What Is Delegated Proof of Stake (DPoS)? A Beginner’s Guide

In blockchain systems, consensus mechanisms form the foundation upon which trust, security, and decentralized decision-making are built. Delegated Proof of Stake (DPoS) stands out as a consensus protocol that offers high throughput, reduced energy consumption, and democratic participation.

Compared to Proof of Work (PoW) and traditional Proof of Stake (PoS), Delegated Proof of Stake introduces a governance-driven model that delegates responsibility to elected validators. This shift enables greater efficiency without completely relinquishing the core ideals of decentralization.

The Structure and Operation of DPoS

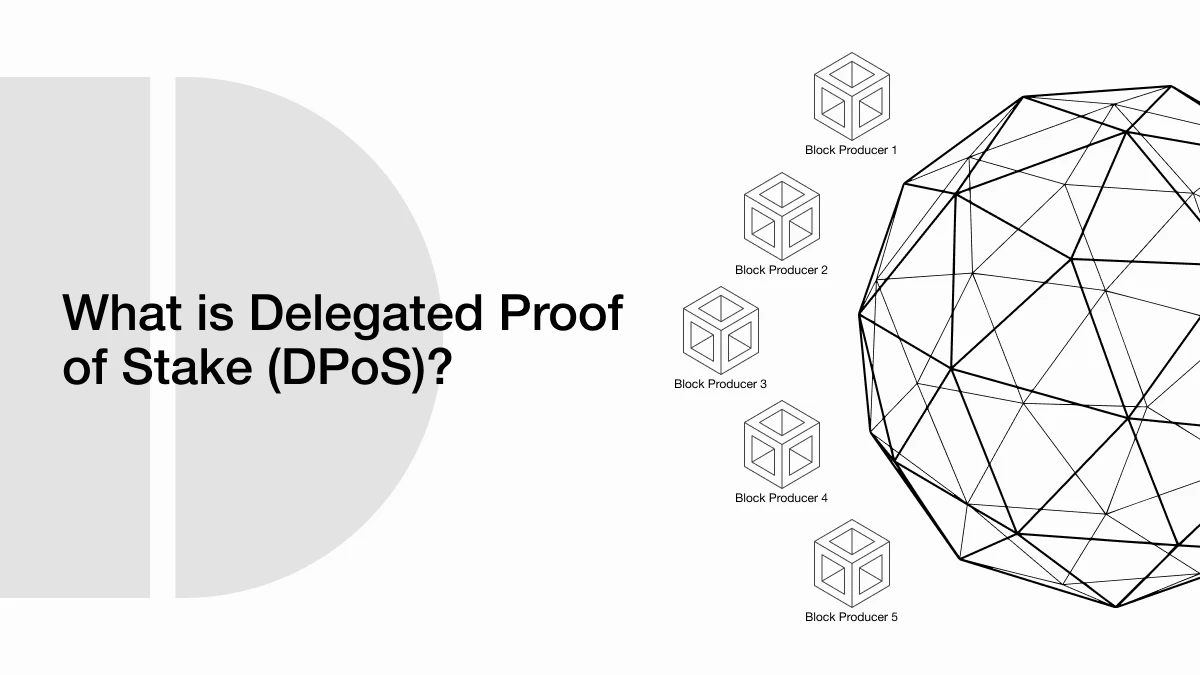

Daniel Larimer conceptualized Delegated Proof of Stake and first applied it in the BitShares blockchain. In Delegated Proof of Stake systems, token holders do not validate blocks themselves. Instead, they participate by voting for a limited number of delegates, who are also known as witnesses or block producers. These elected delegates are responsible for validating transactions and creating new blocks.

Voting power is proportional to the amount of cryptocurrency staked, and the election process remains dynamic, allowing token holders to change their votes at any time. Only the top-ranking candidates are selected, and they produce blocks in a round-robin or scheduled order.

Efficiency and Performance Advantages

One of the most significant benefits of Delegated Proof of Stake is its ability to enhance transaction throughput. By limiting the number of block producers, DPoS reduces communication overhead and streamlines the consensus process.

Networks based on this model, such as EOS, have been able to support thousands of transactions per second, a level of performance unattainable by PoW-based systems like Bitcoin or even many PoS implementations. This capability positions DPoS as a highly scalable solution suitable for real-time applications, decentralized exchanges, and digital content networks.

Energy Conservation and Accessibility

Unlike PoW mechanisms that require immense computational power and energy, DPoS achieves consensus without mining. This significantly reduces the environmental impact and operational costs. Energy consumption per transaction in DPoS networks is minimal compared to the hundreds of kilowatt-hours consumed by leading PoW networks.

Additionally, since block production does not rely on expensive hardware, the barrier to entry for participating in DPoS networks is lower. Individuals and institutions can engage in governance and earn rewards without needing advanced technical infrastructure.

Governance and Accountability

Another distinguishing feature of DPoS is its democratic approach to network governance. Token holders, acting as stakeholders, continuously influence who maintains control of the blockchain’s validation process. Delegates are subject to ongoing evaluation and can be replaced if they underperform or act against the network’s interests. This accountability encourages transparency and performance excellence, as delegates are motivated to retain their position and earn rewards by meeting community expectations. The cycle of election and replacement ensures that authority is never permanently concentrated.

Risks and Limitations of the DPoS Model

Despite its strengths, Delegated Proof of Stake is not immune to criticism. The most pressing concern is the risk of centralization. Since block production is limited to a small number of delegates, the system can become oligarchic, with a few entities potentially exerting outsized control. If large stakeholders coordinate or collude, they can manipulate elections, influencing decisions in ways that may not reflect the broader community’s interests. Historical examples such as the Steem network’s takeover controversy underscore how DPoS systems may be vulnerable to politically driven or economically motivated attacks.

Voter apathy is another concern. Many token holders abstain from participating in elections, leaving decisions to be dominated by a small subset of active users. This can lead to a misalignment between the elected delegates and the will of the entire community. Some networks attempt to mitigate this by incentivizing participation or by introducing proxy voting mechanisms, but these solutions are not always effective in practice.

Research-Driven Enhancements to Delegated Proof of Stake

Recent research has focused on refining the Delegated Proof of Stake model to address its known limitations. One such innovation is reputation-based DPoS, which adds a behavioral scoring layer to the delegate election process. Delegates are evaluated based on historical performance, reliability, and compliance with protocol standards. This approach helps reduce the influence of purely financial or promotional campaigns in elections and promotes the selection of technically competent and honest participants.

Another variant, known as Deep Link DPoS, introduces a two-tier voting framework. It allows for the creation of subcommittees or secondary groups that share in the consensus process, thereby distributing influence more widely and promoting fairness. In experimental models, DL-DPoS has shown improved scalability, with performance gains of over twenty percent in throughput while maintaining decentralization goals. Preferential DPoS proposes a similar layered model, where regional or interest-based representatives select primary validators, adding a layer of representative democracy that can be especially useful in global networks.

Additional studies have introduced advanced decision-making tools such as fuzzy logic and DEMATEL evaluation models. These tools aim to make delegate selection more rational and multi-criteria-based, integrating both technical metrics and stakeholder preferences. While still in the research or pilot stages, such innovations reflect a growing recognition that delegate selection is not merely a popularity contest but a critical factor in network resilience.

Adoption and Use Cases

Delegated Proof of Stake has been adopted by a variety of blockchain platforms across different industries. EOS, perhaps the most well-known, uses DPoS to support decentralized applications with high-speed requirements. TRON applies a similar structure to manage content sharing and financial transactions. BitShares and Steem, both early adopters, have implemented Delegated Proof of Stake to power decentralized exchanges and social media platforms, respectively. Lisk and Ark also utilize DPoS to facilitate the creation of custom blockchain applications. These examples demonstrate that DPoS can be tailored to diverse use cases, particularly those that demand performance without compromising governance.

Conclusion

Delegated Proof of Stake has introduced a paradigm that merges efficiency, democratic oversight, and reduced energy consumption into a single consensus model. It provides a compelling alternative to older systems that often struggle with scalability or accessibility. By allowing token holders to elect and continuously evaluate network validators, DPoS ensures that governance remains flexible and transparent. However, its reliance on active participation and its tendency toward centralization necessitate thoughtful implementation and continuous improvement.

Emerging variations and research-backed enhancements offer promising solutions to the model’s weaknesses. Whether through reputation systems, multi-tier governance, or intelligent evaluation mechanisms, DPoS continues to evolve into a more robust and secure protocol. For developers, enterprises, and protocol designers seeking to balance high performance with responsible governance, Delegated Proof of Stake remains a consensus method worthy of serious consideration.