A Beginner’s Guide: Building a Fair Token Distribution System in DPoS Networks

In every blockchain, tokens are like the blood that keeps the system alive. They are not just numbers on a screen. They show ownership, reward users, and decide who gets to make decisions in the network. That is why token distribution is one of the most important parts of any crypto project. If the tokens are not shared fairly, the whole system can get unbalanced. A few people might own too much, while most users get almost nothing. That can break trust and stop community growth. This is seen in some old projects where early investors sold all their coins and left small users with losses.

- Understanding DPoS and Its Governance

- What Is a Token Distribution Model

- Common Problems in Token Distribution

- Designing a Fair Token Distribution Model for DPoS

- Set Total Token Supply

- Decide Allocation Percentages

- Add Vesting and Lock Periods

- Using Smart Contracts for Token Distribution

- Case Studies of Token Models in DPoS Projects

- Balancing Fairness and Scalability

- Testing and Simulation

- Regulatory and Ethical Considerations

- Future Trends in DPoS Token Models

- Conclusion

- Frequently Asked Questions About Building a Fair Token Distribution

- What is a DPoS token?

- Why is token distribution so important?

- How do you prevent whales in DPoS?

- What is vesting and why is it used?

- What tools can help in token distribution?

- Glossary

Bitcoin and Ethereum both showed how strong token models build long-term trust. Bitcoin rewards miners for real work. Ethereum gave early access through a sale but still spread tokens widely. But when everyone looks at Delegated Proof of Stake (DPoS), things get even trickier. Because in DPoS, users don’t just hold tokens, they vote with them. That means distribution affects who controls the network. If one group has too many tokens, they could take over the delegate votes and change the rules. So, a smart and fair token design is not only about money. It is about keeping democracy alive in the blockchain.

ALSO READ: How DPoS Remains the Backbone of Blockchain Governance in the Layer 2 Era

Understanding DPoS and Its Governance

DPoS stands for Delegated Proof of Stake. It is one of the most popular blockchain consensus systems today. It was made to fix the slow speed of Proof of Work and the high costs of Proof of Stake. In DPoS, people who own tokens vote for a few trusted delegates. These delegates then confirm transactions and make blocks. Think of DPoS like an election. The token holders are the voters, and the delegates are the government. If a delegate does something wrong, people can remove their vote anytime. This makes the system fairer and faster than other types.

A DPoS chain can process more transactions per second and uses less energy. But there is also one problem: who owns the tokens matters a lot. If a small group owns too many, they can control who becomes a delegate. That is why distribution is so important. It decides how many people actually have voting power. Here is a simple table to understand how DPoS is different from other systems:

| Feature | PoW | PoS | DPoS |

| Consensus Type | Mining | Staking | Delegated Voting |

| Speed | Slow | Medium | Fast |

| Energy Use | High | Low | Very Low |

| Governance | Miners | Validators | Elected Delegates |

So, in short, DPoS mixes democracy with efficiency. But it only stays fair when the tokens are spread in a balanced way. That’s why designing the token model is one of the first steps before launching any DPoS project.

What Is a Token Distribution Model

A token distribution model explains how and when all the tokens in a project are shared. It shows who gets them, how much, and for what reason. It can be seen as a plan for the project’s economy.

For example, if a project has 1 billion tokens, it has to decide how much goes to the community, the developers, the validators, and the treasury. This plan is written before the project starts and helps people trust that there is no secret unfair advantage. A good token model should answer three questions:

- Who gets the tokens?

- When do they get them?

- What do they need to do to earn them?

| Component | Description | Example |

| Allocation | How total supply is divided | 40% community, 20% team |

| Vesting | Lock period for early investors | 12 months lock |

| Reward System | Incentives for staking or voting | 5% annual reward |

| Reserve | Tokens for future use | Ecosystem grants |

In a DPoS blockchain, these details are even more important. Because if too many tokens go to one group, like the team or private investors, it can hurt governance. So the design must make sure that delegates and community members all have a voice. The goal is to keep power distributed, just like the tokens themselves.

ALSO READ: Why Switch from PoS to DPoS Staking in 2025

Common Problems in Token Distribution

When a token model is not planned carefully, many things can go wrong. One of the biggest problems is centralization. If a few wallets hold a large part of the supply, they can control most of the votes. This kills the main idea of DPoS, which is fair community control. Another problem is token dumping. This happens when early investors or team members get their tokens all at once and sell them fast. It crashes the price and scares away small users. Many new blockchains failed for this reason.

A third problem is inactive holders. Sometimes, tokens go to people who never vote or use them. This reduces participation and makes governance weak. Imagine a country where 80% of people never vote, then a few powerful players can rule easily. That’s exactly what happens on the chain, too. So, before creating a DPoS network, founders should ask a few questions. These questions help build trust. Because once a blockchain loses fairness, it’s hard to get it back.

- How can tokens stay active?

- How can dumping be prevented?

- And how can control be spread fairly?

Designing a Fair Token Distribution Model for DPoS

Now comes the main part: how to design a good token distribution model that works for DPoS. This is where economics meets community trust. The design has to balance three goals: fairness, usability, and long-term value. Let’s go step by step.

Set Total Token Supply

Every project should first decide how many tokens will ever exist. It could be a fixed amount or a small inflation model. A fixed supply like 1 billion tokens keeps scarcity, which supports long-term value. But inflation models give space for future rewards and validator incentives.

If the supply keeps changing without reason, investors lose trust. So the project must clearly tell how many tokens will exist and what they will be used for. Even Bitcoin had a limit from the start, 21 million coins, and that helped build its strong image.

Decide Allocation Percentages

After deciding total supply, it’s time to plan how much each group gets. Here is an easy example of how a DPoS project could divide tokens:

| Group | Percent | Purpose |

| Delegates and Validators | 25% | Voting and rewards |

| Public Sale | 35% | Distribution to public |

| Developers | 15% | Long-term growth |

| Treasury | 10% | Ecosystem funds |

| Advisors & Partners | 5% | Network support |

| Reserve | 10% | Future expansion |

The exact numbers can change from one project to another, but this shows the general balance. Validators and delegates should get enough to stay motivated, but not so much that they control everything. Public sale and community share should stay the biggest part to keep decentralization.

ALSO READ: DPoS Voting Explained: How Does On-Chain Governance Work?

Add Vesting and Lock Periods

To prevent dumping, tokens for the team and early investors should not be available right away. A vesting plan locks their tokens for a period of time, like 12 or 24 months. This makes them stay longer and helps the project grow. This kind of design keeps token prices stable and avoids panic selling. It also sends a message that the project is serious about long-term growth. Here’s a small example of a vesting schedule:

| Time Period | Tokens Released | Notes |

| Month 0 | 0% | Lock starts |

| Month 6 | 25% | Early unlock |

| Month 12 | 50% | Mid release |

| Month 24 | 100% | Fully unlocked |

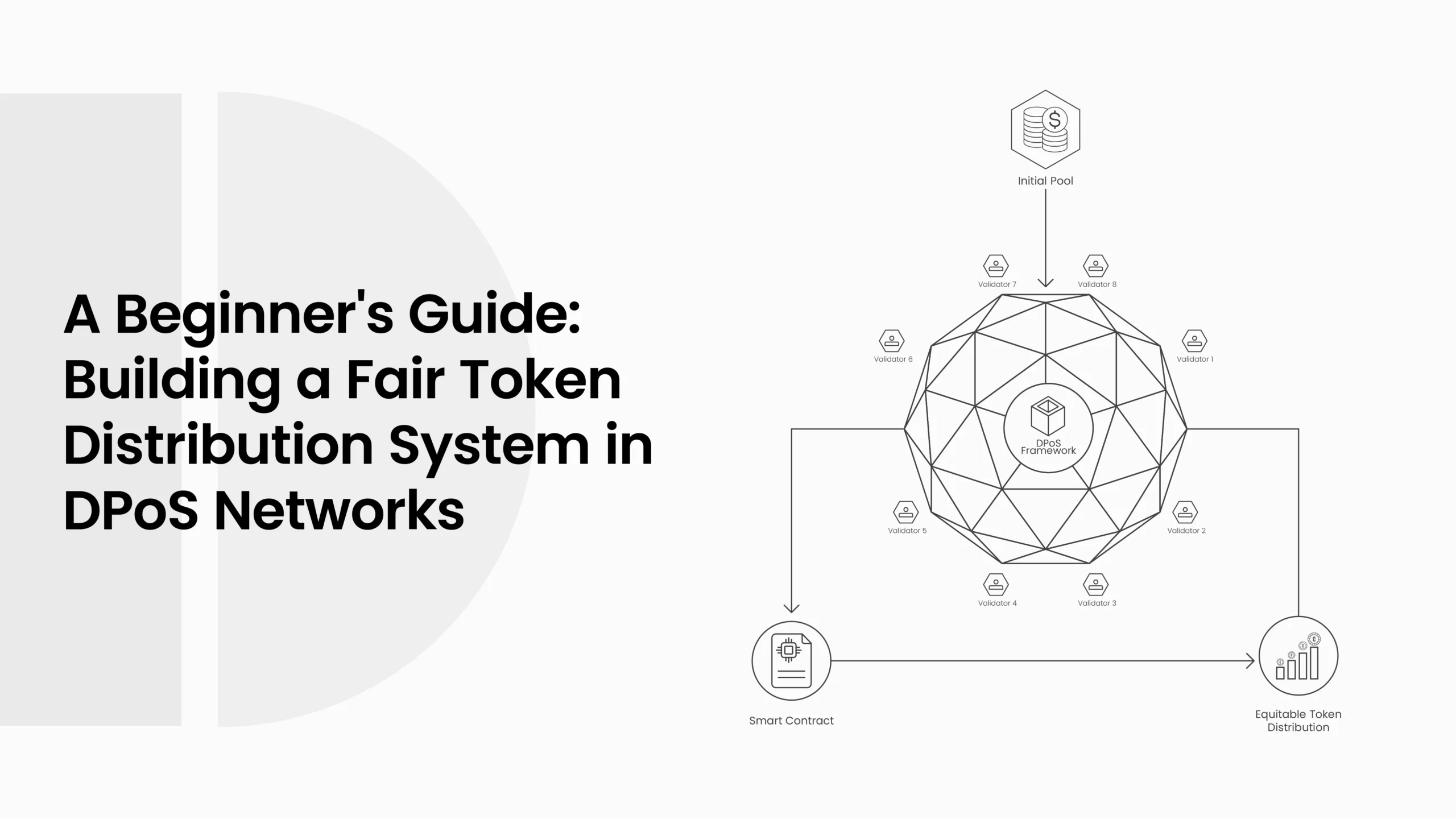

Using Smart Contracts for Token Distribution

In today’s blockchain world, no one wants to manage token spreadsheets by hand anymore. That’s where smart contracts come in. A smart contract is like a small program that runs automatically on the blockchain. Once it’s set, no one can change it without permission. It makes the whole process transparent and fair.

In a DPoS system, smart contracts help send out rewards, manage vesting, and even run airdrops to voters. Instead of trusting a company or admin, trust the code itself. This builds confidence between users and developers. Here’s a simple comparison between manual and smart contract token systems:

| Method | Manual | Smart Contract |

| Control | Managed by humans | Controlled by code |

| Transparency | Limited view | Public on blockchain |

| Error Risk | High chance | Very low |

| Cost | Long term expensive | One time gas cost |

Smart contracts also help new users because they don’t have to rely on middlemen. Everything happens on-chain: rewards, delegate payments, and even burns if needed. Still, it’s important to audit the contracts before launching them. A small coding mistake can lock or lose millions of tokens. So, testing is not optional. It’s a must.

Case Studies of Token Models in DPoS Projects

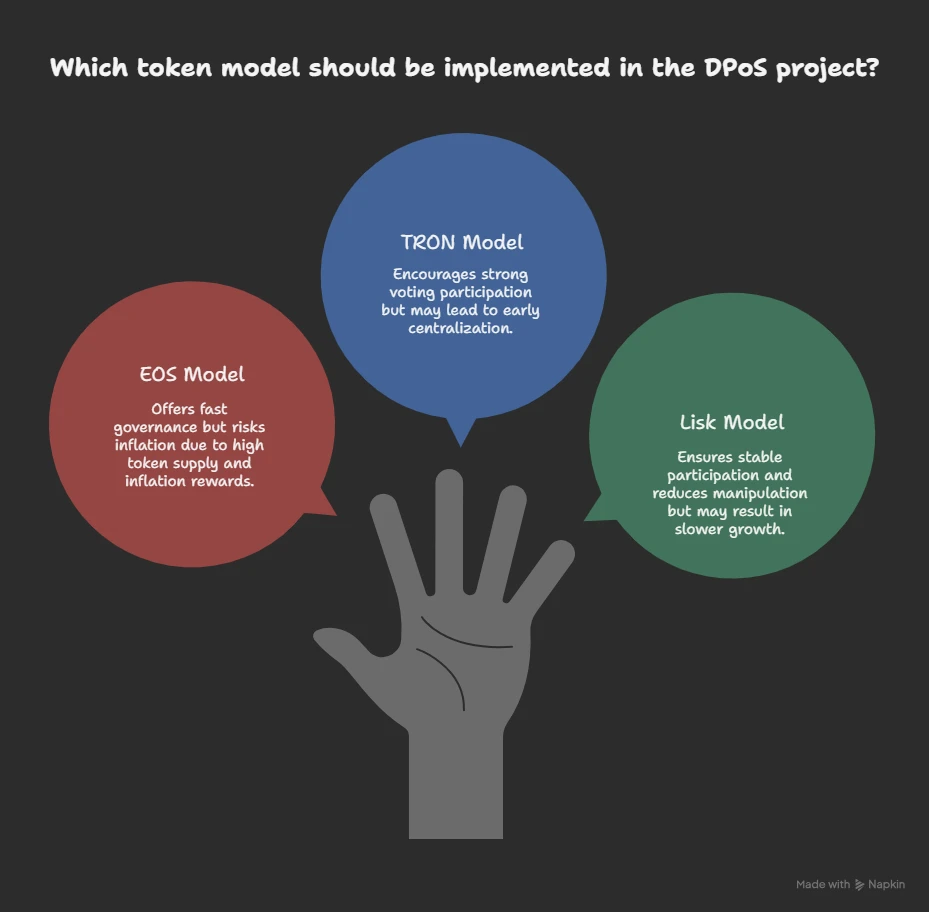

Before creating your own model, it helps to see how others did it. Let’s look at three known DPoS projects: EOS, TRON, and Lisk. Each one used a slightly different token system, but the goal was the same: fast governance and wide participation.

| Project | Total Supply | Validators | Reward Style |

| EOS | 1B EOS | 21 | Inflation rewards |

| TRON | 100B TRX | 27 | Voting reward |

| Lisk | 140M LSK | 101 | Block reward |

EOS focused on inflation, giving delegates new tokens every block. It kept them active but caused inflation over time. TRON tied rewards directly to voting, so holders had a reason to take part. The more they voted, the more rewards they earned. Lisk kept a smaller supply and gave block rewards to delegates for honest work. This helped keep participation steady and reduced manipulation.

Each model has its pros and cons. EOS had speed but too much inflation. TRON had strong voting but early centralization. Lisk was stable but slower to grow. From these lessons, it’s clear that balance is key. Too much reward risks inflation; too little participation and the system becomes inactive.

Balancing Fairness and Scalability

A major challenge in DPoS token design is maintaining a balance between fairness and performance. When token rules are too strict, the network slows down. When they are too loose, large holders can dominate the system. It’s like trying to balance both sides of a seesaw. Fairness means that all participants, from small holders to large investors, should have a voice. That’s why some projects use voting weight limits so that a single wallet cannot control more than a certain percentage of votes. Another method is to reward active voters more than inactive ones. This ensures that contributors who actually help the system grow receive a larger share.

ALSO READ: Why DPoS-Based Tokens Are a Viable Option for Long-Term Investment?

At the same time, scalability matters. A DPoS system must handle thousands of users and transactions per second. If a token model gives rewards too often or too randomly, it can overload the chain. So, timing of rewards, maybe once per day or week, helps keep the chain stable. So, the best model grows slow and steady. Fair for the users, smooth for the chain. To make it easier to understand, look at this small table:

| Factor | Too Fair (Strict) | Too Scalable (Loose) | Ideal Balance |

| Reward Speed | Slow | Too Fast | Moderate |

| Voting Power | Equal for all | Only rich win | Weighted |

| Token Spread | Even but slow | Fast but risky | Gradual and fair |

Testing and Simulation

Before launching a token model, it must be tested many times. Simulation works like a dress rehearsal for the blockchain. It helps identify weak spots before real money is involved. Projects often use testnets to perform these experiments. On a testnet, fake tokens are used to check how staking, vesting, and rewards behave in real conditions. By simulating multiple scenarios, such as whale attacks, inactive voting, or sudden sales, it becomes easier to observe how the system reacts. Here’s a small example of a testing report:

| Scenario | Validator Count | Token Spread | Result |

| No Vesting | 10 | Centralized | Failed |

| With Vesting | 10 | Balanced | Good |

| With Rewards | 20 | Active voting | Excellent |

Testing helps understand where problems can happen. For example, if rewards are too big, people might just farm tokens and dump them later. Or if the vesting is too long, users might get bored and leave. These are real tradeoffs you’ll only see by testing. A few days of testing can save months of fixing later. Also, simulation helps decide the best gas usage, transaction cost, and validator rewards before the network goes public. So, in short, test everything twice, and you’ll have fewer problems later.

Regulatory and Ethical Considerations

Even if blockchain is decentralized, it still operates in the real world. That means your token distribution model must respect legal and ethical limits. Some countries see tokens as securities. Others call them utilities. So it’s a must to be clear about what your token actually is. Never hide allocation details or promise unrealistic returns. Regulators hate that. And users do too. Projects that are open about how tokens are distributed build stronger communities over time. A few basic principles to follow:

- Keep the token plan public and easy to read.

- Avoid insider allocations that give unfair power.

- Use audits and public records to prove transparency.

For example, when EOS ran its ICO, it had to follow strict compliance checks in several countries. Projects today face even more oversight, especially in the U.S. and EU. So, adding a legal review before launch isn’t just good ethics, it’s protection for your project. At the end, ethics and law both come down to one thing: trust. If users trust how someone handles tokens, they will trust the blockchain too.

| Area | Common Issue | Best Practice |

| Regulation | Tokens treated as securities | Legal review before launch |

| Transparency | Hidden team allocations | Public token report |

| Ethics | Pump and dump patterns | Long vesting & audits |

Future Trends in DPoS Token Models

The way tokens are shared and used is always changing. In the early days, it was all about simple sales and airdrops. But now, DPoS projects are starting to use smarter systems that reward long-term community action instead of quick profits. One new idea is AI-based token distribution. Some projects are testing machine learning tools to study user behavior. They check how active someone is, how much they vote, stake, or help other users, and then send rewards automatically. This makes the system smarter and fairer.

Another big trend is quadratic voting. It means each token gives a little less voting power the more you have. So whales can’t control everything, and small holders still matter. It’s already being tried in some governance projects. Instead of sending all reward transactions through the main chain, Layer 2 rollups handle them cheaply and quickly. That means DPoS systems can reward users more often without spending too much on gas fees.

So, the future is all about smarter automation, fairer voting, and lower costs. DPoS is likely the main way blockchains manage community governance because it fits well with these upgrades.

Conclusion

Designing a good token distribution model for DPoS is not just about numbers. It’s about trust, balance, and long-term success. A fair token model helps keep the system democratic, motivates users to vote, and builds a stronger network.

This blog explains that supply size, allocation, vesting, and smart contracts all matter. Plus, there is also fairness and scalability that must work together; too much of one can hurt the other. Testing before launch and keeping everything transparent is what separates strong projects from short-lived ones.

In the end, a DPoS blockchain is only as fair as its token model. The rules designed now will decide how power flows later. If the tokens are shared with care, the community will grow. If they are not, the system can fall apart. So, plan it slow, test it often, and always keep fairness at the heart of your token economy.

Frequently Asked Questions About Building a Fair Token Distribution

What is a DPoS token?

A DPoS token is the main currency used in a Delegated Proof of Stake network. It helps users vote for delegates, pay fees, and earn staking rewards.

Why is token distribution so important?

Because it decides who holds power. A fair distribution keeps the system democratic, while an unfair one lets a few people control everything.

How do you prevent whales in DPoS?

You can use limits on voting weight, make vesting periods longer, and reward active small holders to stop whales from dominating.

What is vesting and why is it used?

Vesting means locking tokens for a time before they can be sold. It helps stop team members and investors from dumping tokens too soon.

What tools can help in token distribution?

Smart contracts are the best tools. They automate payments, enforce vesting, and keep everything public and transparent.

Glossary

Delegate:

A person or node chosen by token holders to create blocks and keep the DPoS network running.

Validator:

A network member that verifies transactions and maintains blockchain security.

Vesting:

The process of locking tokens so they become available slowly over time.

Airdrop:

A free token giveaway used to attract new users or reward community members.

Smart Contract:

A piece of code on blockchain that runs automatically and can’t be changed once deployed.

Quadratic Voting:

A voting method that reduces power for large holders, giving small token owners more say.

Layer 2:

A faster blockchain system that works on top of a main chain to reduce cost and speed up transactions.