How Green Bonds Could Be Managed Using DPoS Chains

The world is changing rapidly, and one of the most significant challenges today is climate change. Governments, companies, and investors are searching for ways to support projects that protect the environment and reduce carbon emissions. One of the most popular tools for this purpose is the green bond. A green bond functions similarly to a conventional bond, but the proceeds raised are exclusively allocated to environmentally beneficial projects, such as wind farms, solar energy plants, or clean transportation systems.

- What Are Green Bonds?

- Definition and Purpose

- Growth of the Green Bond Market

- Why Transparency Matters

- Difference Between Conventional Bonds and Green Bonds

- Problems in Current Green Bond Issuance

- High Intermediary Costs

- Limited Traceability

- Regulatory Confusion

- Current Challenges in Green Bond Issuance

- Blockchain Basics for Green Bonds

- What Blockchain Brings to Finance

- Why DPoS Instead of Other Blockchains

- Benefits of Green Bonds

- How DPoS Can Manage Green Bonds

- Role of Issuers, Validators, and Investors

- The Green Bond Lifecycle on DPoS

- Green Bond Lifecycle in DPoS Chains

- Why DPoS Improves Trust in Green Bonds

- Transparent Reporting

- Lower Risk of Greenwashing

- Regulatory Support

- Case Study Examples and Experiments

- Santander’s Blockchain Green Bond

- World Bank’s “Bond-i” Project

- Lessons for DPoS Adoption

- Traditional vs. DPoS-Based Green Bond Management

- Challenges Ahead for Using DPoS in Green Bonds

- Regulatory Uncertainty

- Scalability Concerns

- Privacy and Data Protection

- Future of Green Bonds on DPoS Chains

- Integration With CBDCs and Stablecoins

- Interoperability Across Markets

- Growing Investor Confidence

- Conclusion

- Frequently Asked Questions About How Green Bons Could Be Managed Through DPoS

- What is a green bond?

- How does DPoS improve green bond issuance?

- Can blockchain prevent greenwashing in green bonds?

- What role do regulators play in DPoS-based green bonds?

- Are DPoS chains energy-efficient for green finance?

- Glossary of Key Terms

Green bonds have gained primary relevance in international finance as they connect finance and climate action. They will provide investors with the opportunity to generate a profit while contributing to the sustainability objectives. However, a complicated and costly system of issuing and administering these bonds exists today. The number of middlemen, such as banks and rating agencies, is numerous, and these increase the cost and slowness of the process. At the same time, investors often face doubts about where the money actually goes, raising concerns about “greenwashing,” where funds may be claimed to be used for environmental projects but are not always tracked properly (Malamas, Dasaklis, Arakelian, & Chondrokoukis, 2020).

Here, blockchain technology could assist. Blockchain offers a transparent and safer channel for recording transactions. Applied to green bonds, blockchain will simplify and reduce the costs of the process, as well as simplify the audit. However, not every blockchain is identical. Others are slow and costly, such as proof-of-work systems. Others can have scalability constraints. A more recent model, Delegated Proof of Stake (DPoS), possesses properties that render it suitable for managing green bonds.

To put it simply, DPoS enables a network to operate efficiently by allowing stakeholders to elect trusted delegates who authenticate transactions. It is faster, energy-efficient, and highly scalable relative to other blockchain models. In the case of green bonds, this translates to faster issuance, reduced costs, and increased confidence among issuers, investors, and regulators.

This blog will explain how green bonds could be managed using DPoS chains. It will examine what green bonds are, the current system’s problems, how DPoS works, and how it can enhance transparency and efficiency in sustainable finance. By the end, you’ll see how this technology could transform the way the world finances climate projects.

ALSO READ: What is the Role of Dynamic Inflation in Long-Term DPoS Stability?

What Are Green Bonds?

Definition and Purpose

A Green Bond refers to a financial instrument designed to finance environmentally friendly projects. It resembles an ordinary bond: a borrower, such as a government or corporation, borrows money from investors and assures them that they will be repaid with interest. The difference is that in green bonds, money raised cannot be used on projects other than those that deliver climate or environmental benefits. Such projects could involve the construction of solar farms, the conversion of the existing means of transportation to electric ones, or the enhancement of the clean water infrastructure.

The primary concept behind green bonds is to link finance with sustainability. Investors still get a return on their money, but at the same time, they know their investment is helping the planet.

Growth of the Green Bond Market

Green bonds have proliferated over the last decade. The Climate Bonds Initiative stated that by 2019, the global green bond market was over 750 billion dollars and has only grown since that time. Although the percentage of the bond market occupied by green bonds remains small, their presence continues to grow annually. Governments and international organizations are also encouraging their use to meet climate goals and the United Nations’ Sustainable Development Goals (SDGs) (Reboredo, 2018).

This growth indicates that investors are increasingly interested in climate finance. However, the market also faces challenges, particularly in terms of trust, traceability, and costs.

Why Transparency Matters

One of the most important parts of green bonds is credibility. Investors want to ensure that their money is being used for genuine environmental benefits. If a company issues a green bond but then uses the money for unrelated projects, it creates a problem known as greenwashing. This not only damages the issuer’s reputation but also erodes confidence in the entire green bond market (Sartzetakis, 2020).

This is the reason why transparency is necessary. Regulators, investors, and the general public must have a means of monitoring the expenditure of funds. This is one of the primary reasons why blockchain technology, particularly DPoS-based systems, may be so significant in the context of green bond management.

Difference Between Conventional Bonds and Green Bonds

| Feature | Conventional Bonds | Green Bonds |

| Purpose | General funding for projects or expenses | Funding only for environmentally friendly projects |

| Trust Issues | Standard financial checks | Risk of greenwashing without proper reporting |

| Market Size | Very large and established | Smaller but growing quickly |

| Investor Benefit | Financial return only | Financial return + environmental impact |

Problems in Current Green Bond Issuance

Although the concept of green bonds is gaining popularity, the current issuance and management of these bonds have a number of issues. The issues pose a hindrance to the issuers and investors. Most of these problems are attributed to conventional finance systems, which have a strict dependency on middlemen, extensive paperwork, and complex bureaucratic procedures.

High Intermediary Costs

Issuing a green bond is expensive. Companies or governments typically rely on banks, underwriters, rating agencies, and auditors to manage the process. Each of these intermediaries charges fees. This results in a significantly high overall cost of issuance. As a result, some organizations, especially smaller ones, may avoid issuing green bonds even if they have good environmental projects.

For example, a bank syndicate may organize the issuance and charge a spread, which reduces the amount of money the issuer finally receives. These costs reduce the returns that could otherwise be allocated to projects or reinvested in investors.

ALSO READ: Can DPoS Solve High-Frequency Trading Bottlenecks on Blockchain?

Limited Traceability

Another big issue is that it is often difficult to trace exactly where the money from green bonds goes. An investor may be told that their funds are financing solar plants, but in many cases, the tracking and reporting systems are weak. Because the records are handled by multiple parties and are not always transparent, it can be hard to verify if the funds are really being used as promised (HSBC & Sustainable Digital Finance Alliance, 2019).

This lack of traceability is what creates the risk of greenwashing. Without clear tracking systems, investors have no easy way to prove that their money is achieving real environmental impact.

Regulatory Confusion

The bond market is inherently international in nature, yet regulations vary from country to country. This complicates operations by issuers and cross-border investors. Success in the case of green bonds, the absence of standard rules is more difficult. Some markets are strict on the definition of what is considered to be green, and there are those markets that are not strict.

Due to this, issuers face additional challenges in ensuring compliance with various jurisdictions. Investors, however, may not be able to make comparisons across bonds from different regions due to differences in reporting standards.

Current Challenges in Green Bond Issuance

| Challenge | Impact on Market | Example |

| High Costs | Issuers lose a large part of the raised capital to fees | Bank syndication spreads |

| Limited Traceability | Hard for investors to confirm the real impact | Greenwashing cases |

| Regulatory Confusion | Extra hurdles for cross-border bonds | Different “green” definitions in the EU vs Asia |

| Settlement Failures | Delayed or failed payments | Back-office processing errors |

These issues reveal the reasons why a new system is necessary. The system reduces costs, enhances traceability, provides compliance, and instills confidence in investors. To a large extent, blockchain, particularly Delegated Proof of Stake (DPoS) chains, can resolve most of these problems by providing transparency, automation, and expedited settlement.

Blockchain Basics for Green Bonds

The problems with green bond issuance highlight the need for a more effective system. Blockchain technology can transform the issuance, trading, and management of green bonds by rendering the entire process more transparent, faster, and cheaper. Before learning how, people must first examine what blockchain offers and why Delegated Proof of Stake (DPoS) is a powerful option in this market.

What Blockchain Brings to Finance

Blockchain is similar to an electronic journal that captures transactions in a safe and irreversible manner. Each transaction is appended to a block, and when it is confirmed, it cannot be modified. This renders blockchain permanent and very reliable.

For finance, blockchain reduces the need for middlemen. Instead of relying on banks or agents to verify every step, transactions can be verified by the network itself. This cuts down costs, speeds up settlement, and makes auditing easier. For green bonds, blockchain could mean that every coupon payment, every investment, and every environmental report is stored on a ledger that anyone can access and verify.

The smart contract is another potent attribute of blockchain. A smart contract refers to a piece of code that automatically executes once certain conditions are met. For example, a type of smart contract could be a coupon payment release to bondholders on predetermined dates, eliminating the need for human intervention. This lessens mistakes and enhances trust.

Why DPoS Instead of Other Blockchains

Not all blockchains operate in the same manner. The original blockchain model, Proof of Work (PoW), is very secure but slow and energy-intensive. Proof of Stake (PoS) is faster but still has limitations when scaling up to large financial markets.

Delegated Proof of Stake, or DPoS, is different. In this model, token holders vote for a small group of delegates who are responsible for validating transactions and ensuring the integrity of the blockchain. Because only a limited number of delegates are active at any given time, the network can process transactions much faster and with significantly lower energy consumption.

For green bonds, this is important because speed and efficiency matter. Bonds involve many transactions, from issuance to trading to settlement. Using DPoS, these steps can occur in near real-time, while still maintaining a high level of security and transparency.

Benefits of Green Bonds

When applied to green bonds, DPoS blockchains offer several key advantages:

- Faster Issuance and Settlement: Transactions can clear within seconds or minutes, not days.

- Lower Costs: By eliminating multiple intermediaries, issuance becomes more cost-effective.

- Better Transparency: Every transaction is recorded on-chain and can be audited at any time.

- Energy Efficiency: Since DPoS consumes less energy than Proof of Work, it aligns more closely with the environmental goals of green bonds.

- Stronger Governance: Delegates are voted in and can be replaced if they do not perform well, ensuring accountability.

With these features, DPoS appears to be a natural fit for managing green bonds in a manner that is both financially and environmentally sustainable.

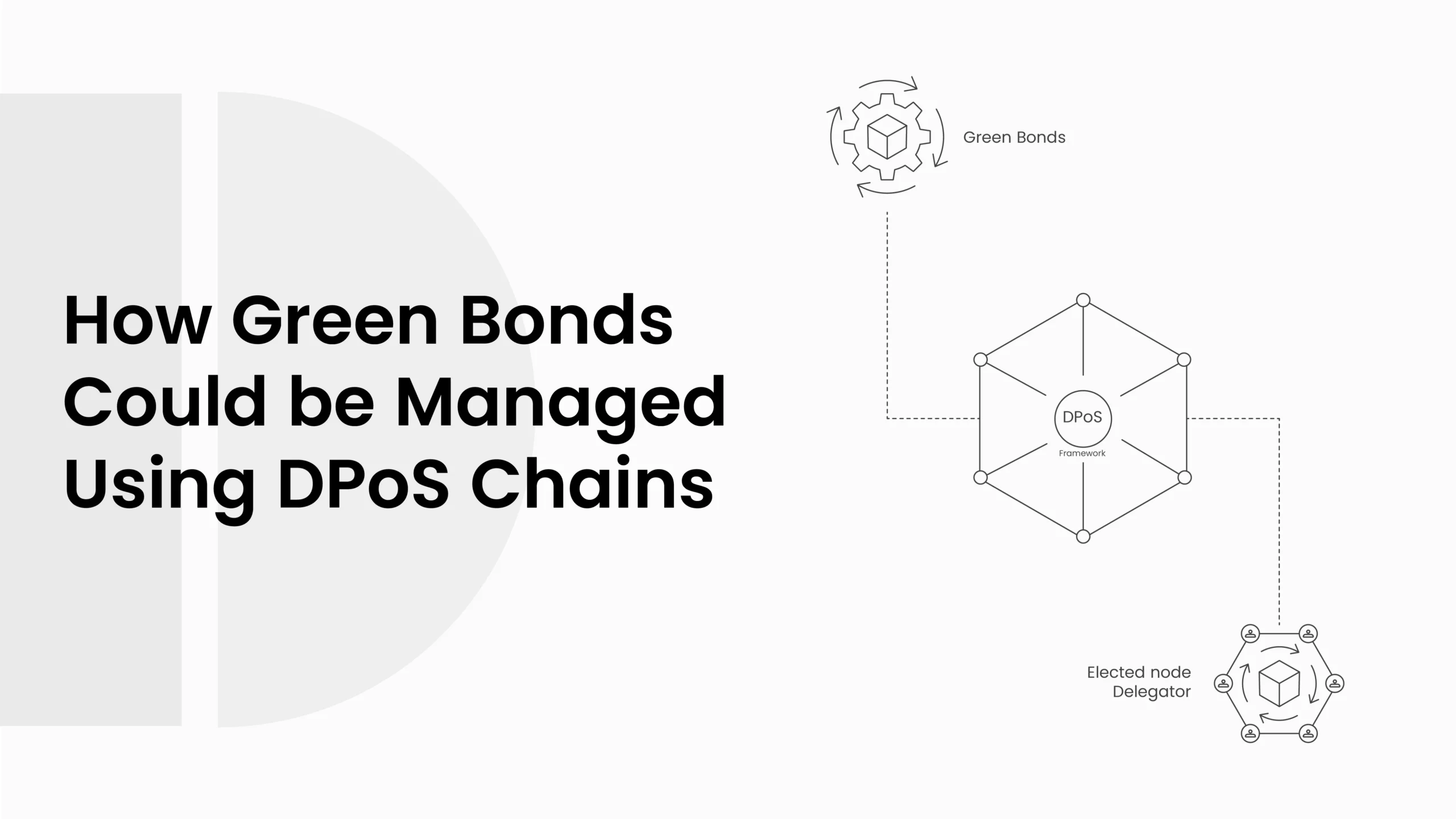

How DPoS Can Manage Green Bonds

With that information on why DPoS is a good option, everyone can now learn how it can be effectively used to manage green bonds. What is relevant is that the complete bond lifecycle, including creation and redemption, can be stored and administered on a DPoS blockchain. This also provides full transparency to the investors, issuers, and regulators at every stage.

Role of Issuers, Validators, and Investors

In a DPoS-based green bond system, each group has a clear role.

- Issuers: These are governments, banks, or companies that want to raise money for green projects. They create and issue the bonds.

- Validators (Delegates): These are trusted actors who verify the data provided by issuers. For example, they might confirm that a solar energy project meets environmental standards before the bond is launched.

- Investors: These are individuals or institutions who buy the bonds. They can see exactly where their money is going and track the bond’s performance on the blockchain.

- Regulators: They can participate as observer nodes, making sure compliance is followed without needing to control the entire system.

Because all actions are recorded on the chain, everyone can see the same verified information. This reduces the chance of fraud or mistakes.

ALSO READ: How DPoS Can Reshape Mobility Governance with Mobility-as-a-Service (MaaS)?

The Green Bond Lifecycle on DPoS

The management of green bonds can be broken down into five key stages, all of which are supported by DPoS technology.

- Initialization – The issuer creates the bond and defines its terms, such as interest rate and maturity.

- Validation and Approval – Validators check the project details and confirm that it meets green standards. Regulators may also review the documents at this stage.

- Issuance as Digital Tokens – Once approved, the bond is tokenized into digital assets. These tokens represent ownership and can be traded on the market.

- Trading and Settlement – Investors can buy or sell the tokens. Smart contracts automatically manage coupon payments and redemptions. Settlement is almost instant compared to traditional markets.

- Archiving for Audits – When the bond reaches maturity, all records are stored permanently on the blockchain. This gives regulators and investors an audit trail they can trust.

This lifecycle removes many manual steps and replaces them with automated, transparent processes.

Green Bond Lifecycle in DPoS Chains

| Stage | What Happens | Role of DPoS |

| Initialization | Issuer sets bond terms | Terms stored in a smart contract |

| Validation | Validators confirm compliance | Delegates verify documents |

| Issuance | Bond is tokenized | Tokens distributed on-chain |

| Trading | Investors trade tokens | Near real-time settlement |

| Archiving | Records stored permanently | Immutable blockchain ledger |

By moving to this model, green bonds can become easier to issue, cheaper to manage, and more trustworthy for investors. Every transaction is visible, reducing the risk of greenwashing, and automation ensures that payments and reports are processed on time.

Why DPoS Improves Trust in Green Bonds

Trust is one of the biggest challenges in the green bond market. Investors want clear proof that their money is being used for real environmental projects. Issuers want a system that reduces costs while maintaining high credibility. Regulators want transparency so they can enforce rules. A DPoS blockchain can improve trust for all three groups by making records open, accurate, and verifiable.

Transparent Reporting

One of the strongest advantages of DPoS is transparency. Every step of the green bond lifecycle, from issuance to coupon payments, is recorded on the blockchain. This means investors can check at any time how much money has been raised, how it is being used, and when payments are made.

For example, if a government issues a $100 million green bond to build solar farms, investors can track the exact allocation of funds through blockchain entries. Reports do not need to be manually requested; instead, they are available in real time through the ledger.

Lower Risk of Greenwashing

Greenwashing is a major concern in sustainable finance. Companies may market bonds as “green” but later use the money for projects that have little environmental value. This damages investor confidence and slows market growth.

By using DPoS, all transactions and project reports are validated by elected delegates. These validators can confirm whether a project meets the required green standards before money is released. Since records are immutable, issuers cannot alter data later. This makes it very difficult for organizations to misuse funds without being detected (HSBC & Sustainable Digital Finance Alliance, 2019).

Regulatory Support

Regulators also benefit from DPoS chains. They can run observer nodes that allow them to view all bond activity without controlling the system. This provides them with access to detailed audit trails, making compliance enforcement easier. Instead of relying on multiple intermediaries, regulators can utilize blockchain records that cannot be tampered with.

This model also reduces disputes. Since everything is timestamped and verified, settlement failures and reporting errors become rare. For green bonds, this level of assurance helps attract more investors, including large institutions that demand strong governance and transparency.

Case Study Examples and Experiments

The idea of using blockchain for bonds is not just theoretical. Several experiments and real-world examples have already demonstrated how digital ledgers can enhance bond issuance. These early projects help us understand how DPoS chains could take the model further.

Santander’s Blockchain Green Bond

In 2019, Santander issued the world’s first end-to-end blockchain-secured green bond, worth approximately $20 million. The entire process, from creation to allocation and settlement, was managed on blockchain. This proved that bonds could be issued faster and at lower cost using distributed ledger technology.

World Bank’s “Bond-i” Project

The World Bank also issued a blockchain bond known as “Bond-i,” in partnership with the Commonwealth Bank of Australia. This project demonstrated how blockchain can handle the entire bond lifecycle transparently and efficiently. While it was not DPoS-based, it highlighted how distributed systems can replace traditional intermediaries.

Lessons for DPoS Adoption

Both of these examples used private or permissioned blockchain systems. While successful, they still had some limitations in speed, scalability, and governance. This is where Delegated Proof of Stake can push the model forward. By using elected delegates to validate transactions, DPoS combines speed and transparency with democratic governance. For green bonds, this means lower costs, faster settlement, and stronger accountability.

Traditional vs. DPoS-Based Green Bond Management

| Feature | Traditional Process | DPoS-Enabled Process |

| Speed | Settlement takes 2–3 days | Near real-time settlement |

| Costs | High fees for intermediaries | Reduced costs via automation |

| Transparency | Limited reporting, manual audits | Full on-chain visibility |

| Trust | Based on third parties | Based on an immutable blockchain |

| Greenwashing Risk | High due to weak tracking | Low due to validator checks |

These real-world experiments show the direction the market is moving. While blockchain is still new in finance, its use in bonds has already proven successful. Adding DPoS can make the system even more efficient and aligned with the goals of green finance.

Challenges Ahead for Using DPoS in Green Bonds

Although DPoS can address many of the issues in green bond issuance, there are still challenges to be overcome. Finance is a highly regulated industry, and new technologies like blockchain must deal with both technical and legal barriers before they can be widely adopted.

Regulatory Uncertainty

One of the biggest hurdles is regulation. Financial markets have strict rules to protect investors and ensure stability. However, many of these rules were designed before blockchain existed. This creates uncertainty around how digital bonds, tokens, and smart contracts fit into existing laws.

For example, different countries may have different definitions of what counts as digital security. This makes it harder for green bond issuers who want to raise money across borders. Without clear rules, many investors and institutions may hesitate to adopt blockchain-based bonds (Seretakis, 2019).

Scalability Concerns

Another challenge is scalability. Green bonds are growing fast, and the bond market as a whole is worth trillions of dollars. For blockchain systems to handle this volume, they must process a huge number of transactions quickly and cheaply.

While DPoS is faster than many other blockchain systems, large-scale adoption would still require careful planning. If too many transactions happen at once, the network could become congested, slowing down the entire process.

Privacy and Data Protection

A third challenge is privacy. Transparency is a strength of blockchain, but it also creates risks. If every transaction is visible, sensitive financial data could be exposed. For green bonds, issuers may not want all project details to be publicly disclosed, and investors may require confidentiality.

This also ties into legal requirements, such as the European Union’s General Data Protection Regulation (GDPR), which grants individuals the right to be forgotten. Blockchain, by design, is permanent and cannot delete records. Finding a balance between transparency and privacy will be important for green bond systems (Politou, Alepis, & Patsakis, 2018).

Future of Green Bonds on DPoS Chains

Despite the challenges, the future of green bonds managed on DPoS chains looks very promising. As technology and regulation continue to improve, people may see blockchain becoming the standard system for sustainable finance. Several trends indicate how DPoS can enhance the efficiency, trustworthiness, and widespread adoption of green bonds.

Integration With CBDCs and Stablecoins

One major trend is the rise of central bank digital currencies (CBDCs) and stablecoins. If green bonds are issued on DPoS chains and linked with these digital currencies, settlement could become instant. Coupon payments could be released directly in digital dollars or euros without delays or extra bank fees. This would make green bonds faster and cheaper to manage, while also giving investors more confidence that payments are secure.

ALSO READ: How Decentralized Social Media Could Use DPoS for Content Moderation

Interoperability Across Markets

Another important development is interoperability. Today, green bonds face challenges due to varying rules and systems across different countries. A DPoS-based system can be designed to connect across different markets. For example, a company in Europe could issue a bond that is instantly tradable in Asia or North America, with all transactions recorded on the same blockchain. This would lower barriers for issuers and give investors more options.

Growing Investor Confidence

Perhaps the most important benefit of using DPoS is building trust. Investors want to know that their money is being used for real green projects. With a DPoS chain, they can verify every step of the process themselves. This not only reduces the risk of greenwashing but also attracts larger investors, such as pension funds, banks, and governments. As trust grows, more money will flow into green projects, helping the world move faster toward sustainability goals.

Conclusion

Green bonds are one of the most powerful tools in sustainable finance. They give investors a way to earn returns while also supporting projects that protect the planet. However, the current system for issuing and managing these bonds still has significant issues, including high costs, a lack of transparency, and risks of greenwashing.

Blockchain technology offers a solution, and among the different blockchain models, Delegated Proof of Stake stands out as a strong choice. By allowing elected delegates to validate transactions, DPoS combines speed, efficiency, and trust in a way that fits perfectly with the needs of green bonds. It lowers costs by reducing intermediaries, improves transparency by recording every step on-chain, and builds confidence by making green finance more transparent and accountable.

Real-world experiments, such as the Santander green bond and the World Bank’s Bond-i, already demonstrate that blockchain can be applied to bonds. Adding DPoS to the model could make green bond markets even more efficient, reliable, and scalable. While challenges such as regulation, scalability, and privacy still require solutions, the direction is clear.

In the future, green bonds managed on DPoS chains could connect seamlessly with CBDCs, reach investors across borders, and bring unprecedented trust to climate finance. This would not only make financial systems more modern but also help channel billions of dollars into projects that fight climate change.

The bond market is huge, and even small improvements can create big impacts. By adopting DPoS blockchains, green bonds could become cheaper to issue, more trustworthy, and more effective in funding a greener world.

Frequently Asked Questions About How Green Bons Could Be Managed Through DPoS

What is a green bond?

A green bond is a financial instrument where the money raised is used exclusively for environmentally friendly projects, such as renewable energy or clean transportation.

How does DPoS improve green bond issuance?

Delegated Proof of Stake (DPoS) facilitates faster, cheaper, and more transparent bond issuance by utilizing blockchain delegates to validate and record transactions.

Can blockchain prevent greenwashing in green bonds?

Yes. Blockchain records are immutable, meaning every transaction and report can be verified. This reduces the risk of false claims about how funds are used.

What role do regulators play in DPoS-based green bonds?

Regulators can act as observer nodes. They don’t control the system but can view real-time audit trails to ensure compliance with financial rules.

Are DPoS chains energy-efficient for green finance?

Yes. DPoS uses far less energy than Proof of Work systems, making it more aligned with the environmental goals of green bonds.

Glossary of Key Terms

- Green Bond: A bond where proceeds are invested in projects with environmental benefits.

- Blockchain: A digital, tamper-proof ledger of transactions shared across a network.

- DPoS (Delegated Proof of Stake): A consensus mechanism where token holders vote for delegates who validate blockchain transactions.

- Smart Contract: Automated digital agreements that execute when preset conditions are met.

- Greenwashing: When an issuer falsely claims their investment is environmentally sustainable.

- CBDC (Central Bank Digital Currency): A digital form of money issued by a central bank, often used for fast settlement.