Synthetic Assets on DPoS Chains: Expanding Token Utility Beyond Staking

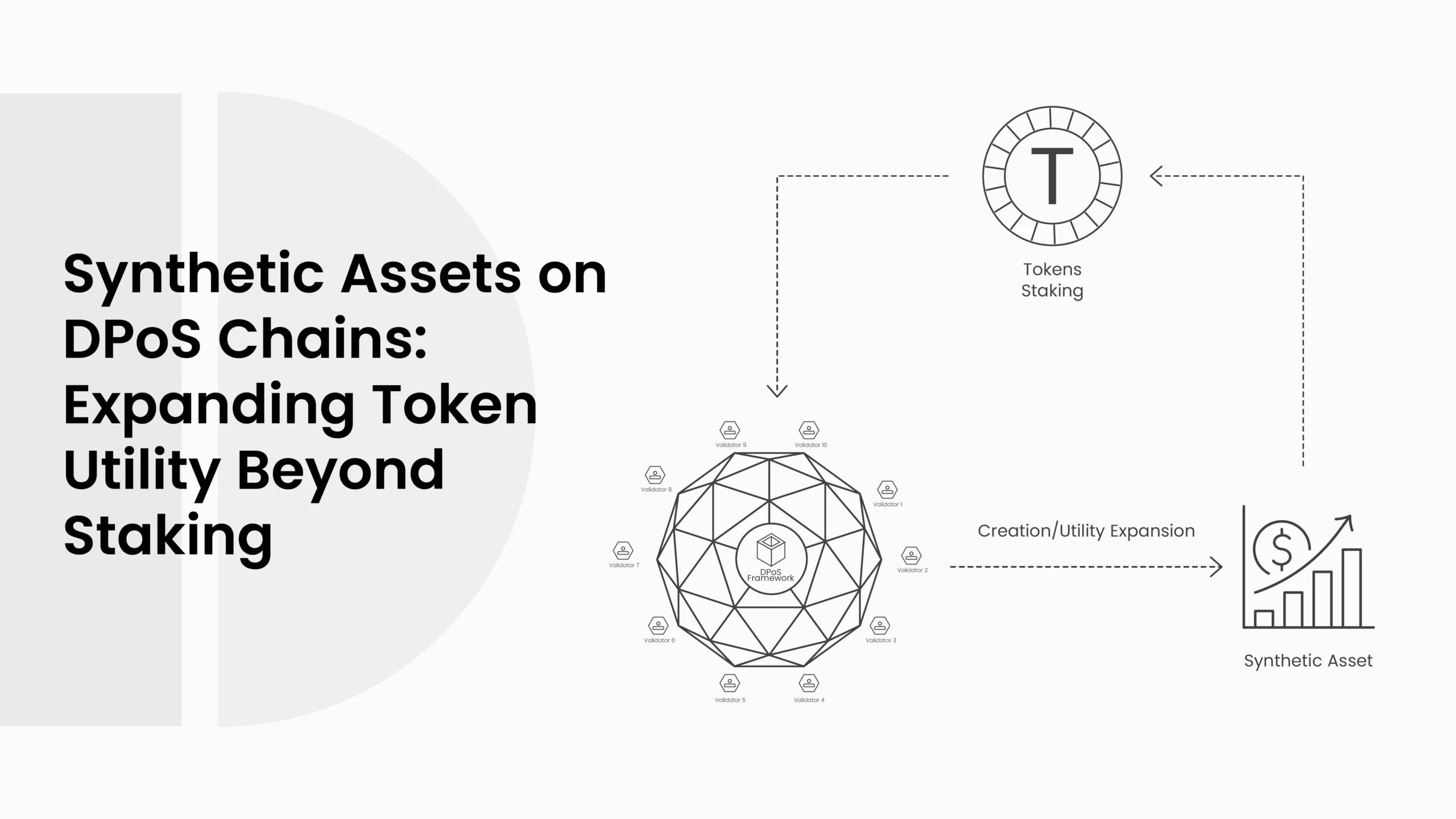

Delegated Proof of Stake (DPoS) was designed to make blockchain systems faster, more scalable, and community-driven. It replaced the energy-intensive mining model with a democratic process in which token holders vote for validators to produce blocks. At first, the main use for DPoS tokens was staking. Users locked their tokens to earn rewards and support the network consensus. However, as decentralized finance grew, staking alone no longer felt like the ultimate use of tokens. Developers began to explore how these tokens could support more complex assets and financial tools.

- What are Synthetic Assets in Blockchain

- How Synthetic Assets Function on DPoS Chains

- Why Use DPoS Tokens for Synthetic Asset Collateral

- Expanding Token Utility Beyond Staking

- Key Benefits of Synthetic Assets on DPoS Networks

- Risks and Limitations of Synthetic Assets

- Popular Protocols Supporting Synthetic Assets in DPoS Ecosystems

- Use Cases and Applications of Synthetic Assets

- Governance and Economic Design in DPoS-Based Synthetic Protocols

- Synthetic Asset Layer vs Staking Layer in DPoS

- Challenges for Future Development

- Future Outlook

- Conclusion

- Frequently Asked Questions About Synthetic Assets of DPoS Chains

- What is a synthetic asset in blockchain?

- How are synthetic assets created on DPoS chains?

- Why use DPoS tokens as collateral for synthetic assets?

- What are the benefits of synthetic assets in a DPoS network?

- What risks exist with synthetic assets?

That evolution led to the rise of synthetic assets on DPoS chains. A synthetic asset is a token that represents the value of another asset, such as gold, oil, or a stock index. This means users can get exposure to those assets without owning them directly. When synthetic assets were integrated into DPoS ecosystems, native tokens took on a new role beyond voting or staking. They became the building blocks for minting, trading, and collateralizing new digital instruments. This combination of governance and finance has started to reshape the function of DPoS tokens in the decentralized economy.

What are Synthetic Assets in Blockchain

Synthetic assets are blockchain-based tokens that copy the price or value of real or digital assets. They are sometimes called “Synths” because they are created artificially through code. A smart contract locks collateral, usually in the form of native blockchain tokens, and then issues new synthetic tokens that follow the price of another asset. The result is a new kind of derivative product that works entirely on a chain, without the need for brokers or centralized exchanges.

The key difference between a traditional derivative and a synthetic token lies in ownership and transparency. Traditional derivatives depend on financial institutions and legal contracts. Synthetic assets exist through automated code and are verified by the network. They can represent currencies, commodities, or even other cryptocurrencies, but their value is always linked to price data provided by blockchain oracles. This system allows DeFi users to trade or hold assets like gold or Tesla stock while remaining inside the crypto ecosystem.

ALSO READ: Cross-Chain DPoS Staking: How Delegates are Expanding to Multi-Chain Platforms

| Feature | Synthetic Assets | Traditional Derivatives |

| Custody | Fully on chain | Managed by financial intermediaries |

| Collateral | Crypto tokens locked in smart contracts | Margin or credit-based |

| Transparency | Public smart contracts | Private agreements |

| Accessibility | Global and permissionless | Restricted to regulated markets |

| Example Platforms | Synthetix, Mirror Protocol | CME Futures, Options markets |

Synthetic assets act as programmable representations of traditional markets. Their smart contract foundation allows for instant settlement and interoperability between DeFi applications. This makes them a major component of decentralized economies, especially when paired with DPoS governance.

How Synthetic Assets Function on DPoS Chains

DPoS chains are well-suited for hosting synthetic assets because they offer faster confirmation times and lower transaction costs. The process starts when a user deposits their DPoS tokens, like LUNA or ATOM, into a smart contract that supports synthetic creation. This collateral serves as security for the synthetic token that will be generated.

Once the collateral is locked, the protocol mints a new synthetic token whose value mirrors the target asset. This process is fully automated. For example, a user can mint a synthetic gold token by locking DPoS tokens of equal or greater value. The contract checks live market data through oracles, which continuously update the synthetic asset’s price to stay aligned with the real one.

When the user wants to redeem or close the position, the system burns the synthetic token and releases the locked collateral. The ratio between collateral and synthetic value is usually kept high, often above 150%, to prevent undercollateralization. If the collateral value falls too low due to market volatility, the smart contract can liquidate part of the position automatically to protect the system.

| Step | Action | Function |

| 1 | Deposit native DPoS token | Acts as collateral |

| 2 | Smart contract mints a synthetic token | Creates the “Synth” asset |

| 3 | Oracle updates market prices | Keeps the synthetic value accurate |

| 4 | Trading on DEX or DeFi apps | Expands asset utility |

| 5 | Burning and redemption | Returns collateral to the user |

This mechanism transforms ordinary staking tokens into multi-use financial instruments. The DPoS system’s validator architecture ensures the underlying chain remains fast and secure, while smart contracts manage risk and collateral ratios on top of it.

Why Use DPoS Tokens for Synthetic Asset Collateral

DPoS tokens have special characteristics that make them good collateral for synthetic asset creation. The first is liquidity. DPoS chains usually have active validator pools and staking markets that maintain constant token circulation. High liquidity means collateral can be locked and unlocked without large slippage or liquidity shortages. The second reason is governance reliability. Token holders who already participate in validator elections tend to maintain a long-term commitment to the network, giving collateral a more stable base value.

From a technical side, DPoS chains are efficient at handling high-frequency transactions. When synthetic assets are traded, oracle updates and collateral adjustments must happen fast. A network with slow block times could cause inaccurate price reflections or delayed liquidations. The DPoS design, with its delegated validation system, helps avoid those problems. This speed and governance structure make DPoS-based collateral safer and more practical for synthetic systems than older consensus mechanisms.

In addition, smart contracts on DPoS blockchains can be configured to integrate staking directly with collateralization. Some networks allow partial delegation of staked tokens as collateral, enabling users to earn staking rewards while supporting synthetic minting. This dual functionality extends token utility further and encourages deeper engagement with the ecosystem.

Expanding Token Utility Beyond Staking

The introduction of synthetic assets changes how DPoS tokens are used. Before this shift, staking was the primary way to earn rewards and secure the chain. Tokens were idle while staked, locked for validation purposes. With synthetic assets, those same tokens can now power new financial tools, creating a second layer of utility. A staked token can serve as collateral for synthetic currencies, commodities, or crypto indexes, thereby giving it economic value beyond its consensus security.

This innovation also improves liquidity. When DPoS tokens are used as collateral, new markets emerge around the synthetic assets they produce. Traders can exchange these assets across decentralized exchanges, opening additional demand for the original token. In time, this makes the entire network more liquid and valuable.

| Utility Type | Before Synthetic Assets | After Synthetic Assets |

| Primary Function | Network staking and voting | Collateralization and DeFi integration |

| Token Movement | Mostly locked | Actively circulating in DeFi |

| Earnings Source | Validator rewards | Trading fees, yield, and synthetic minting |

| Market Reach | Limited to the chain ecosystem | Expands to global financial assets |

The result is a DPoS environment where every token has multiple roles. It can secure the chain, represent collateral, and enable synthetic exposure to real-world markets. This flexibility expands the value-capture potential of DPoS tokens far beyond their original design and strengthens the foundation for decentralized finance on these chains.

Key Benefits of Synthetic Assets on DPoS Networks

Synthetic assets expand DPoS networks’ range of financial activities. The first clear benefit is increased liquidity. When tokens are used as collateral to mint synthetic versions of other assets, they circulate through lending, trading, and yield platforms. This circulation drives liquidity and helps balance price fluctuations across markets. Liquidity attracts more participants, which strengthens the overall economy of the chain.

The second benefit is accessibility. DPoS networks are already faster and more scalable than traditional proof-of-work chains. When synthetic assets are added, users gain access to new investment options without leaving the blockchain. They can trade gold, stocks, or stable assets directly on chain, opening global access to financial exposure that used to require centralized brokers.

Another benefit is risk management. Synthetic tokens can be designed to mirror or even move inversely to other assets. This feature allows users to hedge against volatility. Developers can also create synthetic indexes that combine multiple assets into one token, offering stable exposure across markets.

| Benefit | Description | Effect on DPoS Ecosystem |

| Liquidity | More assets in circulation and more trading pairs | Strengthens the network economy |

| Accessibility | Broader access to traditional and digital assets | Attracts non-crypto investors |

| Risk Hedging | Ability to hold synthetic inverse assets | Protects against price volatility |

| Diversification | Portfolio exposure across multiple markets | Reduces dependence on a single token value |

| Capital Efficiency | Using DPoS tokens as collateral | Expands financial utility beyond staking |

These combined advantages show how synthetic finance can turn a DPoS network from a simple validation layer into a full-scale decentralized market infrastructure.

Risks and Limitations of Synthetic Assets

Every innovation introduces risk, and synthetic assets are not different. The first major risk is market instability. Because synthetic tokens are pegged to real-world assets, sudden changes in those markets can affect the collateral system. If gold drops sharply, synthetic gold tokens may lose value faster than the underlying collateral can adjust. This imbalance may trigger automatic liquidations, resulting in losses for users.

The second risk is collateral volatility. DPoS tokens themselves can be volatile, and when used as collateral, their price swings directly influence the stability of the synthetic assets. A sudden drop in the token’s price can reduce the collateral ratio below safety levels. This may lead to forced liquidation or system-wide imbalance.

Another concern is Oracle dependency. Synthetic assets rely on data oracles to provide live market prices. If the oracle is compromised, delayed, or feeds incorrect data, the synthetic token’s value can drift away from its target. Lastly, there is a smart contract risk. Coding errors or exploits can result in loss of locked collateral, as seen in several DeFi incidents.

| Risk Type | Cause | Possible Impact |

| Market Risk | Price movements in the underlying asset | Loss of peg, liquidation events |

| Collateral Risk | Drop in DPoS token value | Collateral shortage, forced liquidations |

| Oracle Risk | Manipulation or downtime of the price feed | Incorrect asset pricing |

| Contract Risk | Bugs or exploits in smart contracts | Collateral loss or frozen assets |

| Liquidity Risk | Low demand for the synthetic token | Difficulty in trading or redemption |

DPoS systems reduce some operational risks because validators can collectively vote on network parameters such as collateral ratios and liquidation triggers. However, complete security requires ongoing audits, reliable oracles, and active community governance.

Popular Protocols Supporting Synthetic Assets in DPoS Ecosystems

Several blockchain projects have implemented or inspired synthetic systems that could integrate with DPoS models. One of the most well-known is Synthetix, which allows users to mint synthetic versions of cryptocurrencies, fiat currencies, and commodities. It was first built on Ethereum, but newer versions are being tested on faster, validator-oriented frameworks. Its design model has influenced DPoS ecosystems such as Terra, Cosmos, and Injective.

Mirror Protocol, originally based on the Terra blockchain, enables the creation of mirrored assets that follow real stock prices. For instance, users can mint synthetic Apple or Tesla shares by locking up collateral. When Terra used a DPoS consensus, the validator set played a key role in securing these transactions and updating oracle data.

Injective Protocol operates as a layer-2 DPoS-decentralized exchange. It supports trading of synthetic futures, perpetuals, and asset pairs with near-zero gas fees. Injective shows how synthetic derivatives can work directly within a DPoS validator environment while maintaining cross-chain compatibility.

| Protocol | Blockchain Type | Synthetic Asset Focus | Collateral Model |

| Synthetix | EVM and cross-chain | Crypto, commodities, fiat | SNX collateral |

| Mirror | Terra (DPoS) | Stocks and ETFs | LUNA and UST collateral |

| Injective | Cosmos SDK (DPoS) | Perpetuals, futures | INJ token collateral |

| UMA | Ethereum and multi-chain | Custom synthetic assets | Priceless contracts |

| Band Protocol | Cosmos (DPoS) | Oracle data for synthetic assets | Validator-based oracles |

These systems highlight how synthetic products can fit inside DPoS networks, either as native protocols or interoperable layers. The validator infrastructure ensures fast data processing while maintaining security for collateralized assets.

Use Cases and Applications of Synthetic Assets

Synthetic assets on DPoS blockchains enable many practical use cases in decentralized finance. The first use case is cross-chain exposure. Through interoperability bridges, DPoS users can gain exposure to non-native assets like Bitcoin or US dollars without leaving their home chain. This makes DPoS ecosystems competitive with multi-chain DeFi networks.

The second use case is portfolio diversification. Investors can mint synthetic assets that mirror real-world commodities such as oil, silver, or agricultural indexes. This allows them to build diverse portfolios inside blockchain networks while avoiding the regulatory or geographic limits of traditional finance.

Another application is hedging and leverage. Traders can use synthetic assets to protect against price swings or open leveraged positions. For example, holding a synthetic token that moves inversely to a volatile asset helps balance portfolio losses. Some protocols even allow leveraged synths that magnify exposure.

Synthetic stablecoins are another growing application. These tokens maintain stability by tracking fiat currencies through overcollateralized DPoS tokens. They are useful for payments, cross-border trade, and DeFi lending.

ALSO READ: How DPoS Validators Power On-Chain Oracles: A Technical Overview

| Application | Description | Key Benefit |

| Cross-Chain Assets | Access to non native cryptocurrencies | Expands trading reach |

| Hedging Tools | Synthetic inverse or neutral assets | Reduces exposure risk |

| Stablecoins | Synthetic tokens pegged to fiat | Enables payments and lending |

| Commodity Exposure | Tokenized gold, oil, or indices | Brings real-world assets on the chain |

| Leveraged Trading | Synths with amplified exposure | Increases speculative options |

Each of these use cases relies on DPoS efficiency and validator coordination. The chain’s governance layer supports parameter updates for collateral ratios and oracle adjustments, ensuring synthetic systems stay balanced under changing market conditions.

Governance and Economic Design in DPoS-Based Synthetic Protocols

Governance plays a critical role in maintaining the stability of synthetic systems on DPoS blockchains. Delegates and token holders decide on parameters like collateral ratios, minting limits, and fee structures. Because DPoS uses elected validators, decisions can be made quickly compared to proof-of-work networks, where updates require hard forks or longer consensus times.

The economic design usually includes three layers. The first is the collateral layer, which defines how native tokens are locked to create synthetic assets. The second is the oracle layer, which feeds external data and ensures accurate pricing. The third is the governance layer, where validators and voters control system upgrades and risk management. Each layer depends on the others for stability.

For example, when collateral value drops below a threshold, governance proposals can adjust the ratio or interest rates. If Oracle performance declines, validators may vote to switch data providers. These features create a feedback system that maintains equilibrium within the community.

A study found that DPoS-based governance models reduce coordination friction and improve update speed in cross-chain synthetic systems. The researchers emphasized that validator reputation and stake distribution directly influence risk tolerance and liquidity depth.

| Layer | Function | Governance Role |

| Collateral Layer | Locks DPoS tokens to mint assets | Sets ratio and liquidation rules |

| Oracle Layer | Feeds external price data | Approves and audits oracles |

| Governance Layer | Oversees economic parameters | Voting and parameter adjustment |

In this design, DPoS chains act not only as infrastructure but also as economic regulators. They form decentralized markets where token holders have a say in maintaining financial balance.

Synthetic Asset Layer vs Staking Layer in DPoS

Staking and synthetic creation may both depend on locking tokens, but they serve different purposes. The staking layer protects the network. It lets validators propose and confirm blocks while earning token rewards. The synthetic asset layer, however, focuses on expanding the token’s financial use. It transforms those same staked tokens into instruments that create or back other assets.

In staking, tokens are locked only to secure the chain and cannot circulate elsewhere. In synthetic asset systems, those tokens remain locked but produce new assets that can move freely through markets. This dual use provides DPoS ecosystems with a stronger financial base while maintaining stable validation.

| Feature | Staking Layer | Synthetic Asset Layer |

| Main Purpose | Network security | Financial utility and liquidity |

| Token Status | Locked and idle | Locked but productive |

| Reward Type | Validator rewards | Fees, yield, trading exposure |

| Risk Factor | Slashing for downtime | Collateral loss or depeg |

| Example Use | Voting, block validation | Minting synthetic USD, gold, or indexes |

The synthetic asset layer doesn’t replace staking. It builds on it. Validators remain vital for consensus, while synthetic systems create economic depth around them. Together, they make DPoS networks both operationally secure and economically active.

Challenges for Future Development

Despite strong growth, synthetic systems on DPoS chains face structural and regulatory challenges. The first is interoperability. Many synthetic protocols work in isolation, making it hard for assets minted on one chain to move to another without losing their peg or security guarantees. Cross-chain bridges can fix this, but they bring extra attack surfaces.

The second is regulation. Synthetic assets can represent real-world financial products, which may attract scrutiny from authorities. There are ongoing debates about whether these tokens should be treated as derivatives or digital representations. Unclear regulations could slow adoption.

A third challenge is liquidity fragmentation. As more chains create their own synthetic systems, liquidity gets split across networks. This makes it harder to maintain stable prices and to manage collateral smoothly. Shared liquidity pools and interchain exchanges are being explored to fix this issue.

Technical scalability is also a concern. Oracles must update prices in real time across thousands of synthetic tokens. Even with DPoS efficiency, this can strain validators and increase transaction load.

| Challenge | Cause | Impact | Possible Solution |

| Interoperability | Fragmented chain ecosystems | Cross-chain asset isolation | Unified bridge standards |

| Regulation | Overlap with securities law | Legal uncertainty | Global DeFi compliance framework |

| Liquidity Fragmentation | Separate pools on different chains | Volatile synthetic prices | Cross-chain liquidity hubs |

| Oracle Scalability | A large number of data feeds | Latency and high cost | Layered oracle aggregation |

| Security | Contract bugs, attacks | Loss of collateral | Periodic audits and validator voting |

The long-term success of synthetic finance will depend on secure interoperability layers that combine liquidity across validator networks. Without this, synthetic assets could remain siloed within individual blockchains.

ALSO READ: Can DPoS and Tendermint Work Together for a Faster Blockchain?

Future Outlook

The outlook for synthetic assets in DPoS environments is strong. The continued rise of DeFi and the growing focus on interoperable staking platforms mean native tokens will no longer be limited to a single role. They will serve as collateral, governance tools, and trading assets all at once. As validator networks improve cross-chain bridges, synthetic markets will expand from single asset exposure to composite indexes and multi-asset portfolios.

Artificial intelligence is expected to play a role in managing collateral ratios and predicting liquidation risks. Automated analytics could adjust system parameters faster than manual governance votes, keeping DPoS synthetic economies stable even during volatile conditions. Oracle designs will also evolve, using distributed node clusters to avoid data manipulation.

Institutional interest may grow once clear regulations are in place. Synthetic tokens can represent stocks, bonds, or commodities, allowing traditional investors to participate in blockchain systems without holding crypto directly. If DPoS chains maintain speed, transparency, and shared liquidity, they may become the foundation of decentralized global trading networks.

The next phase will likely bring hybrid models in which staking, lending, and synthetic trading share the same collateral pool. This unification could make DPoS chains the most efficient DeFi backbone in the coming decade.

Conclusion

Synthetic assets on DPoS chains mark a significant step in blockchain evolution. They extend the value of tokens from passive staking to active participation in global finance. By locking tokens as collateral and minting assets that mirror real-world values, DPoS networks gain liquidity, flexibility, and broader market relevance.

While challenges such as regulation, oracle integrity, and cross-chain liquidity remain, research and innovation continue to advance solutions. The validator-based governance of DPoS ensures that synthetic protocols remain adaptable to market change. This balance of security and usability may turn DPoS blockchains into multi-purpose economic platforms where staking, governance, and synthetic finance coexist.

As blockchain ecosystems mature, the boundary between traditional finance and decentralized networks continues to blur. Synthetic assets on DPoS chains demonstrate how a single token can power governance, validate blocks, and represent global assets simultaneously, laying the foundation for the next generation of open and programmable financial systems.

Frequently Asked Questions About Synthetic Assets of DPoS Chains

What is a synthetic asset in blockchain?

A synthetic asset is a digital token created through smart contracts to copy the price of another asset, such as gold, fiat money, or cryptocurrency. It allows users to gain exposure to that asset without actually holding it.

How are synthetic assets created on DPoS chains?

Users lock their DPoS tokens in a smart contract as collateral. The contract then mints a new synthetic token that tracks the value of a chosen real-world or digital asset through oracle data feeds.

Why use DPoS tokens as collateral for synthetic assets?

DPoS tokens are liquid, secure, and backed by validator governance. Their fast transaction speeds and reliable consensus make them ideal for maintaining synthetic markets with accurate price updates.

What are the benefits of synthetic assets in a DPoS network?

They increase liquidity, expand token utility beyond staking, allow exposure to new markets, and help users hedge against volatility. They also attract institutional and cross-chain interest to DPoS ecosystems.

What risks exist with synthetic assets?

The main risks include drops in collateral value, oracle data errors, and smart contract exploits. Synthetic markets can also face regulatory scrutiny because they may resemble traditional financial derivatives.