How Liquid Staking Derivatives Could Disrupt DPoS Economics (2025 Guide)

The way people earn rewards from blockchain networks is changing, and at a brisker rate than ever. One of the biggest shifts in 2025 is happening through something called Liquid Staking Derivatives (LSDs). These are new crypto tools that let users earn staking rewards and still use their tokens in other ways. It’s like getting paid to lock your money up, but with a secret door to take it out and use it whenever you want.

- What Are Liquid Staking Derivatives?

- How Regular Staking Works

- What Liquid Staking Does Differently

- Quick Recap: What Is DPoS and How It Works

- What Is DPoS?

- How It Works—Step by Step

- Why DPoS Is Popular

- Why Economics Matter in DPoS

- The Economics of LSDs—Breaking the Traditional DPoS Model

- How LSDs Change the Flow of Rewards

- Impact on DPoS Economics

- Four Main Ways LSDs Disrupt DPoS Economics

- a. Changing Staking Incentives

- b. Centralization and Validator Influence

- c. Breaking the Illiquidity Barrier

- d. Price Discovery and Governance Power

- Risks to DPoS Networks from Liquid Staking Derivatives

- Smart Contract Vulnerabilities

- Slashing Risk

- Centralization

- Liquidity Risk

- Regulatory Uncertainty

- Counterparty Risk

- Market Risk

- Risks vs Mitigation Strategies

- Are Liquid Staking Derivatives the Future of Staking?

- A Growing Trend in Crypto Economics

- Predictions for the Coming Years

- Frequently Asked Questions (FAQs)

- Glossary of Key Terms

This change matters especially for Delegated Proof of Stake (DPoS) networks. These networks let users vote for special nodes (called validators) to confirm transactions and keep the network secure. Until now, staking in DPoS meant you had to lock up your tokens and just wait for your rewards. But with LSDs, that rule is being rewritten.

This blog will explain what liquid staking derivatives are, how they work, and why they’re such a big deal for DPoS economics.

What Are Liquid Staking Derivatives?

Suppose you invested your money in a savings account where it is tied up for a year. You will earn interest, but you cannot access your money until the year comes to an end. So consider a variant of that explanation in which you still get interest, but you can spend your money whenever you want, to shop, invest, or whatever.

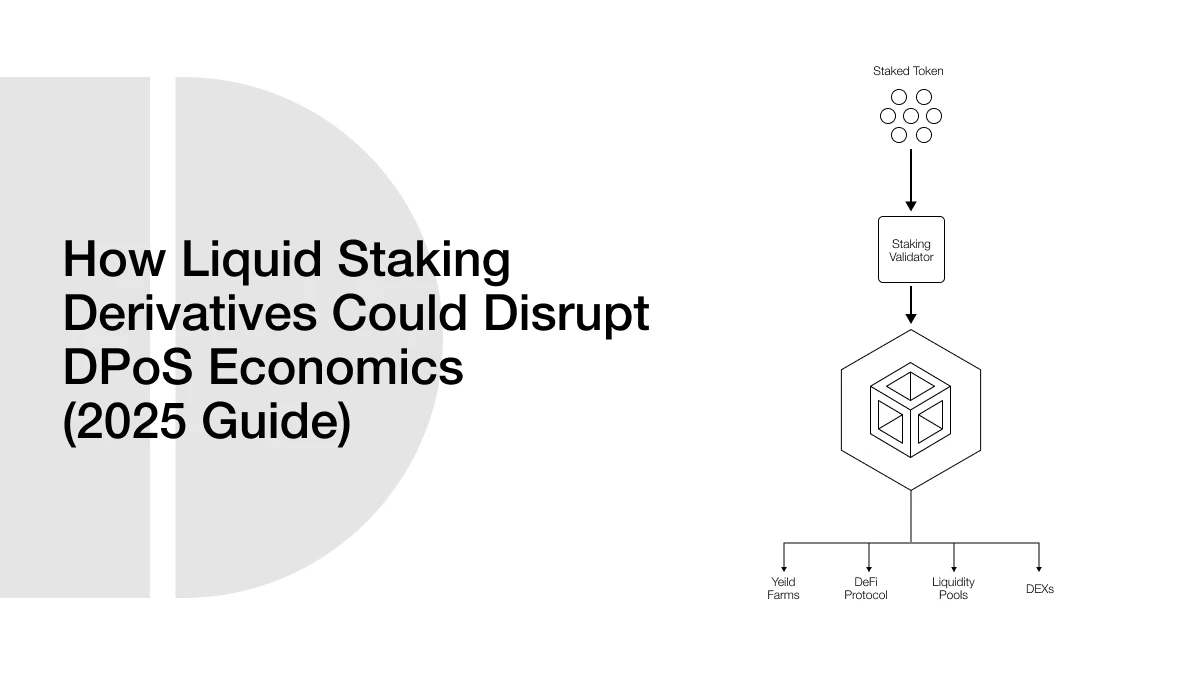

That’s basically what liquid staking derivatives (LSDs) do in cryptos.

How Regular Staking Works

In most Proof of Stake (PoS) or Delegated Proof of Stake (DPoS) blockchains, you can earn rewards by locking up your crypto. This is called staking. Your staked tokens help secure the network, and in return, you get more tokens as rewards. But the problem is, you can’t use your staked tokens while they’re locked up.

ALSO READ: Is This the Future of Blockchain? The Impact of AI Bots on Voting in DPoS Systems

That’s where liquid staking comes in.

What Liquid Staking Does Differently

When you stake through a liquid staking protocol like Lido, Rocket Pool, or Benqi, you get a tokenized version of your staked asset. For example:

- If you stake ETH on Lido, you get stETH.

- If you stake AVAX on Benqi, you get sAVAX.

- If you stake DOT on Bifrost, you get vsBOND.

These new tokens are liquid staking derivatives. They still earn rewards from staking, but you can also:

- Trade them

- Use them in DeFi apps like lending or yield farming

- Sell them at any time

This gives you the best of both worlds, staking rewards and the ability to use your crypto.

| Feature | Direct Staking | Liquid Staking Derivatives (LSDs) |

| Liquidity | Locked, not usable | Tradable and usable instantly |

| Reward Access | Delayed or locked during unbonding | Earned continuously or built into token |

| Flexibility | Low | High |

| Risk of Slashing | Direct exposure to validator risk | Often shared or reduced by platform |

| Usable in DeFi | No | Yes—can be used in lending, farming |

| Minimum Stake Required | Sometimes high (e.g. 32 ETH on Ethereum) | Often low or none |

| Custody Risk | Depends on method (custodial/non) | Varies, non-custodial options exist |

| Example Tokens | ETH, SOL, DOT (staked directly) | stETH, rETH, sAVAX, vsBOND, aETH |

Quick Recap: What Is DPoS and How It Works

Before this blog dives into how liquid staking derivatives (LSDs) affect Delegated Proof of Stake (DPoS), let’s first understand what DPoS is and why it matters in the crypto world.

What Is DPoS?

Delegated Proof of Stake (DPoS) is a variant of blockchain that allows individuals to assist in operating the network to vote on validators rather than becoming one.

In Proof of Stake (PoS), everyone can stake their tokens and become a validator provided that they meet some requirements. However, in DPoS, individuals give their tokens to other validators who can do the work on their behalf.

It is just like you want somebody to represent you in a team; you give them your support, and they work on your behalf.

How It Works—Step by Step

- Users hold tokens.

- Instead of staking directly, they delegate their tokens to a validator.

- Validators are chosen based on the amount of support (delegated stake) they have.

- These validators verify transactions, create new blocks, and earn rewards.

- The rewards are then shared between the validator and the people who voted for them.

Why DPoS Is Popular

- Faster and cheaper than Proof of Work (like Bitcoin)

- Uses less energy

- Easier for everyday users (you don’t need to run a full node or own a lot of tokens)

- More scalable, which means the network can handle more activity

DPoS is used in many big projects like TRON, EOS, and Steem.

Why Economics Matter in DPoS

In DPoS, economics = incentives.

- Validators want more votes so they can earn more.

- Delegators want to choose validators that give them the best rewards.

- The network wants everything to stay secure and decentralized.

If the balance of these incentives changes, it could affect who becomes powerful, how rewards are distributed, and whether users stay in the system.

And that’s where LSDs start to shake things up.

They don’t follow the same rules as traditional staking. They let users trade, re-stake, or use their tokens elsewhere, sometimes without involving validators or delegators at all. This new freedom could change how power, money, and trust flow in DPoS networks.

The Economics of LSDs—Breaking the Traditional DPoS Model

Liquid staking derivatives (LSDs) are changing the way money moves in DPoS networks. Traditionally, staking was simple: you locked your tokens with a validator, earned rewards, and waited for your tokens to unlock. Now, LSDs bring a new set of rules that change the entire economic game.

ALSO READ: How DPoS Builds Trust in Tokenized Real Estate, Art, and Gold

How LSDs Change the Flow of Rewards

When people use LSDs, they no longer just delegate tokens to validators and wait. Instead, they are issued a tokenized version of their stake, e.g., stETH or rETH, which can be moved to other applications and can receive rewards. The dual utilization indicates that stakers can get additional revenue through trading, lending, or even re-staking the same amount on various platforms.

An important factor is the liquid staking basis (the difference in price between an LSD and the underlying token). When the direct staking provides more rewards than holding the LSDs, the LSD may be discounted (Scharnowski and Jahanshahloo 2024). On the other hand, LSDs can fetch a premium when they have better yields on LSD platforms.

Impact on DPoS Economics

Under DPoS, the validators depend on delegated stakes to sustain their position and get rewards. When a large population of users migrates to LSD platforms such as Lido or Rocket Pool, the control can become concentrated in the hands of those platforms rather than being spread among a multitude of individual validators. This could:

- Reduce the number of independent validators

- Increase centralization risk, as seen with Lido holding 30% of all staked ETH

- Change reward distribution, since LSD platforms keep a portion of rewards as fees

By giving users the ability to trade or move their tokens without unbonding, LSDs may also weaken the loyalty of delegators to specific validators. This might result in frequent shifts of delegated tokens, affecting validator stability and governance.

Four Main Ways LSDs Disrupt DPoS Economics

LSDs are not just a new tool; they actively challenge how DPoS networks work. Here are four major disruptions:

a. Changing Staking Incentives

In traditional DPoS, rewards motivate users to delegate their tokens to validators. LSDs add another layer of rewards, as these derivatives can earn yield in DeFi protocols like Aave or Curve.

For example:

- A user stakes ETH via Lido → gets stETH

- Uses stETH as collateral to borrow more ETH → stakes it again

This cycle, known as “leveraged staking,” can multiply returns. But it can also inflate the supply of staked tokens, creating economic pressure on reward distribution.

b. Centralization and Validator Influence

When most users prefer staking through platforms like Lido, Rocket Pool, or Binance, a few operators control a large share of the network’s stake. This is dangerous for DPoS, which depends on decentralization for security.

As noted in Ethereum Foundation reports, Lido’s 30% stake in Ethereum raised alarms about centralization risks. The same problem could happen in other DPoS networks if LSD providers dominate.

c. Breaking the Illiquidity Barrier

DPoS traditionally required tokens to stay locked for days or even weeks. LSDs eliminate this barrier. With LSD tokens, users can sell, trade, or use their staked value instantly.

This new liquidity makes staking more attractive to small investors, but it also creates price volatility in secondary markets. The value of an LSD might deviate from the actual staked token value due to market sentiment or low liquidity.

d. Price Discovery and Governance Power

Research shows LSD tokens play an increasing role in price discovery (Scharnowski & Jahanshahloo, 2024). This means that the price of LSDs like stETH can affect the value of ETH itself.

Additionally, LSD platforms may gain governance power in DPoS networks because they control a massive pool of delegated votes. If not managed properly, this could lead to validator cartels or unfair decision-making.

Risks to DPoS Networks from Liquid Staking Derivatives

Liquid staking derivatives (LSDs) bring powerful benefits, but they also introduce serious risks to DPoS networks. These risks affect not only individual investors but also validators, delegators, and the health of the entire blockchain ecosystem.

Let’s go over the main risks and how they can be reduced.

Smart Contract Vulnerabilities

LSDs are powered by smart contracts. These are codes that manage your staking, mint the LSD tokens, and send rewards. But just like any software, bugs or hacks can cause big losses.

If a smart contract is poorly written or not audited, attackers can steal funds or cause the protocol to fail.

Mitigation: Choose LSD platforms that undergo regular audits from well-known security firms. Stick with projects that publish transparency reports, like Lido or Rocket Pool.

Slashing Risk

In PoS and DPoS systems, validators can be slashed (penalized) if they misbehave. This slashing affects the staked tokens. Since LSD platforms pool users’ funds, one bad validator can lead to losses across many users.

Mitigation: Use platforms that spread the stake across multiple validators. For example, Rocket Pool uses a decentralized validator network to lower slashing exposure.

Centralization

As more users stake through a few LSD providers, those platforms gain too much power. In DPoS, this could mean that a single entity ends up controlling most of the validator votes, which the system was designed to prevent.

Mitigation: Support protocols that promote validator diversity. Some projects like Lido are now adding permissionless validator onboarding to reduce this issue.

Liquidity Risk

While LSDs offer liquidity, they can become illiquid during market panic or crashes. This means users might not be able to sell or trade their tokens quickly, or may be forced to sell at a loss.

Mitigation: Stick with LSDs that have deep liquidity pools on exchanges like Curve or Uniswap. Diversifying across different LSDs can also help manage liquidity shocks.

Regulatory Uncertainty

Some countries may treat liquid staking derivatives as securities or regulated financial products. This could lead to sudden bans or fines for platforms or users.

Mitigation: Choose platforms that follow compliance-friendly practices, such as Know Your Customer (KYC) or anti-money laundering (AML) policies. Keep an eye on local laws before investing.

Counterparty Risk

Some liquid staking derivative protocols are custodial, meaning they hold your funds. If the company behind the protocol goes bankrupt or acts dishonestly, your tokens may be at risk.

Mitigation: Choose non-custodial liquid staking derivatives where smart contracts (not humans) hold the funds. Projects like Ankr and Rocket Pool focus on decentralized control.

Market Risk

If the underlying token (like ETH or SOL) crashes in price, your liquid staking derivative also loses value, even if staking rewards continue. This is a natural risk in all crypto assets.

Mitigation: Spread your investment across multiple blockchains and tokens. Don’t put all your funds into one LSD or protocol.

ALSO READ: Privacy in DPoS: Why It Needs Zero-Knowledge Proofs (ZKPs) More Than Ever Now

Risks vs Mitigation Strategies

| Risk | What It Means | How to Reduce It |

| Smart contract bugs | Code failure or hacks can lead to losses | Use audited, transparent platforms |

| Slashing | Validator errors can cause token loss | Choose LSDs with multiple validator support |

| Centralization | Too much control in one protocol breaks decentralization | Support protocols with open validator onboarding |

| Liquidity issues | Hard to sell LSDs in bad markets | Pick LSDs with strong exchange listings and big pools |

| Regulatory problems | Legal rules may block or ban LSDs | Choose KYC-compliant or regulated platforms |

| Counterparty risk | Custodial platforms might mismanage or lose user funds | Prefer non-custodial LSDs using smart contracts |

| Market volatility | LSDs lose value if the underlying crypto drops | Diversify across LSDs and manage portfolio exposure |

Are Liquid Staking Derivatives the Future of Staking?

So, are liquid staking derivatives the future of staking? In many ways, yes, but it’s not that simple. Let’s explore what 2025 and beyond might look like.

A Growing Trend in Crypto Economics

The total value locked (TVL) in liquid staking derivatives continues to rise. Platforms like Lido hold over $15 billion in staked ETH alone. More users are choosing liquid staking derivatives for their flexibility and capital efficiency.

Predictions for the Coming Years

- Liquid staking derivatives will likely become standard tools in crypto wallets and DeFi apps

- Restaking protocols like EigenLayer may allow liquid staking derivative holders to earn extra rewards by securing other services

- Liquid staking derivative tokens may become accepted collateral for real-world asset tokenization

- New risk management layers, like decentralized insurance, will likely help secure liquid staking derivative platforms

- Governance models may shift, as Liquid staking derivative platforms hold more voting power in DPoS systems

Not fully. Some users will still prefer traditional staking for its simplicity and directness, especially long-term holders who don’t use DeFi. Also, LSDs come with risks, smart contract bugs, slashing exposure, and regulatory issues that some users might want to avoid.

But overall, liquid staking will likely become the dominant form of staking for active users in 2025 and beyond. The key will be finding the balance between liquidity and security, freedom and control.

Frequently Asked Questions (FAQs)

- What is a liquid staking derivative (LSD)?

A liquid staking derivative is a token you get in exchange for staking crypto through a special platform. It lets you earn staking rewards while still using the token in other DeFi apps like trading, borrowing, or yield farming.

- How is liquid staking different from normal staking?

In regular staking, your tokens are locked. You can’t touch them until the unbonding period ends. With liquid staking derivatives, you can use your staked tokens right away without waiting; they stay “liquid.”

- What does “liquid staking basis” mean?

This is the price gap between the LSD and the real token it’s based on. If stETH is trading at less than ETH, that’s a negative basis. It’s affected by rewards, liquidity, risk, and market behavior.

- Do LSDs create risks for DPoS networks?

Yes. They can lead to centralization (too many people using one provider), smart contract failures, and governance issues. They also make it harder for networks to know where real voting power lies.

- Can I lose money using LSDs?

Yes, you can. If the liquid staking derivatives protocol gets hacked, slashed, or faces market crashes, your token could lose value. There’s also a chance of regulatory crackdowns in some regions.

Glossary of Key Terms

| Term | Definition |

| LSD | Liquid Staking Derivative, a tradable token representing staked crypto |

| DPoS | Delegated Proof of Stake, a system where users vote for validators |

| Validator | A trusted node that confirms transactions and earns rewards |

| Delegator | A user who stakes by assigning their tokens to a validator |

| Unbonding Period | The time you must wait before withdrawing staked tokens |

| Slashing | A penalty for validators who break the rules or go offline |

| Smart Contract | A blockchain program that runs automatically, without human control |

| TVL | Total Value Locked, showing how much money is staked or used in a protocol |

| Price Discovery | The process where market prices reflect all known information |

| Liquid Staking Basis | The price difference between the LSD and its original staked token |