Rent-Seeking Behavior in DPoS: When Validators Extract Without Contributing

Rent-seeking is a big word, but the idea is very simple. It means getting rewards without really giving something useful back. In normal markets, people earn money because they make goods, offer services, or build something new. In rent-seeking, someone earns money just because of their position or control. They take value but do not add equal value in return.

- Understanding Delegated Proof of Stake (DPoS)

- How Validators Are Chosen

- Rewards and Incentives in DPoS

- Why DPoS Attracts Governance Issues

- What is Rent-Seeking Behavior?

- Market vs. Non-Market Decisions

- When Normal Rewards Become Rent-Seeking

- The Threshold of Decentralization

- Rent-Seeking in DPoS Validators

- Example 1: Zcash Founders’ Reward

- Example 2: SushiSwap Developer Fund

- Similar Risks in DPoS Validators

- Why Rent-Seeking Hurts DPoS Ecosystems

- Impact on Token Holders

- Impact on Network Growth

- Impact on Governance Quality

- The Shadow of Bootstrapping

- Bootstrapping in Zcash and Ripple

- Lessons for DPoS Chains

- Risks of Long-Term Centralized Control

- Detecting Rent-Seeking in DPoS

- Signs Communities Should Watch For

- Role of Transparency in Governance

- Forking as a Defense Against Extractive Actors

- Possible Fixes and Solutions

- Fair Launch Models

- Lock-Up Periods for Validator Rewards

- Community Funds and Grants with Oversight

- Role of Reputation in Validator Selection

- More Inclusive Voting Systems

- Incentives for Productive Contribution

- Conclusion

- Frequently Asked Questions About Rent-Seeking Behavior in DPoS

- What is rent-seeking in simple words?

- How do DPoS validators earn money?

- Why is rent-seeking bad for blockchain growth?

- Can rent-seeking be stopped fully?

- What are “fair launch” projects in crypto?

- Glossary of Key Terms

In the world of blockchain, this is a problem too. Many blockchains use something called Delegated Proof of Stake, also called DPoS. This system allows people called validators to check transactions and earn rewards. It is fast, and it uses less energy compared to mining in Proof of Work. But sometimes validators can find ways to get rewards even when they are not adding much to the system.

This type of behavior is what people call rent-seeking in DPoS. It makes users angry, hurts trust, and can slow down the growth of the network. This blog will explore what rent-seeking means, how it shows up in DPoS, and why it is risky for blockchain governance.

ALSO READ: Blockchain Governance Is Changing: Why DPoS Is Moving Toward DAOs

Understanding Delegated Proof of Stake (DPoS)

DPoS is one of the most popular systems for running a blockchain. It is different from the old mining system. Instead of letting thousands of computers compete, DPoS uses a small group of trusted members called validators. These validators are chosen by people who hold the blockchain’s tokens.

The idea looks simple. People who own tokens can vote for validators. The validators then confirm transactions and create new blocks. For their work, they earn rewards. These rewards may come as new tokens or transaction fees. The system moves fast because only a few validators are needed to check transactions.

This makes DPoS very popular for blockchains that need speed and low fees. Networks like EOS, Tron, and Steem use DPoS for these reasons. But the system also brings governance issues. Because only a few validators are in power, the system can be captured by groups or whales who hold many tokens. That is where rent-seeking can appear.

How Validators Are Chosen

Validators are picked through token voting. Each token holder can use their tokens to vote. The ones with more votes join the validator set. This is good because the system is democratic. But it can also lead to centralization when rich token holders control the outcome.

Rewards and Incentives in DPoS

Validators get paid in tokens. The reward keeps them motivated to run servers and secure the network. But if the reward system is not balanced, some validators may collect rewards without really doing useful work, which creates unfairness.

Why DPoS Attracts Governance Issues

The small group of validators makes very important decisions. If they only care about short-term profit, the whole system suffers. Token holders may lose trust, and the idea of decentralization weakens.

What is Rent-Seeking Behavior?

Rent-seeking behavior is when people or groups earn money without producing anything new. In economics, it is described as gaining rewards beyond what is fair in the market. For example, a person who owns land and collects high rent without improving it is seen as rent-seeking. They gain because of position, not because of contribution.

In blockchain, rent-seeking happens when validators or developers keep taking rewards without improving the network. They may use their power, influence, or control of tokens to keep earning even when their work is low or absent.

Researchers like Chris Berg (2021) explain that blockchain faces a tricky shift. At first, a blockchain may be run by a company like a start-up. Later, it moves to community control. During this shift, some people may use their early power to keep rewards. This is when normal rewards can become rent-seeking (Berg, 2021).

Market vs. Non-Market Decisions

In normal companies, decisions are made by the market. If you build something good, you get paid. But in decentralized systems, decisions are made by votes or governance rules. This is non-market decision-making. Rent-seeking often happens when people use these non-market rules to benefit themselves.

ALSO READ: DPoS Forks and Upgrades: How Protocol Evolution Really Works

When Normal Rewards Become Rent-Seeking

At the start, founders and validators need rewards. They are building the system. But once the blockchain is mature, rewards should match real work. If people still keep special rewards after this stage, then it looks like rent-seeking.

The Threshold of Decentralization

There is a moment when a blockchain becomes truly decentralized. Before that moment, rewards to founders and early validators can look normal. After that moment, the same rewards may look unfair. Knowing this threshold is hard, but it is key to judging rent-seeking.

| Feature | Productive Work | Rent-Seeking Work |

| Adds Value | Yes, builds or secures network | No, only extracts rewards |

| Fair Rewards | Based on work and risk | Beyond fair share |

| Effect on Growth | Helps network grow | Slows network progress |

| Example | Validator running reliable servers | Validator blocking changes to keep high rewards |

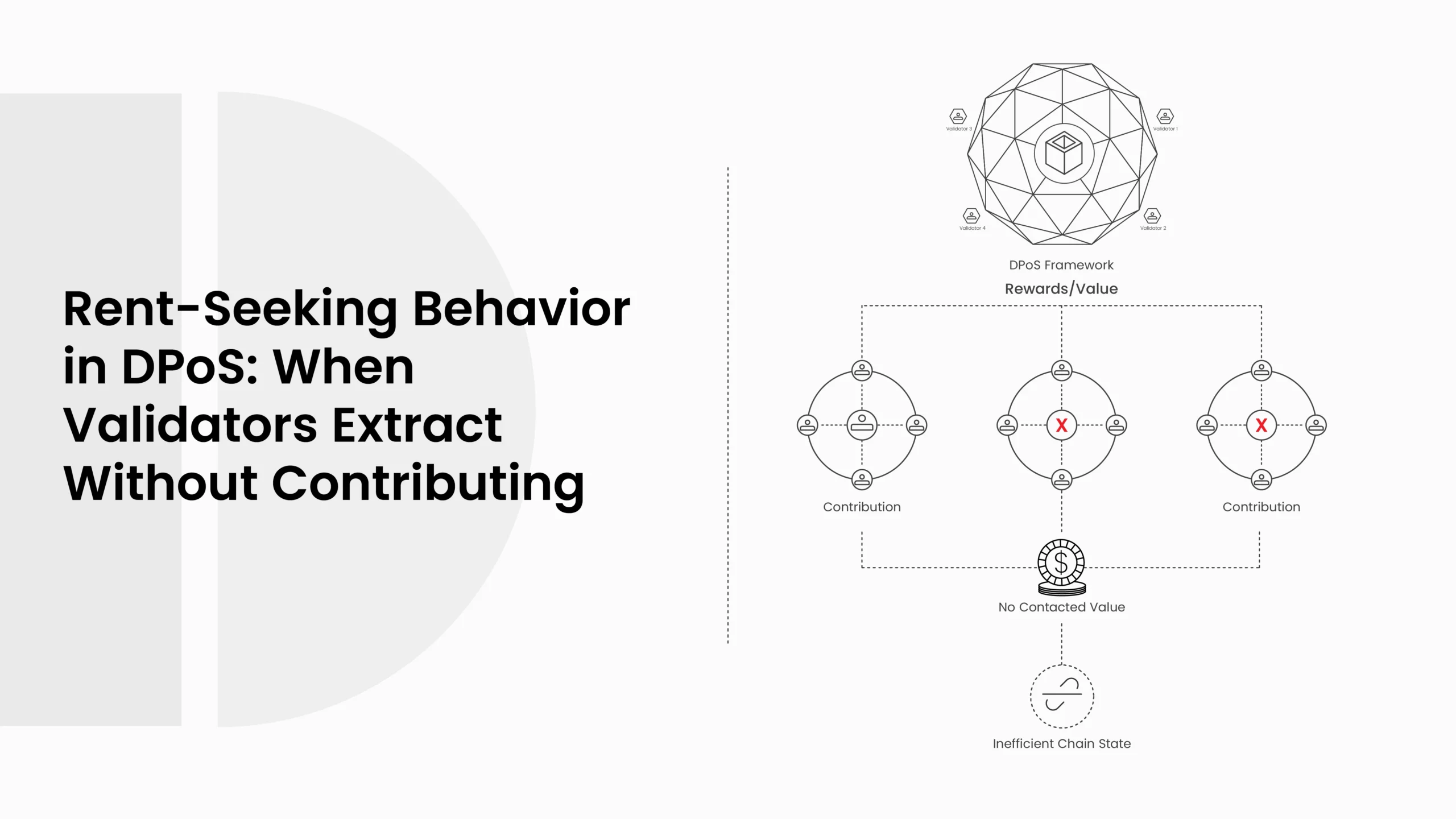

Rent-Seeking in DPoS Validators

Now, people focus on how this problem looks in Delegated Proof of Stake systems. Validators in DPoS have a lot of power. They are chosen by token holders, but once in, they can sometimes play games to keep their spot.

One common way is by forming alliances. Validators may vote for each other or offer rewards to token holders who support them. This vote-buying locks them in power. Even if they are not the best at running nodes, they stay in place because of deals and politics.

Another way is by blocking protocol upgrades. For example, if a change will reduce their earnings, validators may delay or reject it. They keep their short-term profit but hurt the long-term health of the network.

DPoS systems are also at risk when only a few validators control a large share of tokens. These validators can decide governance votes and direct rewards to themselves. The system starts to look less decentralized, and users may lose trust.

Example 1: Zcash Founders’ Reward

Zcash is not a DPoS chain, but its founders’ reward shows a rent-seeking style issue. A share of mining rewards went to founders for years. Many users saw this as unfair once the chain was running on its own. It shows how reward systems can create backlash (Berg, 2021).

Example 2: SushiSwap Developer Fund

SushiSwap had a developer fund, but its founder withdrew millions early. The community saw this as rent-seeking because it was money meant for the public good. Later, the founder returned the funds after criticism. This shows how easy it is to cross the line between fair reward and rent-seeking.

Similar Risks in DPoS Validators

In DPoS, validators can fall into the same trap. If they treat block rewards like a personal bonus while blocking fair governance, it becomes rent-seeking. The system may look decentralized, but power is still concentrated in a few hands.

| Validator Action | Why It Is Rent-Seeking | Effect on Network |

| Vote buying | Gains power without adding value | Less fair validator selection |

| Blocking upgrades | Protects income, not users | Slows growth and innovation |

| Concentrating tokens | Holds control without extra work | Centralization risk |

| Rewarding allies | Keeps friends in power | Loss of fairness in governance |

Why Rent-Seeking Hurts DPoS Ecosystems

Rent-seeking looks small at first, but it creates big problems for the whole system. When validators focus only on extracting value, the blockchain stops feeling fair. People who own tokens lose trust. Developers may walk away. And new users may avoid joining the network.

Impact on Token Holders

Token holders expect their votes to make the system better. But if validators use vote buying or deals, token holders feel cheated. Their tokens still give rewards, but governance power weakens. The feeling of “my vote does not matter” grows.

ALSO READ: The Future of Validator Nodes in DPoS: Hardware, Geography, and Centralization

Impact on Network Growth

Rent-seeking makes the chain slow. Upgrades that could improve speed, security, or fees may be blocked. Validators prefer keeping things the same if changes lower their profits. Over time, other chains that innovate faster become more attractive.

Impact on Governance Quality

Governance means rules for making decisions. In DPoS, governance is the heart of the system. But rent-seeking damages governance quality. Decisions are not made for the good of all but for a few. This makes the system look less decentralized and more like an old company.

| Area Affected | Result of Rent-Seeking | Long-Term Effect |

| Token Holders | Lose faith in votes | Less community participation |

| Network Growth | Upgrades blocked | Chain falls behind rivals |

| Governance | Power in a few hands | Centralization risk |

The Shadow of Bootstrapping

Every blockchain begins small. At first, it is run by a company or a small group. This early stage is called bootstrapping. During bootstrapping, rewards for founders and early validators look normal. They need income to pay costs and to build the network.

But the shadow of bootstrapping is long. If rewards for founders or early teams keep going after decentralization starts, the system looks unfair. People see it as rent-seeking.

Bootstrapping in Zcash and Ripple

For example, Zcash had a founders’ reward for the first years. Ripple created billions of tokens and held a large share for the company. These choices made sense early but created trust issues later. People asked, “Why are these insiders still earning so much?”

Lessons for DPoS Chains

DPoS chains must be careful. If too many tokens are locked with insiders, validators may hold power for years. Token holders may feel the system is closed. Even if the chain runs fast, it does not feel open or fair.

Risks of Long-Term Centralized Control

When early groups never let go of control, the chain can fail. Users may fork it or move to other platforms. The dream of decentralization breaks. This is why bootstrapping rewards must end at the right time, before they look like rent-seeking.

Detecting Rent-Seeking in DPoS

How can people see rent-seeking before it hurts too much? Communities must stay alert. Validators may not call it rent-seeking, but the signs are there.

Signs Communities Should Watch For

If the same validators stay in power too long without real work, it is a red flag. If upgrades are blocked again and again, it is another sign. Vote buying or hidden deals also show rent-seeking.

Role of Transparency in Governance

Open reporting helps. If validators share data about their work, uptime, and rewards, the community can judge fairness. Hidden or secret systems allow rent-seeking to grow in silence.

Forking as a Defense Against Extractive Actors

Blockchain has a special weapon: the fork. If people are unhappy, they can copy the code and make a new chain. This is costly, but it shows that communities will not accept unfair rent-seeking. Forking acts like an escape path when governance is broken.

| Warning Sign | Why It Matters | Possible Result |

| Same validators for years | Lack of competition | Centralization |

| Upgrades blocked often | Profit protection | Slower growth |

| Vote buying or deals | Power gained without value | Broken trust |

| Rewards too high for insiders | Looks unfair to users | Community may fork |

Possible Fixes and Solutions

Rent-seeking in DPoS cannot be fully removed, but it can be reduced. Good design, fair rules, and strong community action all help.

Fair Launch Models

A fair launch means no insiders get a special deal. Everyone has the same chance to join from the start. This limits early rent-seeking because no small group controls too many tokens. Many projects now use this model to build trust.

Lock-Up Periods for Validator Rewards

Some chains use lock-up rules. This means validators cannot sell all their rewards right away. Instead, they must wait months or years. This forces validators to care about long-term health, not just short-term profit.

ALSO READ: Learning from Failures: Post-Mortems of Abandoned DPoS Projects

Community Funds and Grants with Oversight

A community fund can pay developers and validators for useful work. But the fund must be transparent. Rules about how money is spent should be public. Oversight by multiple members makes sure nobody is unfairly treated.

Role of Reputation in Validator Selection

Reputation matters. Validators who help the network should get more votes. Those who only chase profit should lose votes. Public ranking lists or review boards can help token holders choose better validators.

More Inclusive Voting Systems

If only whales (big token holders) decide, rent-seeking grows. Voting systems can give more voice to small holders. Some chains test quadratic voting or capped votes to make decisions more balanced.

Incentives for Productive Contribution

Rewards should go to those who add value. For example, validators who keep servers online, support upgrades, or educate the community should earn more. This creates a culture where contribution is respected more than extraction.

Conclusion

Rent-seeking is not just an old economic problem. It is alive inside blockchain, too. In Delegated Proof of Stake, validators sometimes find ways to take rewards without adding real value. This hurts fairness, slows upgrades, and makes users lose trust.

The shadow of bootstrapping shows how early design choices can last for years. If rewards keep flowing to insiders after decentralization, the system looks unfair. Communities must watch closely, demand transparency, and use tools like forks when needed.

Fixes like fair launches, lock-ups, and community funds make a difference. Better voting rules and reputation systems also help. In the end, rent-seeking in DPoS is about human choices. If communities want real decentralization, they must guard against validators who extract without giving back.

Frequently Asked Questions About Rent-Seeking Behavior in DPoS

What is rent-seeking in simple words?

Rent-seeking means earning money without creating anything new. In blockchain, it happens when validators or insiders take rewards without improving the network.

How do DPoS validators earn money?

Validators in DPoS confirm transactions and create blocks. They get paid in tokens or fees. These rewards keep them motivated to secure the chain.

Why is rent-seeking bad for blockchain growth?

It reduces trust, slows upgrades, and makes the system look unfair. New users may leave and the network can fall behind other blockchains.

Can rent-seeking be stopped fully?

Probably not fully. But with good design and strong community rules, it can be reduced. Transparency, oversight, and fair reward systems help a lot.

What are “fair launch” projects in crypto?

Fair launch projects start with no pre-mined tokens or insider rewards. Everyone gets the same chance to join from day one. This lowers the risk of rent-seeking later.

Glossary of Key Terms

Blockchain

A digital ledger where transactions are stored and shared across many computers.

Delegated Proof of Stake (DPoS)

A system where token holders vote for a small group of validators who confirm transactions and earn rewards.

Validator

A person or group running a server in a blockchain. Validators check transactions and add new blocks to the chain.

Token Holder

Someone who owns the blockchain’s tokens. Token holders can vote for validators and sometimes help make decisions.

Rent-Seeking

Earning money without creating new value. In blockchain, this happens when validators or insiders collect rewards without real work.

Bootstrapping

The early stage of a blockchain, when it is still controlled by a small team or company, is before it becomes fully decentralized.

Fork

When a blockchain splits into two separate versions. This can happen if communities disagree on rules or governance.

Fair Launch

A way of starting a blockchain where everyone has the same chance to get tokens, with no special rewards for insiders.

Governance

The process of making decisions about how a blockchain works, usually done through voting or rules written in code.