How to Integrate Smart Contracts with DPoS-Based Blockchains

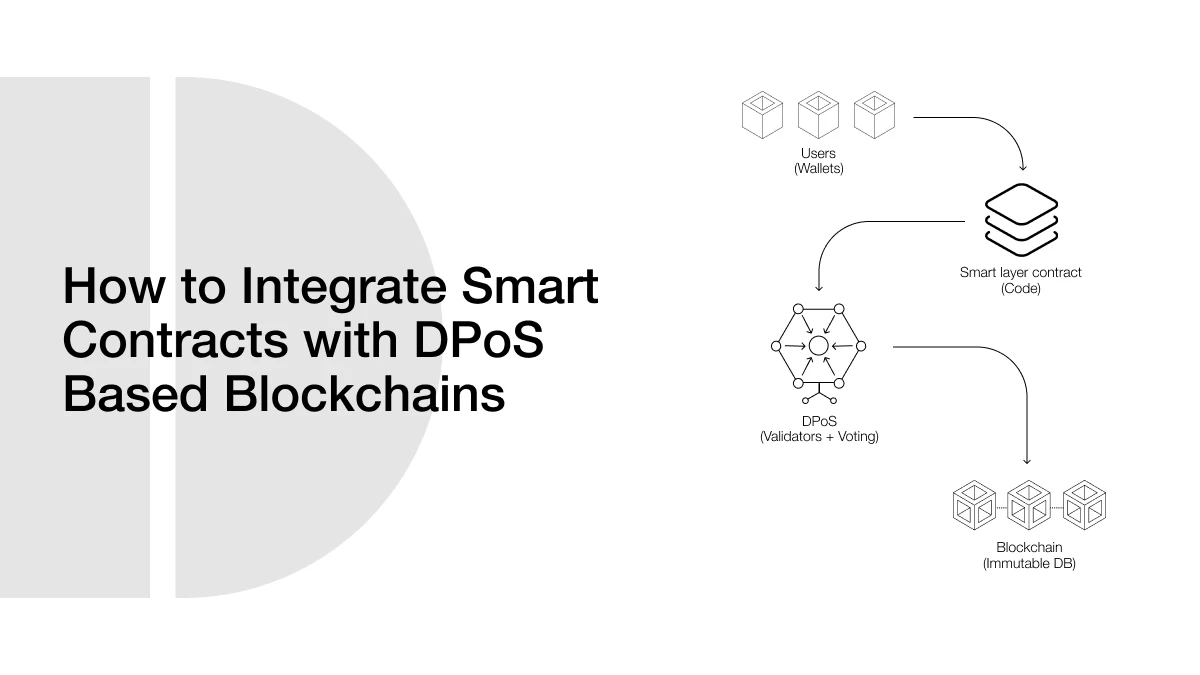

Smart contracts and blockchain networks have changed the process of developing and implementing decentralized apps (dApps). This innovation relies on a reliable, scalable, and efficient consensus mechanism that satisfies the operational needs of smart contracts. Delegated Proof of Stake (DPoS) is one of the most widespread models in this area. The stake of DPoS as the future of scalable governance in blockchain will rise as more industries adopt smart contracts to automate transparently and immutably.

- Learning How DPoS Works

- How Delegate Voting Works in DPoS

- DPoS and Smart Contract Functionality

- Smart Contract Performance: PoW vs DPoS

- Technical Synergy: Efficient Consensus Models for Contracts

- Governance and Flexibility of Delegate Voting Systems

- Real-World DPoS Governance in Action

- Benefits of Integrating Smart Contracts with DPoS Blockchains

- Potential Challenges and Limitations

- Conclusion

- Frequently Asked Questions (FAQs)

- Glossary of Key Terms

This blog goes into how DPoS supports smart contract architecture and how it promotes fast, safe, and cost-effective blockchain governance.

Learning How DPoS Works

Delegated Proof of Stake (DPoS) is a consensus method that is supposed to alleviate the performance limitations of typical Proof of Work (PoW) and even simple Proof of Stake (PoS) systems. The DPoS consensus algorithm enables the holder of tokens to vote a fixed number of delegates or block producers who are responsible for validating transactions and generating new blocks to the blockchain.

This is a form of representative democracy in the governance of blockchain introduced by the delegate voting mechanism. Contrary to PoW systems that involve a competition of all nodes to solve computational puzzles and PoS systems that assign the validation rights to those who possess tokens based on the proportions, DPoS uses a small number of chosen validators, or block producers in DPoS, to provide the consensus to the network.

ALSO READ: From Elections to Blockchain: How DPoS Works in the Real World

The outcome is a faster, environmentally sustainable, and more energy-efficient finality blockchain environment. The blocks in such systems are created at regular intervals with deterministic finality, making DPoS a perfect starting point for real-time applications, such as smart contracts.

How Delegate Voting Works in DPoS

To help beginners understand how delegate voting works in Delegated Proof of Stake (DPoS), imagine your school is choosing a group of class leaders. Instead of everyone managing daily tasks (such as taking attendance or organizing notes), students vote to select a few trusted classmates to do the job for everyone. That’s exactly what DPoS does in blockchain systems.

In DPoS, token holders don’t validate transactions themselves. Instead, they vote for delegates (also known as block producers) who perform the heavy lifting, confirming transactions and adding blocks to the blockchain. This system is fast, efficient, and mirrors real-life democracy.

This voting system keeps the network (or the class) both efficient and accountable; only the most trusted and active participants are allowed to lead, and they can be replaced at any time.

| Step | In Blockchain (DPoS) | In School Election Analogy |

| 1 | Token holders cast their votes | Students vote for class representatives |

| 2 | Top-voted delegates become block producers | Top-voted students become class leaders |

| 3 | Delegates validate transactions and earn rewards | Class leaders handle tasks (e.g., announcements, organizing) |

| 4 | Voters can change votes any time | Students can vote out a rep who underperforms |

| 5 | Delegate list updates regularly | New elections or reshuffles happen as needed |

DPoS and Smart Contract Functionality

DPoS and smart contracts have many benefits regarding performance. The deterministic nature of block production and shorter confirmation times means that smart contracts run accurately and with minimal time lag. In contrast to PoW, like the pre-Merge Ethereum, in which network congestion may lead to slow or failure to execute smart contracts, DPoS-based blockchains are ensured to perform in the same way.

ALSO READ: How DPoS Can Save Crypto’s Environmental Reputation

Major DPoS platforms, EOS, WAX, and TRON, host dApps that are based on smart contracts. The main purpose of these systems was to scale up transaction processing with a low gas cost, and this is essential to applications requiring frequent smart contract engagements. To give an example, EOS could process hundreds of transactions per second during the testing phase, showing the scalability advantage of combining DPoS and the smart contract layer.

This is the capability to achieve high throughput without compromising on the security or the ease of user access, and this has made the DPoS chains appealing to the developers working in the gaming, finance, and logistics sectors.

Smart Contract Performance: PoW vs DPoS

Smart contracts need speed, reliability, and low fees to run effectively, especially in real-time applications like gaming, DeFi, and logistics. This is where the choice of consensus mechanism becomes critical. While Proof of Work (PoW) was revolutionary with Bitcoin and early Ethereum, it often results in slower confirmations and higher energy consumption costs. Delegated Proof of Stake (DPoS), on the other hand, enables faster block creation and lower transaction fees, making it more suitable for platforms that rely heavily on smart contracts.

Let’s compare them side by side:

| Feature | PoW (e.g., Ethereum Pre-Merge) | DPoS (e.g., EOS, TRON) |

| Block Time | 13–15 seconds | 0.5 seconds (EOS) |

| Finality Time | 6 minutes (after confirmations) | Near-instant (few seconds) |

| Transactions per Second | 15–30 TPS | 1000+ TPS (EOS during testing) |

| Gas/Execution Fee | Often high (network congestion) | Very low to negligible |

| Energy Consumption | Very high (mining) | Extremely low (limited validators) |

| Smart Contract Reliability | Prone to delays during congestion | Stable and consistent |

| Use Cases | Simple financial contracts | Real-time gaming, DeFi, social apps |

Technical Synergy: Efficient Consensus Models for Contracts

One of the most important contributions of DPoS to smart contract ecosystems is its ability to enable efficient consensus models. Due to its limited number of trusted validators and emphasis on community voting, DPoS can complete transactions faster and more efficiently than PoW or pure PoS alternatives.

According to a peer-reviewed study published in Automation in Construction, the integration of smart contracts with blockchain infrastructure, particularly in decentralized construction data environments, has been proven to increase transparency and reduce errors in information management (Ciotta et al., 2021). The study highlighted how smart contracts integrated into a blockchain can replace outdated email-based communication by certifying every action and decision digitally and immutably.

By removing latency and lowering the overhead costs associated with increased consensus participation, DPoS platforms ensure that smart contracts execute quickly, which is critical in time-sensitive industries such as real-time bidding, insurance claims processing, and automated compliance.

Governance and Flexibility of Delegate Voting Systems

The DPoS delegate voting system introduces another level of on-chain governance that may affect smart contract behavior directly. It is particularly handy in the case of protocols where there must be an upgrade, a change in policy, or a contract adjustment made that must be proposed, voted on, and implemented without any manual interference.

ALSO READ: How Bitshares, EOS, and TRON Implement DPoS Differently

EOS adopts on-chain referendums and a worker proposal system to allocate network funds and alter system contracts. This organization improves the ecological ability to change with time. By contrast, PoW systems do not have any in-built governance system and instead depend on off-chain community cooperation to make the required upgrades, which might be slower.

Ciotta et al. (2021) emphasize that blockchain-based systems embedded with smart contracts help in reducing human error and increasing reliability in collaborative projects. When voting rights are built directly into the chain, such governance becomes a core architectural feature rather than a secondary process.

Real-World DPoS Governance in Action

DPoS governance isn’t just theoretical; it’s shaping how decisions are made on real networks. Platforms like EOS, TRON, and Steem have pioneered on-chain voting systems, but other DPoS-based chains like Lisk and WAX also offer compelling case studies. These examples show how token-based democracy can succeed or sometimes stumble in live environments.

Let’s expand the list to see how DPoS governance has been applied across five different blockchains:

| Blockchain | Governance Mechanism | Notable Example / Case Study | Governance Outcome |

| EOS | Referendum Voting | Community voted on RAM pricing and inflation model | Enabled flexible system upgrades |

| TRON | Super Representative Voting | Proposal 22 changed resource allocation and bandwidth rules | Enhanced resource fairness and performance |

| Steem | Block Producer Voting | 2020: Hostile takeover attempt led to Hive fork | Community split; decentralized resistance formed |

| Lisk | Delegate Governance | Delegate transparency portal launched to improve voter trust | Promoted more informed voting decisions |

| WAX | Guild and Voting System | Voted changes on NFT staking and game asset rewards | Improved utility for NFT-based ecosystems |

Benefits of Integrating Smart Contracts with DPoS Blockchains

There are several advantages to implementing smart contracts in DPoS networks. First, deterministic block production times improve the dependability of time-sensitive contract execution. Second, lower transaction fees make micro-interactions economically viable, which is critical in the IoT, supply chain, and financial industries.

Moreover, the fact that Ciotta et al. (2021) document the integration of blockchain into construction information systems shows how it can be used to automate document management, inspection logs, and approval processes that remove bottlenecks that humans cause and enhance project compliance throughout its stages.

This automation, which is powered by DPoS’s consensus efficiency, contributes to lower operational costs and increased stakeholder confidence, especially in industries that rely on multi-party data verification and decision-making.

Potential Challenges and Limitations

Despite its performance advantages, DPoS has certain downsides. The most commonly expressed fear is centralization. Because only a small number of block producers engage in validation, there is a theoretical possibility of delegate collusion or vote buying, particularly if a few corporations control significant voting interests.

Furthermore, DPoS security vulnerabilities could develop if hostile actors obtain control of the delegate set. While the system can vote out underperforming or corrupt delegates, the process is primarily reliant on voter turnout, which is not always assured.

Another issue is the platform-specific constraints of smart contract languages. While Ethereum has a large developer base and strong tools in Solidity, many DPoS chains use less mature or proprietary languages, which may limit smart contract innovation or standardization across chains.

Conclusion

Smart contracts, which represent the integration of Delegated Proof of Stake-based blockchains, offer a practical solution to the most time-sensitive problems in decentralized computing. DPoS provides an excellent platform for scalable, secure, and elastic smart contract ecosystems, thanks to its efficient use of consensus, faster finality, and on-chain governance.

The convergence of blockchain, smart contracts, and industry-specific applications like construction and supply chain automation shows immense promise. However, to truly answer the question, is DPoS the future of scalable governance in blockchain? One must consider both its technical superiority and the socio-political implications of its centralized tendencies.

For many smart contract-enabled systems, Delegated Proof of Stake may be the best-balanced path forward, as long as its governance mechanisms continue to evolve in favor of openness and greater participation.

Frequently Asked Questions (FAQs)

- What makes Delegated Proof of Stake better for smart contracts than PoW or PoS?

DPoS offers faster finality, low fees, and reliable performance through its use of elected delegates, which benefits time-sensitive applications like smart contracts.

- Which platforms use Delegated Proof of Stake and support smart contracts?

Major DPoS-based platforms include EOS, TRON, and WAX all of which support smart contract development and decentralized apps (dApps).

- What are the energy advantages of Delegated Proof of Stake?

Unlike PoW, DPoS requires only a few selected block producers, drastically reducing energy usage while maintaining network integrity.

- Are there security risks with Delegated Proof of Stake?

Yes, DPoS can lead to centralization and delegate collusion if voters are inactive. However, active governance mechanisms can mitigate this.

- Can Delegated Proof of Stake handle high transaction loads?

Yes, DPoS is known for high throughput. EOS, for example, can process hundreds of transactions per second, making it ideal for smart contract-heavy systems.

Glossary of Key Terms

- Delegated Proof of Stake: A consensus mechanism where token holders vote for a small group of delegates to validate transactions.

- Smart Contracts: Self-executing agreements with terms written directly into code.

- Block Producers: Elected delegates responsible for validating blocks in a DPoS network.

- Finality: The guarantee that a blockchain transaction is permanent and cannot be altered.

- Governance: The on-chain or off-chain mechanisms used to make decisions and updates to a blockchain protocol.

- Consensus Mechanism: The method by which blockchain participants agree on the state of the ledger.

- Latency: The time delay between transaction initiation and final confirmation.

- Vote Buying: A DPoS risk where delegates may offer rewards to gain votes, undermining decentralization.

- WAX: A DPoS-based blockchain focused on NFTs and virtual assets.