on upgrades in PoW. In the case developers wish to modify something in the code, then miners have to accept using the new version. In case there are not enough miners willing to do so, there is a risk of the chain breaking. This split is called a fork. Sometimes the forks are soft, meaning the network remains mostly intact. On other occasions, they are hard forks, and they form two chains.

A famous example is Bitcoin Cash. In 2017, part of the Bitcoin community wanted bigger blocks to allow more transactions. Another part did not agree. A hard fork resulted from this, creating Bitcoin Cash as a distinct chain. Ethereum experienced a similar situation following the 2016 DAO hack, which gave rise to Ethereum Classic. These forks show that upgrades in PoW can be slow, political, and sometimes divisive (Aggarwal & Kumar, 2021).

Another issue is miner incentives. Miners spend money on energy and hardware. They will only support upgrades if they believe it benefits them financially. If an upgrade lowers mining rewards or makes mining harder, some miners may not agree. This slows down innovation in PoW blockchains.

Because of these reasons, upgrades in PoW chains often take years of debate. For example, Bitcoin’s Taproot upgrade, which improved privacy and smart contracts, took years before the community reached agreement and activated it in 2021.

| Blockchain | Upgrade | Year | What Changed | Challenge Faced |

| Bitcoin | SegWit | 2017 | Improved transaction capacity | Years of debate, miner resistance |

| Bitcoin | Taproot | 2021 | Added privacy and smart contracts | Took long time to activate |

| Ethereum (PoW) | Constantinople | 2019 | Gas fee improvements | Delayed due to security bugs |

| Ethereum (PoW) | DAO Fork | 2016 | Reversed stolen funds | Led to the Ethereum Classic split |

In simple words, PoW upgrades are secure but very slow. They depend on miners and the whole community reaching an agreement, which is not easy. This is one reason many new blockchains moved to Proof of Stake and Delegated Proof of Stake (DPoS).

How PoS Chains Handle Network Upgrades

PoW and Proof of Stake (PoS) chains adopt quite different strategies. In PoS, no miners are using big machinery. As an alternative, some validators lock up, or stake, their tokens. With a larger stake, a validator has a better chance of verifying blocks and earning rewards.

PoS blockchains rely on stakers and validators to vote for updates. Upgrades are faster than with PoW since global mining hardware does not need to be replaced. The software update is activated after the majority gives its approval, enabling validators to update it rapidly.

PoS upgrades aren’t flawless, though. Large token holders have more voting power, which is one issue. A “rich get richer” effect may result from this. Upgrade decisions may be influenced if a few rich stakers own the majority of the tokens. This raises questions about fairness and decentralization.

A big example is Ethereum’s move from PoW to PoS in 2022, known as The Merge. It was one of the most important upgrades in blockchain history. The switch made Ethereum more energy efficient and prepared it for scaling solutions like sharding. The upgrade went smoothly, but many critics said that power in Ethereum now sits with a few big staking pools.

Other PoS blockchains, like Cardano, Cosmos, and Tezos, also rely on validator governance. These networks sometimes include on-chain voting where all token holders can participate. This gives more democracy than Bitcoin-style PoW debates, but in practice, the biggest stakers often have the loudest voice (Nguyen et al., 2019).

Overall, PoS upgrades are faster and more energy-friendly than PoW. But they still struggle with the balance between fairness and centralization.

Key PoS Upgrades and Validator Roles

| Blockchain | Upgrade | Year | What Changed | Validator Role |

| Ethereum | The Merge | 2022 | Shift from PoW to PoS, lower energy use | Validators approved and ran new software |

| Cardano | Alonzo Hard Fork | 2021 | Smart contracts enabled | Validators ensured smooth rollout |

| Tezos | Athens Upgrade | 2019 | Changed block size and gas limits | Voted in by validators and token holders |

| Cosmos | Stargate | 2021 | Inter-blockchain communication (IBC) | Validators coordinated to activate |

In simple words, PoS chains are better than PoW when it comes to upgrade speed. But they are not always fair, because the biggest stakeholders have the most influence. This is where Delegated Proof of Stake (DPoS) comes in, trying to make upgrades both fast and more democratic.

ALSO READ: DPoS and Rent-Seeking Behavior: How Validators Can Extract Value Without Adding Utility

How DPoS Chains Handle Network Upgrades

Delegated Proof of Stake (DPoS) was designed to fix some of the problems found in PoW and PoS. It makes the process of upgrading faster, while also letting the community take part through voting. In DPoS, every token holder has the right to vote for delegates. These delegates, also called block producers or witnesses, are the ones who run the network and apply upgrades.

This system is more direct than PoW, where miners argue for years, and also quicker than PoS, where large stakers can block upgrades. In DPoS, once delegates are elected, they are trusted to make decisions for the network. If they fail, the community can vote them out. This makes upgrades both faster and more flexible.

For example, EOS, one of the first major DPoS chains, is known for fast block times and quick updates. Delegates in EOS can meet, propose changes, and roll them out much faster than Bitcoin miners could ever agree. TRON is another example, where upgrades are often handled in weeks instead of years. Steem, a social blockchain, also relied on DPoS to make frequent updates for its community features (Li & Palanisamy, 2020).

Of course, DPoS is not perfect. Since only a small group of delegates makes the decisions, some people argue it is not truly decentralized. If only 20 or 30 people control upgrades, then the system may act more like a company board than a fully open blockchain. Still, compared to PoW and PoS, DPoS provides a mix of speed, community voice, and easier upgrade management.

DPoS Upgrades vs PoS/PoW in Real Examples

| Blockchain | Upgrade | Year | What Changed | How DPoS Helped |

| EOS | EOSIO v1.8 | 2019 | Security and resource management | Delegates activated the upgrade quickly with community approval |

| TRON | Great Voyage v4.0 | 2021 | Smart contract scaling, DeFi features | Elected delegates rolled out changes within weeks |

| Steem | Hardfork 20 | 2018 | Improved voting and resource credits | Delegates voted and applied changes faster than PoW/PoS chains |

In simple words, DPoS chains handle upgrades in a faster and smoother way than PoW and PoS. Token holders give their power to delegates, and those delegates make the changes. This avoids years of debate and long delays. But the trade-off is that control is in fewer hands, which may worry people who value full decentralization.

Comparing DPoS, PoS, and PoW in Network Upgrades

It is useful to compare them directly. Every model has strong points and weak points. Despite being tested and safe, Proof of Work (PoW) is incredibly slow to update. The largest stakers can control upgrades, but Proof of Stake (PoS) is quicker and consumes less energy. The quickest method is Delegated Proof of Stake (DPoS), but it puts too much power in the hands of a select group of elected delegates.

Four factors are typically balanced when blockchains plan for upgrades: decentralization, cost, speed, and fork risk. These factors decide if the network can grow safely and keep the trust of its users.

Speed of decision making

- PoW: Very slow. Debates can take years before upgrades go live.

- PoS: Faster than PoW. Validators can agree and update their nodes quickly.

- DPoS: Fastest. Delegates are small in number and can push upgrades in days or weeks.

Cost of implementing upgrades

- PoW: High. Miners must upgrade hardware and run energy-heavy machines.

- PoS: Lower. Validators just update their software.

- DPoS: Lowest. Only a small group of delegates coordinates changes.

Risk of forks and splits

- PoW: High. Community disagreements often create hard forks (like Bitcoin Cash).

- PoS: Medium. Upgrades can still split communities, but validator voting reduces the chance.

- DPoS: Low. Small delegate groups reduce the chance of chain splits, though politics can still happen.

Level of decentralization and fairness

- PoW: Decentralized in theory, but mining pools make it less fair.

- PoS: Wealth concentration means the richest stakers have the most control.

- DPoS: Democratic in design, but only a few delegates control upgrades.

Side-by-Side Comparison of PoW, PoS, and DPoS Upgrades

| Factor | PoW Chains (Bitcoin, old Ethereum) | PoS Chains (Ethereum, Cardano) | DPoS Chains (EOS, TRON) |

| Speed | Very slow, years of debate | Faster, months or less | Fastest, weeks, or days |

| Cost | High (hardware + energy) | Lower (validators update software) | Lowest (small group of delegates) |

| Risk of Forks | High (many famous hard forks) | Medium (still possible, but reduced) | Low (delegates align decisions) |

| Decentralization | Mining pools hold big power | Big stakeholders hold big power | Delegates hold power, may centralize |

| Upgrade Examples | SegWit, Taproot | The Merge, Alonzo | EOSIO v1.8, TRON Hard Forks |

In simple words, each system handles upgrades differently. PoW gives maximum security but moves too slowly. PoS improves efficiency but struggles with fairness. If token holders stop keeping track of who they vote for, DPoS could become centralized, despite its speed and ease of governance.

ALSO READ: Is DPoS Ready for AI-Generated Smart Contracts and Autonomous DAOs?

Obstacles and Remarks

Despite their respective benefits, PoW, PoS, and DPoS are not flawless. When it comes to managing upgrades, every system has issues. The community’s level of trust in the network is frequently determined by these difficulties.

Challenges in PoW Upgrades

PoW chains are known for being very secure, but upgrades in PoW often face long delays. Bitcoin, for example, took years to activate SegWit and Taproot. The problem is that miners need to agree, and sometimes their incentives do not align with developers or users. Mining pools also hold much of the power, so a small number of groups can block upgrades. Forks like Bitcoin Cash and Ethereum Classic happened because of such disagreements. This shows how PoW struggles to keep unity when upgrades are needed (Aggarwal & Kumar, 2021).

Challenges in PoS Upgrades

Proof of Stake makes upgrades faster, but fairness is a big issue. In PoS, the more tokens a person holds, the more control they have in voting. This creates what researchers call the “rich get richer” effect (Leporati & Rovida, 2024). Smaller holders may feel their votes do not matter. Also, staking pools often dominate upgrades, which raises questions about decentralization.

Another issue is voter apathy. Many small stakers do not take part in upgrade votes. This leaves decision-making to a small group of whales or large staking pools. For example, after Ethereum moved to PoS, critics argued that just a few large validators controlled much of the voting power.

Challenges in DPoS Upgrades

Delegated Proof of Stake (DPoS) was designed to fix the speed and fairness issues, but it also has its own risks. In DPoS, only a limited number of delegates (like EOS’s 21 block producers or TRON’s 27 super representatives) control upgrades. If token holders do not vote regularly, the same group can stay in power for years. This makes the system more like an oligarchy than a democracy.

There have been times when accusations of vote buying and collusion surfaced in DPoS systems. Some delegates promised rewards to token holders in exchange for votes, which damaged trust. Critics also point out that if only a few delegates control upgrades, the system becomes centralized, even if the design looks democratic on paper.

Shared Problems Across All Models

All three systems also face common challenges. One is governance conflicts. Different groups of users may disagree on what upgrades are best. Another is the problem of communication. Not every user understands technical upgrades, so many decisions are made by insiders.

Security is another shared concern. If upgrades are rushed, they can introduce bugs or vulnerabilities. If upgrades are delayed, the network may be open to attacks. Balancing speed and safety is a challenge that every blockchain faces.

In short, PoW is too slow, PoS may favor the wealthy, and DPoS may concentrate power in delegates. Each system is trying to improve, but the perfect solution does not yet exist.

Future of Blockchain Network Upgrades

Upgrades in blockchain will not stay the same forever. As the industry grows, new tools and ideas are being tested to make upgrades faster, safer, and more fair. Researchers, developers, and communities are all trying to solve the problems that PoW, PoS, and DPoS face today.

AI and Automation in Governance

One new trend is using artificial intelligence (AI) to help with governance. AI can analyze proposals, find risks, and even simulate what might happen after an upgrade. This could help networks avoid bad decisions. Some researchers believe AI will soon be used to guide voting and give fairer recommendations to stakers and delegates. This way, upgrades can be made quickly but still based on data, not just politics.

Role of Simulators and Academic Research

Another important step is the use of blockchain simulators. These are tools that allow developers to test how upgrades might affect wealth distribution, decentralization, or performance before launching them on the real network. For example, researchers Leporati and Rovida (2024) built a PoS simulator that shows how wealth can become unfairly concentrated over time. Such tools can help design better upgrade rules that keep networks stable and fair.

Hybrid Consensus Models

Some blockchains are also exploring hybrid models. Instead of choosing only PoW, PoS, or DPoS, they combine features from each. For example, some use PoW for security and PoS for governance. Others use DPoS-like delegate systems but add extra rules to prevent centralization. These hybrids may offer a balance of speed, fairness, and security that single models struggle to achieve.

Global Regulation and Standards

As blockchain adoption grows, governments may also play a role in upgrades. Regulations might require networks to follow certain standards for security or fairness. While this could slow things down, it could also build trust for big businesses and global finance. The future may see blockchains working together with regulators to design upgrade systems that are both fast and safe.

Toward Fully Decentralized Governance

The long-term vision for many developers is fully decentralized governance. This means upgrades would not depend on miners, whales, or a few delegates, but on systems where every user’s voice counts equally. Some projects are experimenting with quadratic voting, reputation-based systems, or even zero-knowledge proofs to make governance more fair.

ALSO READ: How Generative AI Could Simplify DPoS Codebase Maintenance

Conclusion

Upgrades are the lifeblood of any blockchain. Without them, networks would not stay safe, fast, or useful. But the way upgrades are handled depends fully on the consensus model. Proof of Work (PoW) has shown the world how secure a blockchain can be. But when it comes to upgrades, it is very slow. Miners need to agree; debates go on for years, and forks like Bitcoin Cash and Ethereum Classic often happen.

Proof of Stake (PoS) made upgrades faster and less energy-hungry. Validators can quickly update and vote. But fairness is still a problem, because large stakers hold the most power. Many times, the biggest staking pools end up deciding the future of the network. Delegated Proof of Stake (DPoS) tried to fix these issues by adding community voting for delegates. These delegates can act fast and coordinate upgrades in weeks or days. But if token holders do not stay active in voting, too much power can stay with a small group. That creates centralization, the very thing blockchain wanted to avoid.

The future will likely see mixes of these models, along with new tools like AI, simulators, and fairer voting systems. For now, DPoS stands out as the fastest option for networks that want to evolve quickly. PoS offers a middle ground, while PoW remains the slow but secure choice.

Frequently Asked Questions About How Dpos Chains Handle Network Upgrades

What is a network upgrade in blockchain?

A network upgrade is when developers and the community make changes to a blockchain’s rules or code. Upgrades can fix bugs, add new features, or improve speed and security. Without upgrades, a blockchain could become unsafe or outdated.

How do PoW chains like Bitcoin upgrade?

In PoW chains, miners and the wider community must agree before an upgrade goes live. If miners do not agree, the network may split into two, which is called a fork. This is why upgrades like Bitcoin SegWit and Taproot took many years to activate.

How do PoS chains like Ethereum upgrade?

PoS chains use validators and stakers to vote on upgrades. The more tokens a validator has staked, the more power they hold in the vote. This makes upgrades faster than PoW, but can give control to the largest staking pools. Ethereum’s move to PoS in 2022, called The Merge, was one of the biggest upgrades in blockchain history.

How do DPoS chains like EOS or TRON upgrade?

DPoS chains elect a small group of delegates or block producers. These delegates are trusted by token holders to make fast decisions. When an upgrade is needed, delegates coordinate and activate it. This makes DPoS upgrades much faster than PoW or PoS, though it also creates risks of centralization if only a few delegates control everything.

Which system is better for fast upgrades?

DPoS is the fastest for upgrades because only a small group of elected delegates needs to agree. PoS is slower but still faster than PoW. PoW is the slowest because upgrades require long debates among miners and the community. Each system has trade-offs between speed, fairness, and decentralization.

Glossary of Key Terms

Blockchain – A digital ledger that stores transactions and data in blocks connected in a chain.

Consensus Mechanism – The rule or method that blockchains use to agree on which transactions are valid and added to the ledger.

Proof of Work (PoW) – A system where miners use computers to solve puzzles and add blocks. Used by Bitcoin.

Proof of Stake (PoS) – A system where validators lock up (stake) tokens to earn the right to add blocks. Used by Ethereum, Cardano, and others.

Delegated Proof of Stake (DPoS) – A system where token holders vote for a small group of delegates who confirm blocks and handle upgrades. Used by EOS, TRON, and Steem.

Validator – A participant in PoS or DPoS systems who helps confirm blocks and keep the network running.

Delegate / Block Producer – In DPoS, an elected person or group is trusted to validate blocks and approve upgrades.

Fork – When a blockchain splits into two versions, often due to disagreement over upgrades.

Upgrade – A change in the blockchain’s code to fix problems, add features, or improve performance.

Staking – Locking up tokens to support a blockchain and earn rewards.