TRON Staking Goes Live on Ledger Live, Self-Custody Rewards Finally One Tap Away

A big switch just flipped for self-custody users. TRON’s TRX can now be staked directly inside Ledger Live through Yield.xyz, turning a hardware-wallet dashboard into a one-stop hub for rewards and on-chain voting. The update pushes Delegated Proof of Stake into the same pane where users already check balances and sign transactions. Keys stay on the device, participation gets simpler, and turnout can rise. That is a meaningful upgrade for a network that relies on tokenholder voting to elect Super Representatives and route incentives.

- TRON’s TRX Staking Goes Live, Inside the App

- The Self-Custody Edge: Vote Without Leaving Home

- On the Record: What Ledger and TRON Are Saying

- How TRX Staking Works Inside Ledger Live

- Investor Take: Yield, Liquidity, and Governance

- What Changed and What Stayed the Same

- Governance Meets Convenience: Will Turnout Rise

- Market Notes: Distribution Moves the Needle

- Conclusion

- Frequently Asked Questions About Tron Launching Staking on Ledger Live

- How do I stake TRX in Ledger Live?

- What rewards should I expect?

- Is this non-custodial?

- Does staking affect my ability to sell quickly?

- Why does DPoS keep coming up?

- Where can I verify the launch?

- Glossary of Key Terms

The launch matters because convenience drives behavior in DPoS systems. When staking is buried behind extra portals, voters drop off. When the path sits inside the custody app that many already trust, more holders move from passive to active.

For investors, the change is not a new rate; it is a cleaner route to the existing TRX reward stream with the same self-custody control. In a week when risk assets wobbled, coverage flagged TRX as a relative gainer after the news, underscoring how distribution stories can shape flows in the short run.

ALSO READ: Sui DEX Volume Hits ATH Amid Typus Exploit, SEC’s Green Signal to YLDS

TRON’s TRX Staking Goes Live, Inside the App

Yield.xyz and Ledger enabled native TRX staking inside Ledger Live. Users can delegate, track, and claim rewards without leaving the app, while private keys remain on the Ledger device. The integration uses Yield.xyz’s API layer to abstract validator selection and reward operations, so the flow feels familiar to Ledger users. The companies positioned the rollout as a security-first way for millions of hardware-wallet holders to access TRON’s staking and governance features.

Ledger’s staking page lists the high-level mechanics: voting for a Super Representative, an estimated annual yield of around 5 percent before validator fees, and a daily reward cadence that depends on the chosen SR. Those parameters have existed for years, but the access point is new. The difference is consolidation into the Ledger Live Earn experience.

The Self-Custody Edge: Vote Without Leaving Home

Self-custody investors routinely trade convenience for control. Centralized venues can offer one-tap staking, but they add counterparty and rehypothecation risks. Ledger Live’s approach keeps the private-key boundary intact, then layers on an in-app path to TRON’s staking rewards.

For retail and funds that mandate hardware storage, aligning custody, voting, and income within a single client reduces operational drag. It also helps ensure that DPoS voting reflects a broader base of holders, not just power users who tolerate extra steps.

Market context adds weight. Multiple outlets noted that TRX outperformed peers on the day after the announcement, with some citing a roughly 1.8 percent lift. One-day moves are not a thesis, but they capture how onboarding improvements can nudge positioning when the rest of the tape looks heavy.

On the Record: What Ledger and TRON Are Saying

Ledger framed the launch as a secure yield with simple execution. “TRON and Yield.xyz integrating TRX staking in Ledger Live demonstrates the desire across the industry to provide users with secure, accessible opportunities,” said Jean-Francois Rochet, EVP of Consumer Services at Ledger. He emphasized the reach of Ledger Live and the importance of self-custody for this audience.

The TRON DAO account amplified the rollout for visibility among network participants:

Today, @yield_xyz announced that TRX can now be staked directly on @Ledger Live.

This strategic integration enables millions of Ledger users to seamlessly access TRON’s governance staking rewards while maintaining Ledger’s industry-leading security standards.

More details from… pic.twitter.com/naiaKpLo7x

— TRON DAO (@trondao) October 16, 2025

Ledger’s own handle echoed the message to its user base:

Stake safely. Earn simply.@trondao staking is now live on Ledger Live.

It’s the most secure way to earn passive rewards.

Earn made easy, powered by @yield_xyz pic.twitter.com/Z8C2KDscV0

— Ledger (@Ledger) October 16, 2025

Both tweets confirm that the integration is now live for Ledger Live users and highlight the security posture provided by hardware wallets.

Press coverage from crypto media and syndication wires repeated the core points: hardware-secured keys, in-app delegation, and reward tracking handled through Yield.xyz’s infrastructure. These reports help set expectations on yields, validator choice, and the non-custodial model.

How TRX Staking Works Inside Ledger Live

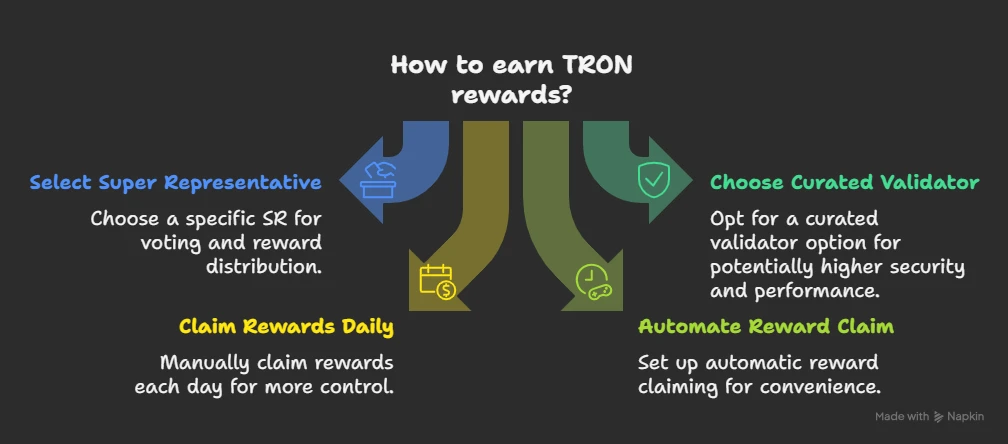

In the Earn section of Ledger Live, users select TRON, choose a Super Representative or a curated validator option, confirm the amount, and sign on the device. Yield.xyz’s API orchestrates voting and reward distribution in the background. Rewards are claimed either daily or automatically, depending on the SR. Net returns vary with validator fees and performance, so due diligence on SR profiles still matters. The security model does not change: transactions are approved on the hardware device, and the app acts as the control surface.

ALSO READ: ARK Invest Rolls Out Space-Defense ETF in Europe as XDC Network Makes Headway in Dubai

TronScan or third-party wallets are now consolidated. That consolidation is often the difference between intent and action, especially for users who treat hardware wallets as their default operating environment. (Ledger)

Investor Take: Yield, Liquidity, and Governance

For investors already holding TRX in cold storage, the integration turns idle balances into governance-linked yield without moving assets to exchanges. That reduces counterparty exposure and preserves audit-friendly custody trails. The remaining variable is liquidity. Unstaking and cooldown behavior can vary by validator, and those settings should match a fund’s internal redemption terms.

In a DPoS system, capital expresses its vote through delegation, and voting power moves with that delegation. Aligning validator choice with liquidity needs is part of the mandate.

Returns require context; Ledger cites an estimated annual yield near 5 percent before SR fees. Net results depend on the chosen representative, reward-sharing policies, and user discipline in claiming or compounding. The integration does not promise a higher rate; it removes friction to access the existing one while the keys stay under user control.

What Changed and What Stayed the Same

| Item | Before | Now | Investor takeaway |

| Access path | External portals like TronScan or multi-app flows | Directly inside Ledger Live via Yield.xyz | Fewer steps, one interface |

| Private keys | On the Ledger device | On the Ledger device | Custody model unchanged |

| Validator selection | Manual research across sites | Streamlined in-app | Easier discovery, due diligence still required |

| Reward types | Block and vote rewards | Same, surfaced in-app | Track and claim without leaving Ledger Live |

| Governance | Staking is possible, extra friction | DPoS voting made convenient | Higher turnout potential, broader voter base |

Sources: Ledger staking page, Yield.xyz, and coverage of the integration. (Ledger)

Governance Meets Convenience: Will Turnout Rise

Delegated Proof of Stake relies on tokenholder voting to elect delegates who validate blocks and shape operational parameters. TRON’s variant centers on elected Super Representatives who share rewards with voters. By integrating the staking and voting loop into Ledger Live, TRON brings DPoS to a place many users already trust for key management. That alignment tightens the feedback loop between holders and block producers, which is the design goal of DPoS in the first place.

DPoS also benefits from convenience. Elections hidden behind extra logins and wallet-connect hops depress participation. Elections, one click from the portfolio view, boost it. The mechanism remains the same, but the funnel widens, which can improve the diversity of voters who choose Super Representatives and influence fee policies, resource limits, and client upgrades.

Market Notes: Distribution Moves the Needle

Distribution is the overlooked pillar of crypto adoption. Integrations that add staking to high-usage clients often move the needle more than discrete feature launches on standalone portals. Ledger Live has scale, and enabling TRX staking there raises the ceiling for governance participation on TRON. This can improve accountability among Super Representatives, allowing voters to redirect support based on uptime, disclosures, and community investment.

ALSO READ: Is Cardano Back on Track: How Hydra and Exchange Staking Revived a 10% ADA Rally

The rollout follows months of content from Ledger that positions staking as a native Earn experience in the app, supported by Yield.xyz across multiple networks. That history suggests the TRX addition is part of a broader product arc rather than a one-off. For allocators who value consistent tooling across assets, the standardization helps.

Conclusion

TRON staking inside Ledger Live, powered by Yield.xyz, is a practical upgrade with broad reach. It keeps private keys on the device, streamlines delegation and claims, and places DPoS participation where users already operate. The change does not alter headline yields; it reduces friction that has long kept casual holders from voting and earning.

Early market reaction hints that distribution improvements can matter even when risk appetite is uneven. If adoption follows awareness, TRON’s Delegated Proof of Stake (DPoS) could see higher voter diversity and firmer accountability for Super Representatives. For investors, the appeal is simple: same custody model, cleaner path, better participation.

Frequently Asked Questions About Tron Launching Staking on Ledger Live

How do I stake TRX in Ledger Live?

Open Ledger Live, go to Earn, select TRON, choose a Super Representative, confirm the amount, and approve on your Ledger device. Yield.xyz orchestrates the staking process in the background.

What rewards should I expect?

Ledger cites an estimated annual yield around 5 percent before SR fees. Net returns depend on the representative’s fee and performance, plus how often you claim.

Is this non-custodial?

Yes. Your private keys remain on the hardware wallet. Ledger Live is the interface, and Yield.xyz provides the staking infrastructure.

Does staking affect my ability to sell quickly?

Unstaking or cooldown behavior can vary by SR. Check those settings and align them with your liquidity needs before delegating.

Why does DPoS keep coming up?

TRON uses Delegated Proof of Stake, a model that relies on tokenholder voting. Staking is how you vote for Super Representatives and help secure the network while earning rewards.

Where can I verify the launch?

You can verify via Bitcoin.com’s news post and Ledger’s public materials. The TRON DAO and Ledger tweets also confirm availability.

Glossary of Key Terms

- Delegated Proof of Stake (DPoS): A consensus design where tokenholders elect delegates to validate blocks and govern parameters.

- Super Representative (SR): An elected TRON validator that produces blocks and shares rewards with voters.

- Self-custody: Holding private keys directly, often on hardware, without a centralized intermediary.

- Ledger Live: Ledger’s desktop and mobile app for managing assets and staking with a Ledger device.

- Yield.xyz: An API-driven provider that integrates on-chain yield into apps, including staking flows.

- Delegation: Assigning your voting power to a validator to participate in consensus and share rewards.

- Validator fee: A percentage kept by a validator from earned rewards, which affects your net yield.

- Block rewards: Incentives paid to validators for producing blocks, generally shared with delegators.

- Vote rewards: Incentives tied to votes for validators in DPoS systems like TRON.

- Unstaking: Withdrawing delegated tokens, subject to delays or cooldown rules set by the validator or network.