Justin Sun Proposes Fee Cuts as TRON Overtakes PayPal in Stablecoin Settlements

Tron is having a standout year. With record-breaking stablecoin transactions, a surging TRX token, and a growing share of the global blockchain economy, the network has emerged as one of the most powerful forces in crypto today. At the helm, founder Justin Sun is taking steps to ensure that Tron’s success remains sustainable.

In a move that aligns with the network’s growing adoption, Justin Sun has proposed new strategies to reduce transaction fees across Tron. As user activity increases and fees begin to climb, Justin Sun’s proposal comes at a critical moment. His message is clear: Tron must remain affordable, fast, and accessible even as it scales at unprecedented levels.

Fee Reduction as a Strategic Necessity

Sun’s recent remarks, shared through a report by CryptoRank, highlight the importance of keeping transaction costs low, especially during periods of heavy network demand. As more users and applications flock to Tron, maintaining a smooth and cost-effective experience has become a priority. To that end, the Tron team is exploring techniques like dynamic fee models and data optimization methods, including compression, to reduce resource usage and keep fees in check.

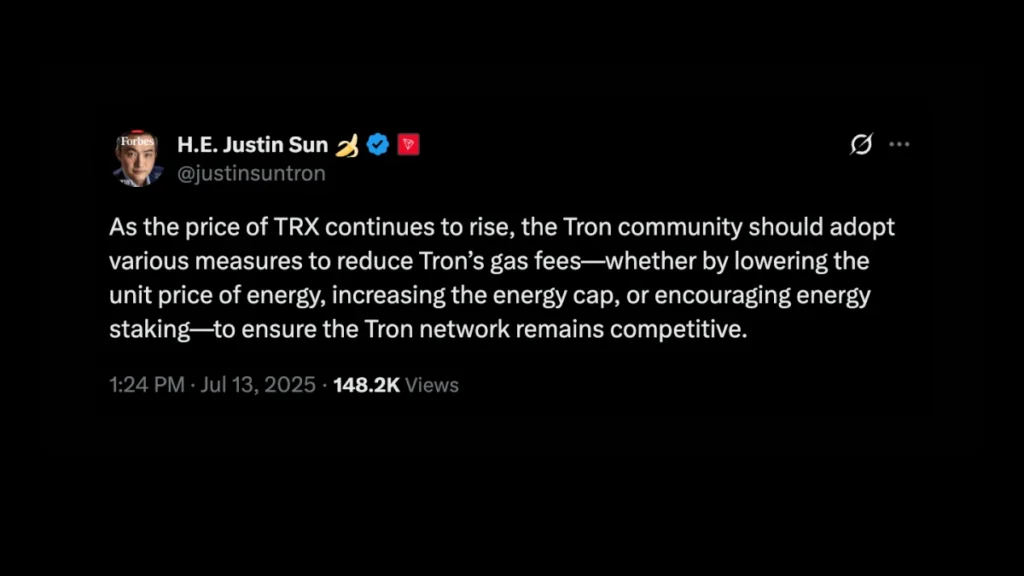

In a recent tweet, Justin Sun emphasized the urgency of tackling Tron’s rising gas fees. He proposed a multi-pronged approach that includes “lowering the unit price of energy, increasing the energy cap, or encouraging energy staking” as ways to keep the network cost-effective and competitive.

Rather than waiting for user complaints or congestion issues, Justin Sun is getting ahead of the curve. These improvements are not just about technical fine-tuning; they’re about preparing the network for the next wave of adoption, where accessibility and performance are critical to success.

TRX Rises Alongside Network Growth

This proposal arrives amid a strong performance from TRX, which has been steadily gaining value throughout 2025. The token’s rise is backed not only by market sentiment but by a noticeable increase in real-world usage. As the number of transactions and active users grows, TRX is becoming more than a speculative asset; it’s the fuel powering one of the busiest blockchain ecosystems in the world.

Justin Sun’s leadership has played a key role in this trajectory. His consistent engagement with the community and commitment to network improvements continue to instill confidence in both developers and investors. With the Tron network running on Delegated Proof-of-Stake (DPoS), TRX holders also play a direct role in securing and scaling the blockchain. This model helps ensure that performance enhancements like fee reductions can be implemented efficiently and with community input.

Tron Outpaces Traditional Payment Giants

One of the clearest indicators of Tron’s rising influence is its daily transaction volume. According to a report from The Currency Analytics, Tron has officially surpassed PayPal and Stripe in daily stablecoin settlements. On average, the network now handles more than $20 billion in stablecoin transactions each day, placing it firmly ahead of some of the biggest names in global finance.

ALSO READ: Tether Turns Its Back on EOS Amid Escalation in Trade War, Crypto Legislation

This milestone reinforces the idea that blockchain platforms are no longer experimental technologies; they are becoming the backbone of modern digital finance. Tron’s ability to outperform legacy payment processors speaks to its technical strengths, including low fees, high throughput, and a strong developer ecosystem. As users increasingly demand speed and affordability, Tron’s infrastructure is delivering exactly that.

USDT Supply on Tron Surpasses $80 Billion

Supporting this record transaction volume is the dramatic rise in Tether (USDT) issuance on the Tron blockchain. According to Ainvest, USDT minting on Tron has jumped by 37.2% in 2025, pushing the total circulating supply above $80 billion. This makes Tron the dominant blockchain for USDT, outpacing Ethereum and other networks in both volume and efficiency.

Stablecoins like USDT are essential for trading, DeFi, remittances, and institutional transactions. Tron’s success in this space shows that its network isn’t just active, it’s trusted. The consistent growth in USDT supply points to increasing user confidence and solidifies Tron’s position as a stable and scalable financial network. For Sun, maintaining this growth while improving user experience through lower fees is a logical next step.

Sun’s Vision Aligns with Tron’s Trajectory

Justin Sun has long positioned Tron as more than just a blockchain project. He sees it as a foundational layer for digital commerce. This latest initiative to reduce transaction fees is part of a broader strategy to keep Tron competitive as user numbers swell and use cases diversify.

The network’s DPoS consensus mechanism continues to serve as a critical advantage, allowing for rapid updates, community participation, and energy efficiency. As new users join and demand for stablecoin payments increases, the importance of a responsive and scalable infrastructure becomes even more evident.

By focusing on usability and performance, Sun is not only responding to the network’s current needs but also laying the groundwork for Tron to remain a key player in the future of global payments.

Conclusion

Tron’s growth in 2025 marks a turning point in blockchain adoption. With over $80 billion in USDT supply, daily stablecoin settlements outpacing PayPal and Stripe, and a rising TRX token, the network is hitting milestones that few other platforms can claim. Justin Sun’s proposal to lower fees comes at the perfect time, ensuring that this growth is supported by continued accessibility and affordability.

Powered by a Delegated Proof-of-Stake (DPoS) framework, TRON is proving that blockchain technology can deliver both scale and speed without sacrificing decentralization. As Justin Sun continues to steer the network with bold, data-driven decisions, Tron’s role in the future of digital finance appears stronger than ever.

FAQs

What fee reductions has Justin Sun proposed for Tron?

Justin Sun has suggested dynamic fee models and data compression techniques to keep transaction costs low as network usage grows.

Why is TRX gaining in value?

TRX is rising due to increased demand for Tron’s network services, including record-breaking stablecoin transactions and strong investor confidence.

How much USDT is circulating on Tron?

As of mid-2025, more than $80 billion in USDT has been minted on the Tron network, spearheaded by Justin Sun’s leadership.

Has Tron really surpassed PayPal and Stripe?

Yes. Justin Sun’s TRON now handles over $20 billion in stablecoin settlements daily, exceeding the volumes processed by both PayPal and Stripe.

What is DPoS, and how does it benefit Tron?

Delegated Proof-of-Stake (DPoS) is a consensus mechanism that allows faster, more scalable transaction processing through elected validators. It supports efficient governance and energy savings.

Glossary

Delegated Proof-of-Stake (DPoS):

A consensus model where users vote for delegates who validate transactions, offering fast and efficient performance.

Stablecoin:

A digital asset pegged to a fiat currency like the U.S. dollar, used to reduce volatility in crypto transactions.

USDT (Tether):

A popular stablecoin that maintains a 1:1 peg with the U.S. dollar, widely used across blockchain networks including Tron.

TRX:

The native cryptocurrency of the Tron blockchain, used for network operations, transaction fees, and governance.

Minting:

The process of creating new units of a cryptocurrency or token on a blockchain.