What is the Role of Dynamic Inflation in Long-Term DPoS Stability?

Delegated Proof of Stake (DPoS) is one of the most popular consensus mechanisms in blockchain today. It is used to keep a network secure and ensure that transactions are confirmed on time. Instead of letting everyone compete with computers, as in Bitcoin, DPoS allows people to vote for a small group of trusted nodes, also called delegates, who create blocks. These delegates receive rewards for their work, and those rewards often stem from a phenomenon known as inflation.

- What Is DPoS and Why Inflation Matters?

- How DPoS Works

- Inflation in Blockchain

- Why Stability Is Important

- Understanding Dynamic Inflation in DPoS

- Fixed vs. Dynamic Inflation

- How Dynamic Inflation Works

- Benefits for Token Holders

- Lessons from Global Inflation (Connecting to Real-World Economics)

- What Global Economics Teaches Us

- Similarities in Blockchain

- Global Inflation Shocks vs. Blockchain Inflation Shocks

- How Dynamic Inflation Supports Long-Term DPoS Stability

- Encouraging Active Participation

- Managing Token Value Over Time

- Case Comparison: Fixed vs. Dynamic Projects

- Keeping the System Fair

- Risks and Challenges of Dynamic Inflation in DPoS

- Governance Risks

- Technical Complexity

- Market Risks

- Challenges of Dynamic Inflation

- Future Outlook: Dynamic Inflation as a Policy Tool in DPoS

- Learning From Central Banks

- Building Trust in DPoS

- Central Bank Policy vs. DPoS Dynamic Inflation Policy

- Implementation Roadmap

- Conclusion

- Frequently Asked Questions About the Role of Dynamic Inflation

- What is dynamic inflation in a DPoS blockchain?

- Why does DPoS need inflation at all?

- How does dynamic inflation protect token value?

- Can people compare blockchain inflation to real-world inflation?

- What are the main risks of dynamic inflation?

- Does dynamic inflation make DPoS more decentralized?

- Glossary of Key Terms

In simple terms, inflation in blockchain refers to the creation of new tokens to compensate those who secure the network. Just like central banks in the real world print money, a blockchain system can also add more coins over time. If this is done in a fixed manner, inflation may become a long-term problem. Too much inflation reduces the value of tokens, but too little inflation can deter people from participating. This is where dynamic inflation comes in.

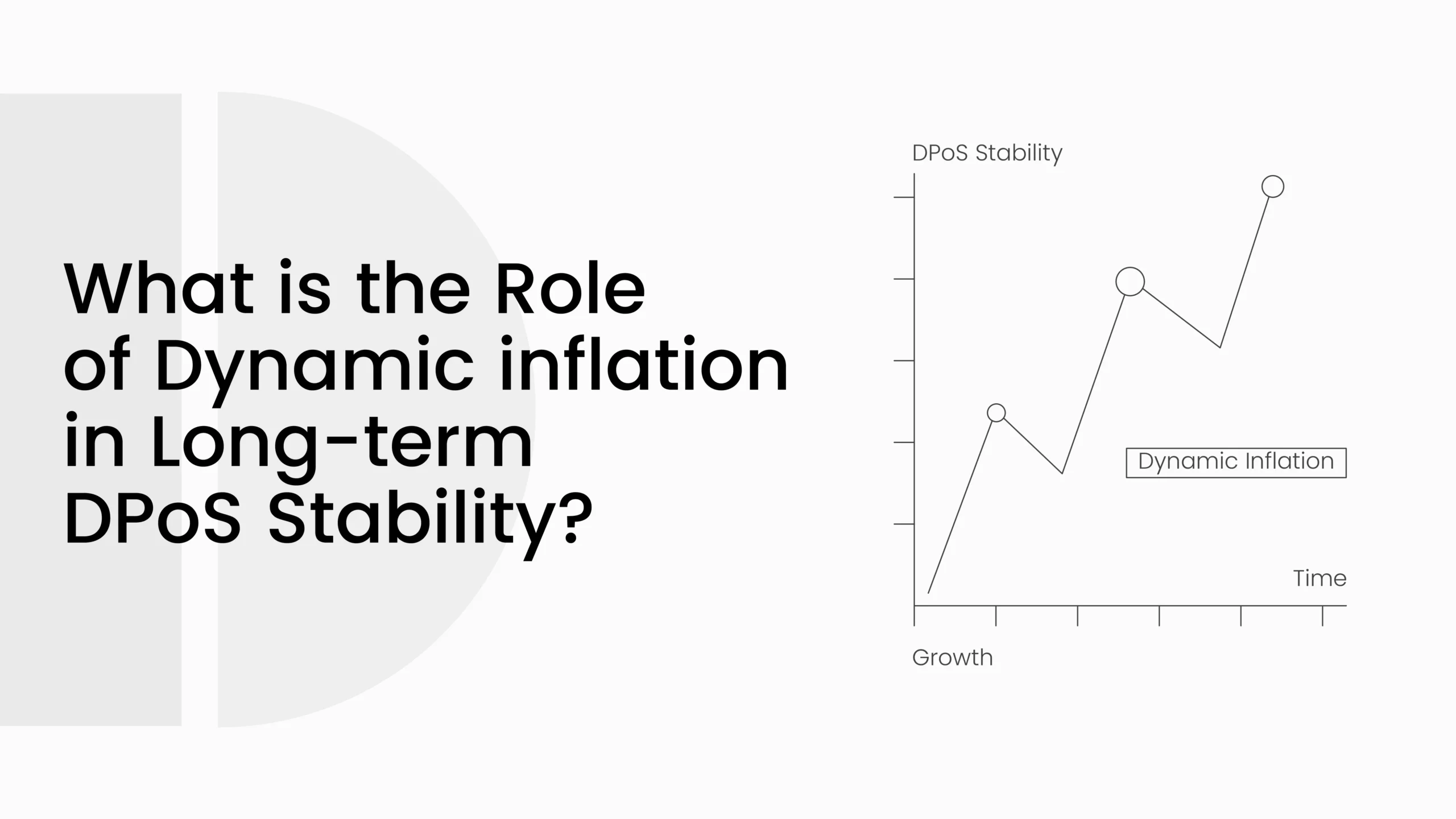

Dynamic inflation refers to the system adjusting the reward rate in response to events within the network. It is not fixed. It can fluctuate depending on the number of people staking or the level of security required. This approach makes DPoS more stable because it adapts to real-world conditions instead of remaining static.

What Is DPoS and Why Inflation Matters?

How DPoS Works

Delegated Proof of Stake, or DPoS, is a system where token holders can vote for a smaller group of block producers. These block producers, delegates, or validators check the transactions and ensure the blockchain’s operation. They are rewarded in exchange for their labour. In contrast to Proof of Work, which requires powerful devices and energy consumption, DPoS relies rather on the voting/staking of a community. This makes it cheaper, quicker, and more readily scalable.

Every time a delegate adds a new block, they earn a certain number of tokens. But those tokens need to come from somewhere. In many cases, they come from newly created coins. This is where inflation enters the system. Without inflation, there may not be sufficient rewards to motivate delegates to perform their duties effectively.

ALSO READ: Can DPoS Solve High-Frequency Trading Bottlenecks on Blockchain?

Inflation in Blockchain

In blockchain, inflation refers to the addition of new coins to the supply over time. This is similar to how governments or central banks print more money in the real world. Some blockchains set a fixed inflation rate, like 5% per year. Others try more flexible methods.

The problem with fixed inflation is that it fails to respond to market conditions. If too many coins are created, the value of the token may drop. If too few are created, then delegates or voters may not feel it is worth their time to participate. This creates risks for both security and token price stability.

Why Stability Is Important

Decentralization of a blockchain system means that individuals are secure in holding and using the token. When rewards are too high, inflation erodes them, and users may opt for a quick sale. If the rewards are insufficient, the delegates may lower their incentives, and the network can become less secure.

Dynamic inflation is a solution to this issue, as it varies rates in response to changing conditions. For instance, when numerous tokens are held in reserve, the inflation rate may be reduced. If fewer tokens are staked, the rate could be increased to encourage more people to join. This balance keeps both token holders and delegates engaged, creating a stronger foundation for long-term stability.

Understanding Dynamic Inflation in DPoS

Fixed vs. Dynamic Inflation

Most blockchain projects start by setting a fixed inflation rate. This might be 5% or 10% each year, no matter what is happening in the network. While this is simple, it can create problems later. For example, if the user base grows rapidly, fixed inflation may create too many tokens and drive prices down. If adoption is slower, the rewards may not be enough to keep delegates interested.

Dynamic inflation, on the other hand, is more flexible. The inflation rate changes depending on conditions in the network. If more tokens are locked in staking, the system may lower the rate. If fewer people are staking, the system can increase it to encourage more activity. This way, the system finds a natural balance.

Here is a simple comparison:

| Feature | Fixed Inflation | Dynamic Inflation |

| Reward System | Same every year | Changes with network conditions |

| Risk to Token Value | Higher risk of devaluation | Lower risk, adjusts over time |

| Security Incentives | Can weaken if the value falls | Keeps delegates motivated |

| Flexibility | None | High |

| Long-Term Stability | Often weaker | Stronger and more adaptive |

How Dynamic Inflation Works

Dynamic inflation is usually managed by an algorithm built into the blockchain. It can use data like:

- How many tokens are staked.

- The total supply of tokens.

- The level of participation in governance.

For example, if only 30% of the total supply is staked, the system may raise inflation to motivate more staking. If 80% is staked, inflation may decrease, preventing rewards from overheating the blockchain’s economy.

This approach ensures that rewards remain fair and useful. Delegates continue to work because they are paid, and token holders feel more confident because inflation does not spiral out of control.

ALSO READ: How DPoS Can Reshape Mobility Governance with Mobility-as-a-Service (MaaS)?

Benefits for Token Holders

Dynamic inflation is not just good for validators. It also helps people who hold tokens for the long term. When inflation is controlled, tokens keep more of their value. This creates trust in the system.

Another benefit is that token holders who stake or delegate their votes continue to earn rewards. They are not left out. This keeps the community engaged, which is the heart of any DPoS system.

In short, dynamic inflation ensures that both sides, delegates and token holders, remain aligned. It creates balance, and balance is the key to maintaining a blockchain’s health for years to come.

Lessons from Global Inflation (Connecting to Real-World Economics)

What Global Economics Teaches Us

Inflation is not just a blockchain issue. It is a global issue that governments and central banks frequently address. For example, the International Monetary Fund (IMF) has examined how global food prices, oil shocks, and supply chain disruptions create persistent inflationary pressures in real economies (Tiedemann, Bizimana, Dalmau, & Ambassa, 2024). These shocks do not disappear quickly. Even if they are called “temporary,” their effects can last for months or even years.

One clear lesson is that inflation is often persistent. When food or energy costs rise, households and businesses adjust slowly. Wages may rise, shipping costs may increase, and the effects spread across many sectors. The IMF notes that this persistence makes it harder for policymakers to bring inflation back down to target levels.

Similarities in Blockchain

Blockchain networks face a similar challenge. A big price shock in the crypto market, such as a crash or a sudden surge in demand, can create systemic problems. If inflation is fixed, the system cannot adjust to changing market conditions. However, if inflation is dynamic, the blockchain can respond by adjusting reward rates in real-time.

For example, if staking participation drops during a bear market, a dynamic system could increase rewards to encourage people to return. If too many people stake during a bull run, the system could reduce rewards to prevent flooding the market with new tokens. This mirrors how central banks adjust interest rates to maintain economic stability.

Global Inflation Shocks vs. Blockchain Inflation Shocks

| Type of Shock | Effect in the World Economy | Effect in Blockchain Network |

| Food Price Spike | Higher cost of living, wage pressure, inflation surge | Token value drops if inflation is fixed |

| Oil or Energy Price Shock | Transport and production costs increase | Validator costs rise, rewards may not be enough |

| Supply Chain Disruption | Slower trade, higher global shipping prices | Delayed network upgrades, lower participation |

| Market Demand Crash | Central banks lower rates to support growth | Dynamic inflation increases rewards to boost staking |

| Market Overheating | Central banks tighten policy to cool inflation | Dynamic inflation lowers rewards to prevent flooding |

By comparing global inflation with blockchain token economies, it becomes clear that flexible systems work better. Just like governments cannot ignore global commodity shocks, DPoS networks cannot ignore shifts in staking or token value. Dynamic inflation provides blockchain networks with a means to behave more like real economies, albeit with faster, algorithm-driven responses.

How Dynamic Inflation Supports Long-Term DPoS Stability

Encouraging Active Participation

One of the key strengths of DPoS is its emphasis on community participation. People must stake their tokens and vote for delegates to maintain a fair and decentralized system. But if rewards are too small, many users will stop staking. On the other hand, if rewards are too big and inflation is high, the token loses value, and long-term holders lose trust.

Dynamic inflation solves this by keeping rewards attractive but not excessive. When more people stake, the system reduces inflation, so rewards stay balanced. When fewer people stake, inflation rises slightly, encouraging more people to join again. This balance helps prevent sudden drops in participation and maintains network security.

Managing Token Value Over Time

Token value is closely tied to trust. If investors think too many tokens are being created, they may panic and sell. But if they see that the system adapts, they feel safer. Dynamic inflation keeps supply under control by making adjustments instead of letting inflation run wild. This helps protect long-term token holders and gives confidence to new users.

A blockchain is only as strong as its economy. If the token’s value collapses, the entire system becomes vulnerable. By managing inflation carefully, DPoS can avoid sharp devaluation and instead grow in a steady and healthy manner.

Case Comparison: Fixed vs. Dynamic Projects

| Blockchain Project | Inflation Model | Long-Term Effect on Stability | Participation Level | Token Value Impact |

| Project A (Fixed) | 5% yearly fixed rate | Rewards become too high when the user base shrinks | Drops during bear markets | Token devalues slowly over time |

| Project B (Dynamic) | Adjusts by staking % | Rewards change to match network conditions | More stable across cycles | Value protected from rapid inflation |

This comparison illustrates why dynamic inflation is gaining popularity. Projects with fixed inflation may look simple at first, but they struggle during market changes. Dynamic inflation provides DPoS networks with the tools to remain resilient, even when conditions shift.

ALSO READ: How Decentralized Social Media Could Use DPoS for Content Moderation

Keeping the System Fair

Another important role of dynamic inflation is fairness. In DPoS, both delegates and token holders want to benefit. If one side gains too much, the other side may leave. Dynamic inflation prevents this imbalance. Rewards are shared fairly, and the system stays attractive for everyone involved.

Risks and Challenges of Dynamic Inflation in DPoS

Governance Risks

Dynamic inflation sounds good in theory, but it depends on governance. In DPoS, delegates and token holders must agree on the rules that decide how inflation changes. If the rules are too loose, powerful delegates could adjust inflation in their favor. For instance, they can cast their votes in favor of higher rewards that are favorable to them in the short term, albeit at the expense of the system’s long-term stability.

This poses a problem: there must be clear regulations in the system that everyone can trust. As in the real world of economies, where central banks are guided by strict rules, DPoS networks require explicit policies. In their absence, confidence may diminish among users, and participation will reduce.

Technical Complexity

Another risk is technical complexity. Building a system that can automatically adjust for inflation is not simple. It requires robust algorithms that accurately measure network conditions. For example, the system must know how many tokens are staked, how secure the network is, and how active governance has been. If the algorithm makes mistakes or reacts too slowly, inflation adjustments may cause more harm than good.

That is why testing and simulations are essential before launching dynamic inflation on a live blockchain. With the algorithm, developers must be prepared to handle unusual conditions, such as market crashes or large withdrawals of stakes, which may cause the algorithm to malfunction.

Market Risks

Even if the system works perfectly, market psychology is another challenge. New investors may not fully understand why inflation fluctuates. They may panic if they see rewards fall, not realizing that lower inflation is a sign of stability. Others may pursue higher rewards without considering the long-term sustainability.

This means communication is key. DPoS projects must explain dynamic inflation in simple terms to the community. If people understand how it works, they are less likely to misinterpret changes and more likely to stay engaged in the system.

Challenges of Dynamic Inflation

| Risk Type | Example Problem | Impact on DPoS Network |

| Governance Risk | Delegates push for higher rewards | Loss of fairness, centralization of power |

| Technical Risk | Algorithm misreads staking levels | Wrong inflation adjustments, instability |

| Market Risk | Users panic when inflation changes | Lower trust, reduced staking participation |

These risks indicate that dynamic inflation is not a panacea. It needs strong governance, solid technology, and clear communication with the community. Only then can it deliver the stability it promises.

Future Outlook: Dynamic Inflation as a Policy Tool in DPoS

Learning From Central Banks

In the real world, central banks monitor prices, employment, and economic growth. They try to keep inflation steady so people can plan for the future. When inflation is rising, they tighten policy. When growth is weak, they ease policy. Research indicates that supply shocks, such as those in energy or food, can persistently push inflation higher for an extended period, making it challenging to bring it back down quickly (Cecchetti & Moessner, 2008; Ha, Kose, & Ohnsorge, 2019). This lesson also matters for blockchain. A token economy also needs stable rules so users and builders can plan with confidence.

A DPoS network can incorporate the beneficial aspects of this idea, but implement them on-chain with code. It can watch simple and clear metrics such as staking ratio, validator uptime, and participation in governance. Then it can adjust the inflation rate incrementally rather than making sudden changes. This avoids big shocks. It also helps the network respond if the market mood changes. When the system reacts slowly and clearly, users trust it more. That trust becomes long-term stability.

Building Trust in DPoS

Trust grows when the rules are clear and consistently applied. A strong, dynamic inflation policy should be transparent and accessible to all. The community should be aware of exactly what triggers an increase or decrease. When staking falls below a healthy level, the system can increase rewards slightly. When staking rises above a healthy level, the system can reduce rewards slightly. The change is small but steady. This soft touch keeps the economy from overheating. It also prevents rewards from collapsing in weak markets. The result is a calmer token price and a safer network over time.

Studies on global inflation also indicate that shocks often persist longer than people anticipate, particularly when food, energy, and shipping costs are involved. In the crypto world, there have been similar long waves following a major market event. Dynamic inflation gives the network the tools to ride out those waves with less stress.

ALSO READ: Breaking Barriers: Why DPoS Could Be the Future of Borderless Credit and Microfinance

Central Bank Policy vs. DPoS Dynamic Inflation Policy

| Policy Area | Central Bank Approach | DPoS Dynamic Inflation Approach |

| Goal | Price stability and growth | Network security and token value stability |

| Inputs Watched | Inflation, jobs, output, and financial conditions | Staking ratio, validator performance, participation |

| Tools | Interest rates, asset purchases, guidance | Inflation rate bands, reward curves, and on-chain rules |

| Response Style | Gradual, data-driven, forward-looking | Gradual, rule-driven, block-by-block adjustments |

| Transparency | Regular reports and minutes | Open-source code, dashboards, and scheduled parameter votes |

| Risk Management | Scenario analysis and stress tests | Testnets, simulations, capped change per epoch |

Implementation Roadmap

First, the network agrees on targets, like a healthy staking range (for example, 60 to 70 percent). Second, it sets a base inflation and a small step size. Third, it defines caps on how much inflation can change per epoch. Fourth, it launches with clear dashboards so everyone can see the same numbers. Finally, it reviews the results after a few months and adjusts the parameters as needed. Simple rules. Slow changes. Open data. That is the core of a good policy.

Conclusion

Inflation in blockchain is not the enemy. It is a tool. In Delegated Proof of Stake, inflation rewards the individuals who maintain the network’s security. The problem arises when inflation is fixed and cannot adjust. Then, either the rewards are too high and the token value slips, or the rewards are too low and security drops because people stop staking.

Dynamic inflation offers a better path. It changes rewards based on real conditions. When staking is low, it helps bring people back. When staking is high, it cools the system down. This steady balance protects long-term holders, keeps validators engaged, and supports a stable token economy.

Real-world research indicates that inflation shocks can be persistent and last for an extended period. Central banks address this issue using clear rules and gradual adjustments. A DPoS network can do the same thing, but faster and on-chain. With simple metrics, clear ranges, and capped adjustments, dynamic inflation can support long-term DPoS stability in a calm and predictable manner. If the community builds it with care, this policy becomes a foundation for growth, security, and trust.

Frequently Asked Questions About the Role of Dynamic Inflation

What is dynamic inflation in a DPoS blockchain?

It is a reward system where the inflation rate fluctuates based on live network data, such as the number of tokens staked. The goal is to maintain a balance between security and token value over time.

Why does DPoS need inflation at all?

Inflation funds block rewards. Rewards pay validators for their work and encourage users to stake their tokens. Without rewards, fewer people would secure the network.

How does dynamic inflation protect token value?

When staking is high, the system can lower inflation, preventing new supply from flooding the market. When staking is low, it can raise inflation to attract more stakers. This helps keep supply and demand in better balance.

Can people compare blockchain inflation to real-world inflation?

Yes, in a simple way. Just as central banks react to price shocks, a DPoS network can respond to staking and market fluctuations. Research indicates that shocks can be persistent in the real world, and flexible policy helps mitigate their effects.

What are the main risks of dynamic inflation?

Weak governance can let powerful delegates tilt the rules. Poor algorithms can react too fast or too slow. Users can also get confused if changes are not explained well. Clear rules, small steps, and open dashboards help reduce these risks.

Does dynamic inflation make DPoS more decentralized?

It can help. By keeping rewards fair across market cycles, more users may keep staking and voting, which supports a wider base of participants and lowers concentration risk.

Glossary of Key Terms

DPoS (Delegated Proof of Stake): A system where token holders vote for a small group of validators who produce blocks and secure the network.

Inflation (Blockchain): New tokens are added to the supply to pay rewards to validators and stakers.

Dynamic Inflation: An inflation rate that changes based on network conditions, such as staking levels.

Staking Ratio: The share of total token supply that is locked in staking.

Validator/Delegate: The node that creates blocks and earns rewards in a DPoS network.

Epoch: A fixed time window or block range used for calculations and updates.