The Economics of DPoS: How Token Inflation and Distribution Shape Blockchain Governance

In blockchain systems, economics is just as important as technology. One of the most interesting models in the crypto space today is the Delegated Proof of Stake (DPoS) consensus mechanism. While DPoS is known for being fast and energy-efficient, it also introduces unique economic patterns. These include how tokens are created (inflation), who receives them (distribution), and how they influence participation and governance.

- What Is DPoS and Why Economics Matter

- How Token Inflation Works in DPoS

- Token Distribution and Incentive Models

- Real-World Token Models in DPoS Projects

- Comparative Token Inflation Models in DPoS Projects

- Risks and Economic Pitfalls

- The Future of Token Economics in DPoS

- Final Thoughts

- Frequently Asked Questions About The Economics of DPoS

- What does token inflation mean in DPoS?

- How are rewards distributed in DPoS systems?

- Why is token distribution important for DPoS?

- What are the risks of poorly managed tokenomics in DPoS?

- How do different blockchains manage DPoS tokenomics?

- What does the future of DPoS economics look like?

- Glossary of Key Terms

The economics of DPoS are vital to the person who invests in or contributes to the work of blockchain projects. How does this system operate, and what does it imply for the end-users? Let us have a look at it.

ALSO READ: What are Block Producers in DPoS? An Ultimate Guide to their Roles and Incentives

What Is DPoS and Why Economics Matter

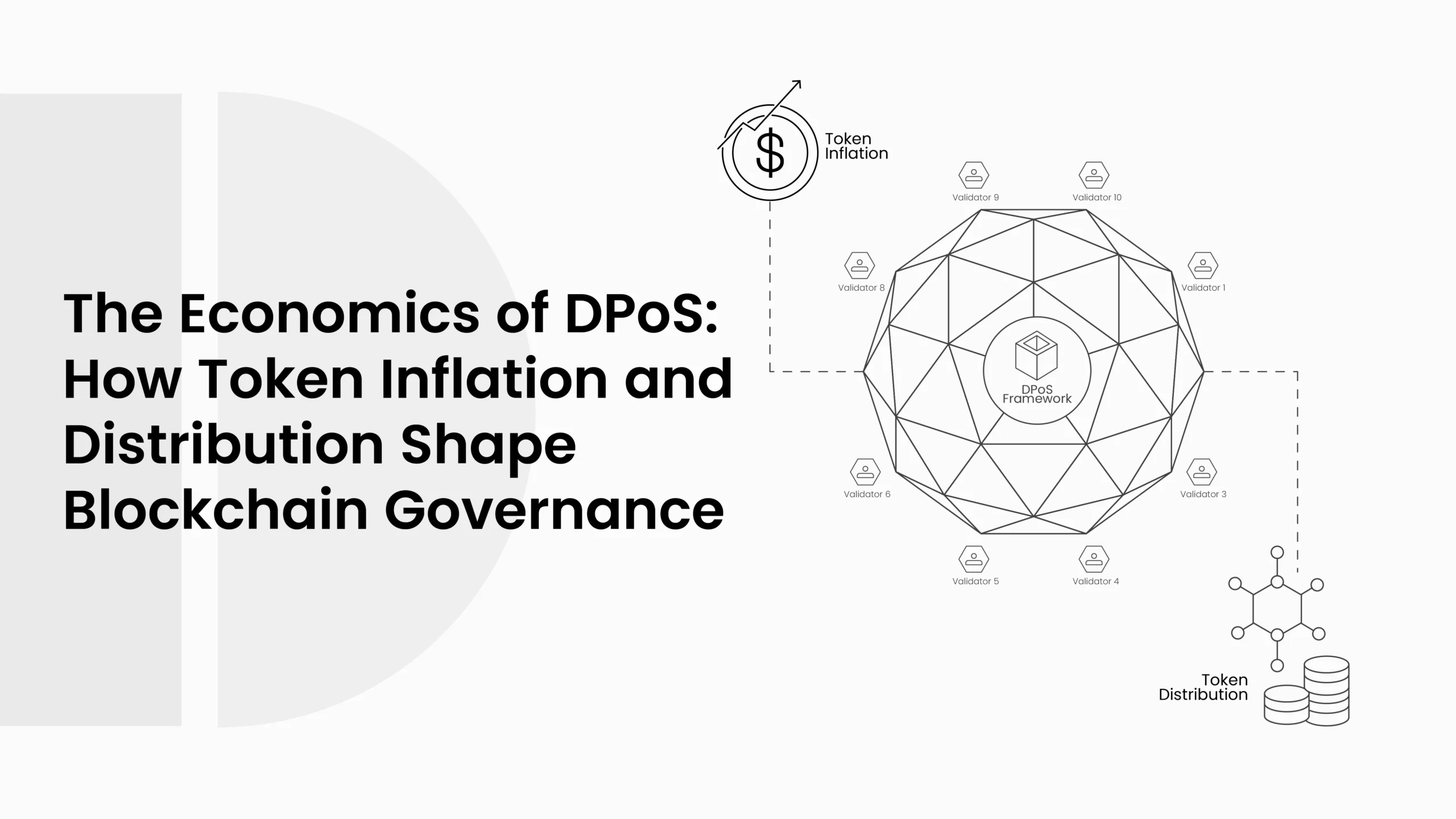

DPoS is a form of consensus algorithm. It implies that it is a set of regulations that serve to reach an agreement on the part of blockchain nodes regarding transactions. DPoS also differs from traditional Proof of Work (PoW), whose mechanism is based on computational mining, as it makes use of voting. The token owners cast a vote to select a handful of the trusted block producers, and between them, they validate a new block by generation.

This pattern leads to rapid finality, minimal energy consumption, and the potential for high transaction throughput. However, people cannot leave such block producers unmotivated, which is why they are to be rewarded. This is where tokenomics comes into effect.

According to research published in Applied Economics Letters, the structure of token rewards in DPoS systems can have a measurable effect on both network participation and token valuation. Too much inflation reduces value over time, while poorly managed distribution can centralise power in the hands of a few actors (Ciacci et al., 2024).

How Token Inflation Works in DPoS

In DPoS blockchains, new tokens are typically introduced through inflationary models. That means more tokens are added to the circulating supply over time. These tokens are usually distributed as rewards to:

- Block producers (for validating and producing blocks)

- Voters or delegators (to encourage participation)

- Community or development funds (to support ongoing growth)

In contrast to deflationary systems, such as those where everybody relies on lighting, although there are certain aspects to this, such as Bitcoin, in which the limit of the sum that can be produced is set. In DPoS systems, inflation will be used to maintain participation, particularly where transaction fees are low and do not cover network costs.

However, the inflation will be strictly controlled. In the case of very high rates of creating new tokens, the tokens can end up deflated, which will hinder a long-term holder. Conversely, under-inflation can imply a situation whereby they have lacked enough inducement towards the producers or the voters to join.

ALSO READ: How to Choose the Right Delegate or Validator in a DPoS System

To stay within this balance, DPoS projects such as EOS and Lisk have changed their inflation rates numerous times. Everyone is trying to settle this balance between network security and economic sustainability all the time.

Token Distribution and Incentive Models

One of the main goals of DPoS tokenomics is to incentivise decentralised participation. The idea is to get more users involved in securing and governing the blockchain.

When a user votes for a block producer, they often share in the rewards that the producer earns. This system aligns incentives, producers want more votes, and voters want a return. It’s a delegate voting system with real economic consequences.

The catch? It can lead to centralisation, where only a few producers dominate the voting landscape. As Ciacci et al. point out, this often happens when major token holders form coalitions or vote for each other to maintain control (Ciacci et al., 2024). That creates potential risks for both governance and fair distribution.

To counter this, some DPoS systems introduce slashing penalties or randomized producer schedules to ensure fairness. Others cap the number of votes a single wallet can cast to prevent monopolies.

Still, the economic foundation remains: those who contribute to the network should be rewarded. And those rewards must be fair, transparent, and sustainable.

Real-World Token Models in DPoS Projects

EOS initially launched with a 5% annual inflation rate. Of that, 1% went to block producers, while 4% was directed toward a savings fund. However, due to community pushback, the 4% fund was eventually removed. Today, block producers are still rewarded with new tokens, but the inflation rate has been adjusted to reduce excess supply.

ARK, another DPoS project, offers a fixed block reward that gradually declines over time. This creates predictable incentives while reducing long-term inflation. TRON, which also uses DPoS, ties its reward system to bandwidth and energy metrics, further blending performance and token economics. TRON’s focus on throughput (TPS) requires fast decision-making, which means its token model must support high-speed, low-cost consensus.

According to Rapid Innovation’s 2024 guide on tokenomics, balancing fixed rewards, dynamic inflation, and performance-based incentives is essential for maintaining network health and user engagement.

Comparative Token Inflation Models in DPoS Projects

Different Delegated Proof of Stake (DPoS) blockchains have approached token inflation and reward distribution in their own ways. Each model reflects an attempt to balance security, decentralization, and economic sustainability. A side-by-side look shows how strategies vary across major networks.

| Blockchain | Inflation Rate / Model | Reward Distribution | Key Economic Feature | Risks / Concerns |

| EOS | Started with 5% yearly (later reduced) | 1% to block producers, remainder to community fund (removed later) | Flexible inflation, adjusted by governance | Risk of centralization among top producers |

| ARK | Fixed block rewards, declining over time | Paid to block producers, who share with voters | Predictable, declining inflation curve | May reduce incentives for future voters |

| TRON | Dynamic, tied to bandwidth & energy metrics | Super Representatives (SRs) earn rewards, share with delegators | Rewards linked to performance & throughput | Vote-buying concerns, competition among SRs |

| Lisk | Gradual reduction of block rewards | Shared between delegates & their voters | Long-term sustainability through decreasing inflation | Smaller delegates may be priced out |

| Tezos | Ongoing issuance (about 5% annually) | Bakers (validators) earn inflation & transaction fees | Strong participation incentives for stakers | Token dilution risk if participation is low |

This table highlights that there is no one-size-fits-all model in DPoS. Projects like EOS emphasize governance flexibility, while ARK prefers predictability, and TRON blends performance with economics. Each approach trades off between fair distribution, voter participation, and long-term sustainability.

ALSO READ: Staking in DPoS Networks: Know All About Risks, Rewards, and ROI

Risks and Economic Pitfalls

Despite its benefits, the economic model of DPoS isn’t perfect. There are several known risks:

- Token Hoarding: If a small group holds most of the tokens, they can control voting and dominate block production.

- Low Voter Turnout: Many token holders don’t vote, leading to skewed representation.

- Reward Farming: Some producers offer high kickbacks to voters, which may prioritise profit over performance or ethics.

- Inflation Drag: If inflation outpaces demand, token value can decline, hurting all stakeholders.

All of these risks are tied to the underlying economic system. They show why efficient consensus models must include both technical speed and thoughtful token design.

The Applied Economics Letters study concludes that poorly managed inflation in delegated systems can actually discourage decentralisation and hurt token utility over time (Ciacci et al., 2024). It’s a strong reminder that tokenomics isn’t just about making money; it’s about protecting the integrity of the network.

The Future of Token Economics in DPoS

As more blockchains move toward scalable governance models, DPoS continues to be an appealing option. Its fast finality, reduced energy consumption, and community participation give it strong advantages. But the key to its future lies in better economic frameworks. Token inflation must be tied to real network needs. Voter incentives must reward long-term contributions, not just short-term gains. And transparency must be at the core of distribution models.

Certain new DPoS chains even consider exploring a dual-token model and a dynamic reward model, and voting-based vesting to enhance participant-network alignment. Eventually, such innovations may extend the DPoS way past what it is today, resulting in economic stability as well as technically proficient ecosystems.

ALSO READ: DPoS in Action: How EOS, TRON, and BitShares Implement It Differently

Final Thoughts

DPoS brings a fresh take on blockchain consensus. It replaces raw computing power with democratic governance, offering faster and greener blockchains. But with this shift comes a new responsibility: to design tokenomics that are fair, efficient, and scalable.

Distributions and inflation in the DPoS systems are not incidental parts; they are core to the way trust, value, and participation are constructed. You could be a developer, a stakeholder, or even a voter; it is necessary to be conversant with these mechanics in this blockchain world so as to make wise decisions. Because in DPoS, the economics are just as important as the code.

Frequently Asked Questions About The Economics of DPoS

What does token inflation mean in DPoS?

Token inflation in DPoS refers to the creation of new tokens that are added into circulation, usually as rewards for block producers, voters, or community development funds.

How are rewards distributed in DPoS systems?

Rewards are typically shared among block producers for validating blocks, delegators who vote for them, and sometimes community funds that support ecosystem growth.

Why is token distribution important for DPoS?

Fair distribution prevents centralization, encourages more people to participate in voting, and ensures the network remains democratic and secure.

What are the risks of poorly managed tokenomics in DPoS?

Risks include token hoarding by large stakeholders, low voter turnout, inflation drag on value, and reward farming that favors short-term gains over network security.

How do different blockchains manage DPoS tokenomics?

Projects like EOS adjust inflation rates over time, ARK uses declining block rewards, and TRON ties rewards to bandwidth and energy metrics. Each aims to balance incentives with sustainability.

What does the future of DPoS economics look like?

Future models may use dual-token systems, dynamic inflation rates, or vesting mechanisms to align incentives between producers, voters, and developers.

Glossary of Key Terms

- DPoS (Delegated Proof of Stake): A consensus mechanism where token holders vote for a limited set of delegates (block producers) to validate transactions.

- Block Producer: An elected participant responsible for creating new blocks, verifying transactions, and maintaining network stability.

- Inflation (Token Inflation): The controlled issuance of new tokens into circulation, often used as rewards.

- Distribution: How newly created tokens are allocated among producers, voters, and community funds.

- Delegator (Voter): A token holder who votes for block producers and may share in their rewards.

- Slashing: A penalty applied when a block producer misbehaves or fails to perform duties.

- Reward Farming: A practice where producers offer high payouts to attract votes, sometimes at the expense of network health.

- Inflation Drag: A reduction in token value caused when supply growth outpaces demand.