How EOS Uses Delegated Proof of Stake (DPoS) to Handle High Transaction Volumes

As blockchain networks expand their utility beyond cryptocurrency into gaming, finance, and logistics, scalability becomes a critical benchmark of success. Conventional consensus mechanisms are secure and decentralized, but may not be able to support the scale and bandwidth that applications with enterprise requirements require. It is in this environment that the EOS was created, not as yet another blockchain, but as a high-performance ecosystem specifically designed to process thousands of transactions per second.

- EOS Blockchain and its Design for High-Performance Applications

- How Delegation Proof of Stake (DPoS) Works in EOS

- Block Producers in EOS: Authority and Accountability

- Performance Analysis: Can EOS Handle High Transaction Volumes?

- Advantages and Criticisms of EOS’s DPoS Model

- The Final Word

- Frequently Asked Questions About EOS and DPoS

- How does EOS use Delegated Proof of Stake (DPoS)?

- How many transactions per second can EOS handle?

- Why did EOS choose DPoS instead of Proof of Work?

- Are EOS block producers centralized?

- What risks exist in the EOS DPoS system?

- Glossary of Key Terms

To achieve this, EOS chose to adopt Delegated Proof of Stake (DPoS) as its core consensus mechanism. In contrast to previous models like Proof of Work (PoW) or traditional Proof of Stake (PoS), DPoS offers an efficiency-governance balance that suits systems requiring close to real-time operation. This blog will discuss EOS’s adoption of DPoS to efficiently make transactions on a massive scale and the reason why its adoption has received both applause and criticism in the blockchain sector.

ALSO READ: Proof of Work vs Delegated Proof of Stake: How DPoS Consensus Differs from PoW

EOS Blockchain and its Design for High-Performance Applications

EOS is a blockchain infrastructure, which is general-purpose and designed to support decentralized applications that demand high-speed and reliability of transactions. EOS is a network created by Block.one and released in 2018, which was advertised as a network that was more efficient than its predecessors due to more efficient validation and systems. The idea behind its design was straightforward: it should allow a Web3 decentralization that does not impair user experience.

To achieve this, EOS moved away from consensus models like PoW, which relies on computational difficulty, and PoS, which often introduces delays in finality due to validator coordination. Instead, EOS turned to Delegated Proof of Stake, a consensus algorithm tailored for throughput and predictability. As noted in the BitMEX research report, EOS’s design allows for blocks to be created every 0.5 seconds, with the system demonstrating an ability to process thousands of transactions per second under optimal conditions, significantly higher than Bitcoin or Ethereum at the time (BitMEX, 2018).

In contrast to previous blockchains, which had a loosely scheduled or permissionless pool of validators, EOS has a structured system where the production of blocks is scheduled. This makes it possible to guarantee that the network can achieve high finality, or the speed at which transactions become irreversible, as the volume of transactions grows. It is these characteristics that render EOS an interesting case study of the application of DPoS to overcome scalability requirements in the real world.

How Delegation Proof of Stake (DPoS) Works in EOS

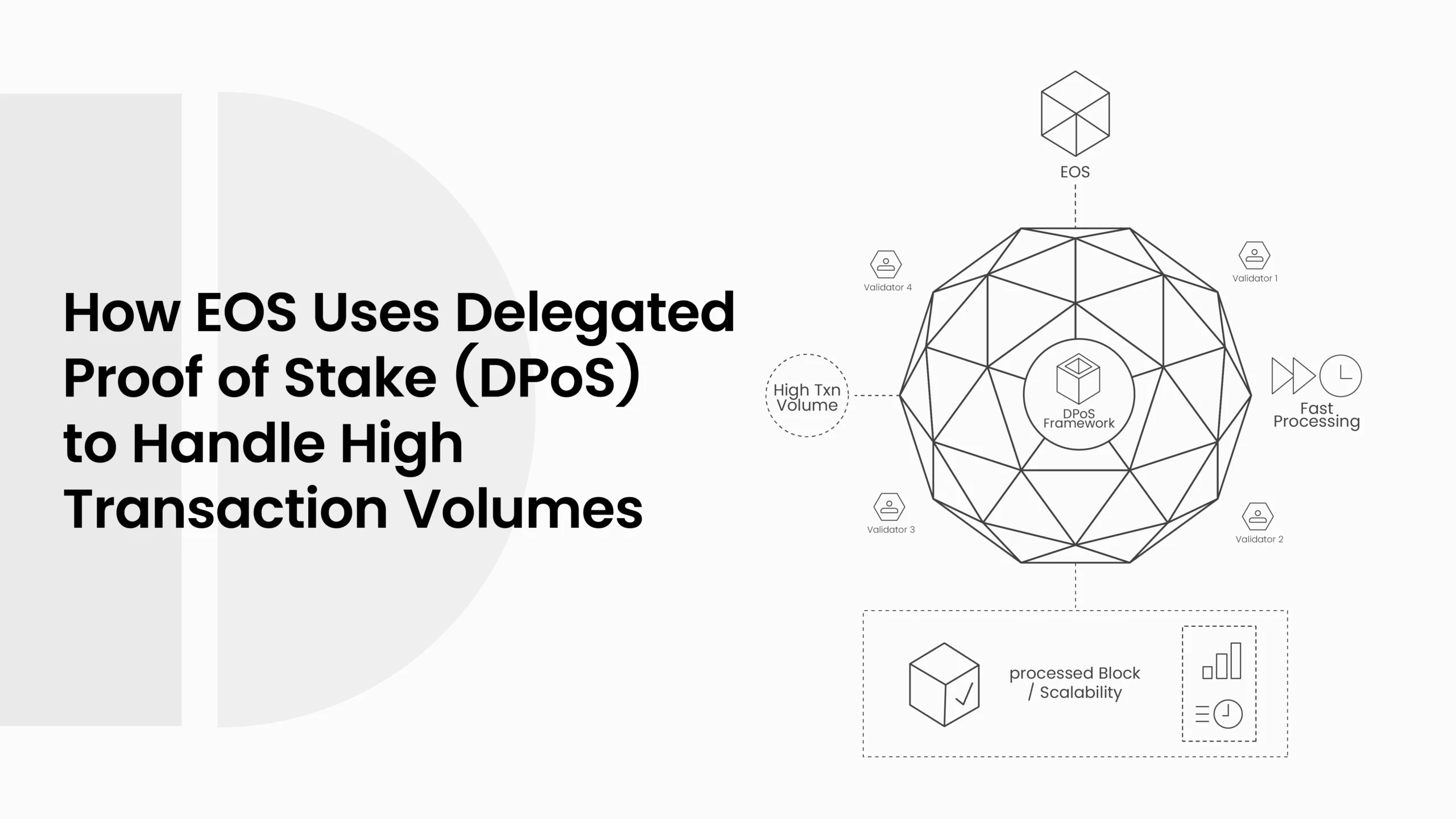

To understand EOS’s performance, one must first grasp how DPoS works. DPoS in EOS revolves around the delegate voting system, where token holders participate in network governance by voting for a fixed number of block producers, in this case, 21, who take on the task of validating transactions and maintaining the blockchain.

Every EOS token owner is able to cast a vote using the staked tokens; that is, the voting power depends on the number of tokens held on a one-to-one basis. Such votes are summarized immediately, and the 21 best-ranked candidates are turned into active block producers. They alternate block generation in an orderly rotation, and this greatly cuts down the latency as compared to PoW networks. Every block producer is given a window time of 0.5 seconds in which to produce a block, and the whole rotation takes about 10.5 seconds, after which the cycle repeats.

Such a system provides not only rapid block production, but also deterministic finality, in which a transaction can be called confirmed after a few rotations only (one or two). The DPoS system of EOS is predictable, unlike PoS chains that may require a number of confirmations by random validators, in which case the set is fixed and known.

EOS’s version of DPoS is also adaptable. The token holders may at any moment alter their votes, which is a continuous feedback mechanism that would encourage accountability among block producers. When a producer does not do his/her job or is suspected of any kind of wrongdoing, voters can take away they’re support and substitute him/her with more trustworthy candidates. This approach, as outlined in the FasterCapital overview, gives EOS a dynamic form of decentralized governance embedded within its consensus mechanism (FasterCapital, 2024).

Block Producers in EOS: Authority and Accountability

Within the EOS DPoS structure, block producers are central to maintaining the network’s integrity and efficiency. These producers are not anonymous miners or randomly selected nodes. Instead, they are public entities, often companies or technically experienced teams, elected by the EOS community. Their roles include validating transactions, producing new blocks, ensuring system uptime, and even proposing software upgrades or parameter changes.

The concentrated authority granted to these block producers enables EOS to avoid the congestion and bottlenecks common in other blockchains. However, this concentration also introduces certain risks. Critics argue that when only a few entities control consensus, the network may lean toward centralization. If block producers collude or engage in vote trading, they could potentially undermine the trust model of the network.

To mitigate these risks, EOS’s DPoS model incorporates continuous voting and transparency. Block producers often publish performance metrics and campaigns to maintain voter trust. They are evaluated not only on technical capability but also on governance integrity. The idea is that accountability is enforced through community action, rather than external regulation.

This structure is also what differentiates EOS from typical PoS or PoW systems. Allowing the governance authority to be directly vested in the hands of the token holders and electing the roles of validation, EOS provides a beneficial hybrid environment that is both quick and somewhat democratic. However, it is a question of continuing discussions as to whether this balance can be adequate to stop centralization or not.

ALSO READ: 8 Reasons a Validator Loses Your Vote in a DPoS System

Performance Analysis: Can EOS Handle High Transaction Volumes?

EOS boasts of supporting more than 4,000 transactions per second (TPS), which is infinitely higher than the services that Bitcoin and Ethereum offer. Real-life performance in tests has been rather reserved in practice, however. According to a detailed benchmarking report by BitMEX Research, EOS was observed to process 250 TPS under stress-testing scenarios, while showing the capacity to scale higher under ideal conditions (BitMEX, 2018).

Several factors contribute to this high performance. First, the block size in EOS is larger compared to legacy chains, allowing more transactions to be included per block. Second, the fixed rotation of block producers avoids the time delays caused by mining or validator randomization. Finally, the network includes a resource allocation system based on CPU, NET, and RAM, which gives developers and users bandwidth proportional to their staked tokens.

EOS also separates transaction throughput from consensus overhead. This implies that the network will be able to check and write numerous transactions simultaneously without the need to overpower the consensus layer. This structure, in combination with the fact that blocks are made every half-second, means that EOS can be considered a fast-finality blockchain.

Although the points are certainly impressive in technical terms, it is necessary to mention that the performance is also conditioned by network conditions, the hardware of the nodes, and the load on applications. Nonetheless, in terms of the successful consensus models, the EOS DPoS implementation offers one of the best examples of the high throughput capacity in the public blockchain setting.

Advantages and Criticisms of EOS’s DPoS Model

EOS’s use of DPoS brings numerous advantages. The most conspicuous of them are less energy usage, low latency of transactions, rapid finality of blocks, and some level of democratic control through voting based on token weight. Such features make EOS an ideal choice in decentralized applications with high reliability and low latency needs like real-time games, social media applications, and financial markets.

Nevertheless, the identical design begs the question as well. In an analysis published in arXiv, several others have expressed worry about how power is concentrated among block producers, and that it could lead to cartel-like behavior (ArXiv, 2022). On other occasions, the leading producers have dominated for a long duration, which has cast doubt over vote trading or reciprocal promotion. Also, the system can give more power to big token holders, undermining the idea of decentralization that is central to the network, and privileging whales over regular users.

Researchers also point out the issue of voter apathy. Staking is mandatory to vote; therefore, many users do not participate in governance at all, so the power is concentrated among a small number of active participants. Time-weighted voting, non-voter inflation penalties, or on-chain audits of delegate activity are some of the suggested solutions to this problem. These discussions demonstrate that, although the DPoS that EOS has created is an interesting experiment in scalable consensus, its governance structures need to be constantly improved to match incentives and decentralization.

ALSO READ: All You Need to Know About DPoS Node Requirements

The Final Word

The implementation of the DPoS consensus mechanism at EOS is among the most promising attempts to balance the trilemma of blockchain, i.e., decentralization, scalability, and security. With both a validation mechanism implemented using elected block producers to conduct validation and a system designed to enable token owners to impose some form of control over it through a delegate voting system, EOS can offer a technically elegant and high-performance solution to one of the oldest problems of blockchain.

With that said, the benefits of speed and throughput offered by EOS should be offset by the issues of governance, transparency, and possible centralization. With the development of blockchains as infrastructural platforms worldwide, efficient consensus models as well as sound accountability structures will be required. EOS has also contributed greatly to this continued development by showing what a fast-finality blockchain can actually resemble in reality.

Its achievements and its failures will probably shape the next generation of blockchain networks, because developers and researchers are still inquiring how quickly a framework can be, but how justly and safely it can run itself at scale.

Frequently Asked Questions About EOS and DPoS

How does EOS use Delegated Proof of Stake (DPoS)?

EOS uses a voting-based system where token holders elect 21 block producers. These producers take turns creating and validating blocks every 0.5 seconds, enabling the network to process transactions quickly and efficiently.

How many transactions per second can EOS handle?

EOS claims it can process over 4,000 transactions per second under ideal conditions, though stress tests have shown around 250 TPS in real-world use.

Why did EOS choose DPoS instead of Proof of Work?

EOS adopted DPoS to improve scalability and reduce energy use. Unlike mining, which consumes heavy power, DPoS allows validation through elected delegates, making it faster and more sustainable.

Are EOS block producers centralized?

Partially. Since only 21 block producers control validation at a time, power can concentrate among large token holders or alliances, raising centralization concerns if voters stay inactive.

What risks exist in the EOS DPoS system?

Potential issues include voter apathy, vote-trading among producers, and governance bias toward large stakeholders. However, continuous voting and transparency reports help reduce these risks.

Glossary of Key Terms

Delegated Proof of Stake (DPoS):

A blockchain consensus mechanism where token holders elect a small group of validators, called block producers, who create and verify new blocks.

Block Producer (BP):

An elected participant in EOS responsible for generating blocks, validating transactions, and maintaining network stability.

Throughput (TPS):

The total number of transactions a blockchain can process per second.

Finality:

The stage when a blockchain transaction becomes irreversible and permanently added to the ledger.

Staking:

Locking up tokens to gain voting power or receive network rewards in PoS and DPoS systems.

Governance:

The decision-making process through which blockchain participants manage upgrades, rules, and validator elections.