Liquid Governance Tokens Explained: How Liquidity Changes Voting Power in DeFi

Liquid governance tokens represent a new direction in decentralized finance governance. In traditional proof-of-stake and DPoS systems, governance power depends on locked staking. Stakeholders commit assets for a fixed period to participate in voting and secure the network. This lock-based model creates a trade-off between governance influence and liquidity. Liquid governance tokens eliminate that trade-off by allowing holders to retain governance rights while maintaining liquidity.

- What are Liquid Governance Tokens

- The Basics of Delegated Proof of Stake

- Liquid Staking and Governance Tokens

- How Liquid Governance Tokens Change Voting Power

- Liquidity Unlocking and Yield Layers

- Layered Governance Networks

- Centralization Risks and Voting Capture

- Power Aggregation and Governance Capture

- Collusion, Vote Buying, and Governance Cartels

- Economic Models Behind Governance Liquidity

- Price Discovery and Governance Power

- Factors Affecting Governance Token Pricing Power

- Possible Mitigations and Protocol Level Solutions

- Stake Decentralization Caps

- Delegation Transparency and Audit Layers

- Governance Decay and Anti-Concentration Models

- Future Outlook

- Conclusion

- Frequently Asked Questions about Liquid Governance

- What are liquid governance tokens?

- How do liquid governance tokens differ from locked staking governance?

- Why are liquid governance tokens important in DeFi

- Do liquid governance tokens increase centralization risk

- Can liquid governance tokens cause governance attacks

The emergence of liquid governance tokens introduces efficiency, but also shifts the power structure in decentralized networks. When liquidity is introduced into governance rights, network control can move faster between actors. Voting power becomes more dynamic, but also more exposed to concentration through liquidity pools, institutional staking operations, and automated governance services. These changes raise new questions about decentralization, economic security, and stability in governance markets.

Research on liquid staking has already identified increases in staking participation and capital efficiency, yet it also warns of governance concentration risks when staking pools become dominant custodians (Cong, He, and Tang, 2022). These concerns expand further when liquid derivatives hold direct voting rights. The following sections explain the design, impact, and risks related to liquid governance tokens, especially in networks that rely on delegation and stake-weighted voting.

What are Liquid Governance Tokens

Liquid governance tokens are tokens that give holders voting power in decentralized networks while remaining transferable and usable in financial applications. Unlike locked governance tokens or staked assets, liquid governance tokens do not require permanent lock periods to participate in governance. They allow governance rights to move freely across markets and platforms.

This model supports higher market participation because assets can support yield generation and collateral use while still providing voting authority. Liquid governance tokens operate as both governance instruments and liquid capital. This dual function introduces both flexibility and complexity into decentralized decision making.

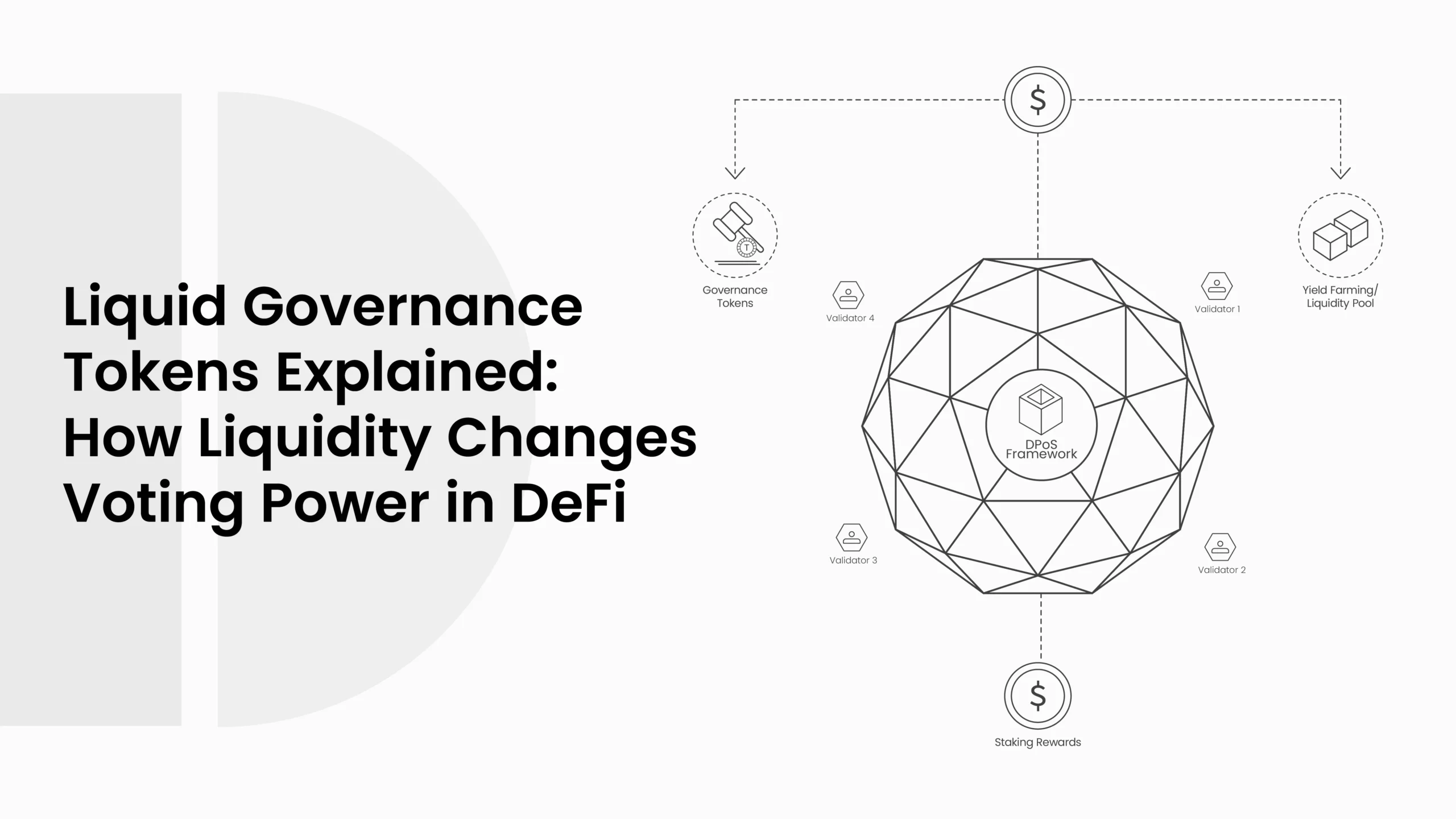

The Basics of Delegated Proof of Stake

Delegated Proof of Stake systems rely on elected validators or delegates. Token holders do not directly validate blocks. Instead, they assign vote weight to trusted validators. Vote weight depends on token quantity and time locked in delegation contracts. Traditional Delegated Proof of Stake models encourage long-term alignment, since locked stake cannot be sold immediately. The lock period supports network security, validator accountability, and predictable voting distribution.

Liquid Staking and Governance Tokens

Liquid staking systems introduce a liquid asset that represents staked value. Examples include stETH in Ethereum staking and mSOL in Solana staking. In a similar structure, liquid governance tokens represent governance stake without restricting transfer. The holder may use the token in lending markets, collateral pools, or exchanges while still holding voting rights.

This flexibility increases capital efficiency but reduces the friction needed to prevent the fast accumulation of governance power by dominant pools. Research from decentralized finance security studies has noted that liquid staking increases systemic correlation between governance markets and token liquidity cycles (Scharnowski and Jahanshahloo, 2024). Liquid governance tokens may amplify this effect.

ALSO READ: The Race for DPoS DeFi Dominance: Sui vs. TRON vs. XDC Network

| Feature | Locked Staking Governance | Liquid Governance Tokens |

| Token transfer | Not allowed during staking | Allowed without restriction |

| Governance power | Stable and long-term | Moves fast with market liquidity |

| Use in finance | Limited until unlock | Can be used in lending, liquidity pools, and trading |

| Decentralization support | Stronger long-term distribution | Higher concentration risk in large pools |

| Governance stability | Resistant to sudden swings | Can shift based on short-term price movement |

How Liquid Governance Tokens Change Voting Power

Liquid governance tokens allow capital and voting power to move freely across platforms. This increases participation but also introduces the chance for fast and concentrated power shifts. Voting rights can follow market cycles rather than long-term governance commitment.

Liquidity Unlocking and Yield Layers

Liquid governance tokens can operate across multiple layers. They can:

- Earn yield

- Provide collateral in lending markets

- Stay in liquidity pools

- Participate in farming strategies

All this while still holding governance power. This creates complex economic layers. A holder can influence governance while still maximizing profit. This is efficient, but it can also let large financial actors amplify their influence through leverage.

Layered Governance Networks

Liquid governance tokens can affect multiple protocols at the same time. When the same token works across networks, decisions in one ecosystem can impact another. Liquidity pools can become power centers capable of shifting policy across chains.

Channels That Increase Governance Influence

| Liquidity Channel | How It Expands Governance Power |

| Lending platforms | Borrow tokens to gain temporary voting weight |

| Yield farms | Earn more tokens to grow governance control |

| Liquidity pools | Concentrate voting rights in shared pools |

| Collateral markets | Use the same token while still voting |

| Automated delegation systems | Algorithmic voting cycles that boost influence |

Centralization Risks and Voting Capture

The main risk in liquid governance systems is the concentration of voting power. When governance tokens remain liquid, extensive custodial services, staking platforms, and liquidity pools can gather large voting power positions. In Ethereum staking research, liquid staking providers have already reached significant stake concentration, with Lido surpassing 30% of the staked supply at peak periods. If liquid governance models follow similar adoption patterns, governance capture becomes a realistic threat.

Power Aggregation and Governance Capture

Delegation services, institutional validators, and yield platforms can aggregate tokens and exercise voting power on behalf of depositors. Even if depositors do not directly intend to delegate governance rights, pooled structures create concentrated authority. This concentration increases systemic vulnerability because large actors can coordinate policy changes. The absence of lock periods reduces resistance to voting dominance.

Collusion, Vote Buying, and Governance Cartels

Liquid governance markets may enable cartel behavior. If tokens can move rapidly across accounts and platforms, participants can coordinate voting strategies, manipulate proposals, or execute short-term governance attacks. Financial incentives may create opportunities for vote-buying, automated delegation rotations, and collusion among large liquidity providers. Monitoring and transparency mechanisms are therefore essential to maintain trust in liquid governance models.

ALSO READ: Synthetic Assets on DPoS Chains: Expanding Token Utility Beyond Staking

Economic Models Behind Governance Liquidity

Liquid governance tokens introduce new economic behaviors in decentralized networks. Governance power becomes tied to liquidity cycles and trading dynamics. In traditional Delegated Proof of Stake models, governance strength is predictable because the stake remains locked. In liquid systems, price movements and leverage directly influence political control inside the protocol.

Price Discovery and Governance Power

Governance tokens with liquidity often experience price discovery through multiple venues. These include decentralized exchanges, lending systems, and automated market makers. When governance rights remain mobile, pricing pressure influences political power. If market sentiment increases demand for voting influence, the token price can rise. If liquidity declines, governance participation often follows suit. This creates a governance power cycle that mirrors speculative market patterns rather than long-term commitment.

Research on governance token pricing models suggests that liquidity increases volatility and may increase governance instability during stress periods (Cong, He, and Tang, 2022). Networks that rely on liquid governance systems must therefore design mechanisms that reduce price-driven governance shocks.

Factors Affecting Governance Token Pricing Power

| Factor | Description | Effect on Governance Power |

| Market sentiment | Emotional trading reactions | Sudden shifts in voting power |

| Liquidity depth | Size of exchange pools and lending access | Higher liquidity may centralize power in pools |

| Leverage availability | Ability to borrow governance tokens | Short term governance influence spikes |

| Collateral utility | Token used in lending or liquidity pools | Governance tied to financial position strength |

| Price volatility | Fast price swings in token markets | Governance stability risk during downturns |

Possible Mitigations and Protocol Level Solutions

Networks can adopt mechanisms that reduce governance concentration and support fair participation. Solutions must balance liquidity benefits with decentralization requirements. The objective is not to disable liquid governance tokens but to ensure that their influence does not compromise collective decision security.

Stake Decentralization Caps

Protocols may implement stake caps that limit governance weight for large pools. Decentralized autonomous organizations have already tested soft caps and threshold alerts to prevent dominance by single entities. Decentralization matrices can detect extreme voting power concentration and initiate automated governance controls. This type of design increases fairness in governance and prevents rapid centralization.

Delegation Transparency and Audit Layers

Transparent delegation systems help detect delegation clustering. Governance systems may require public disclosure of the distribution of delegations. A transparent audit layer can track governance participation and identify coordinated voting blocks. When visibility improves, collusion risk decreases. Academic studies in blockchain governance have emphasized transparency as a primary defense against cartel behavior.

Governance Decay and Anti-Concentration Models

Governance decay models reduce vote weight over time unless tokens remain committed to the governance process. Unlike forced lock periods, decay encourages steady participation without restricting capital. Other networks test multi-stage voting power, where long-horizon delegates receive a higher weight. This mix reduces speculative voting swings in liquid governance models.

ALSO READ: Cross-Chain DPoS Staking: How Delegates are Expanding to Multi-Chain Platforms

Future Outlook

Liquid governance tokens are likely to expand across decentralized finance networks. Institutional staking services, large liquidity pools, and delegated voting platforms will continue to increase participation. Liquidity improves market efficiency, but also increases exposure to governance capture and market-fueled decision swings.

Future networks may integrate hybrid governance, where liquid tokens participate alongside commitment-based stake systems. Researchers also predict that cross-chain governance effects will increase as networks interconnect (Scharnowski and Jahanshahloo, 2024). In multi-chain environments, liquid governance tokens can influence multiple networks simultaneously. Governance attacks could originate in one protocol and impact others through token bridges and liquidity pools.

Future regulation may also affect liquidity in governance. Authorities may examine whether liquid governance mechanisms create indirect ownership control similar to financial voting trusts in traditional finance. Networks must therefore evolve governance security in parallel with liquidity design.

Conclusion

Liquid governance tokens introduce liquidity into decentralized voting systems. This model supports greater participation and capital efficiency, but also increases exposure to governance concentration, price-driven voting swings, and coordinated pool influence. Delegated Proof of Stake networks and liquid staking platforms must consider these risks in governance design. Research and early market behavior indicate that transparency, anti-concentration measures, and hybrid models are necessary to protect long-term decentralization.

The core challenge remains constant. Liquidity enhances innovation, yet governance stability requires commitment and accountability. Successful design must balance both forces. Liquid governance tokens will play a major role in the future of decentralized finance, provided that networks adopt safeguards to ensure distributed control and resilient decision-making.

Frequently Asked Questions about Liquid Governance

What are liquid governance tokens?

Liquid governance tokens give voting rights in a blockchain network while staying transferable and usable in financial activities. They allow token holders to take part in decision-making without locking their assets for long periods. This creates liquidity and flexibility, but also introduces new risks in decentralized governance models.

How do liquid governance tokens differ from locked staking governance?

Locked staking governance requires participants to lock their tokens for a fixed time to receive voting power. This builds long-term commitment and network stability. Liquid governance tokens do not require lock periods. They stay liquid and can be traded, borrowed, or used in lending systems while still providing governance rights. This increases efficiency but reduces the security of commitment-based governance.

Why are liquid governance tokens important in DeFi

Liquid governance tokens allow capital efficiency in decentralized finance systems. They help users maintain governance influence while still using tokens in markets. This design improves participation, yield strategies, and liquidity. At the same time, it changes how voting power forms, moves, and concentrates across networks.

Do liquid governance tokens increase centralization risk

Yes, they can increase the risk of centralization. Because tokens remain liquid, large pools, custodians, and automated staking platforms can collect significant voting power. When power concentrates in a few actors, the network may face governance capture, collusion, and reduced decentralization.

Can liquid governance tokens cause governance attacks

Yes. Liquid governance tokens may enable temporary control of governance through borrowed voting power. Attackers may rent or borrow tokens, influence governance decisions, and exit positions after voting. This creates short-term governance manipulation risk, especially in systems without lock periods or anti-flash governance measures.